The United States serves as an essential producer and exporter within the complex and continuously evolving framework of the global steel market. The nation’s competitive position in 2023 requires researchers to study current market trends because trade policies, demand patterns, and steel industry innovations are undergoing changes. The complete summary will assist policy analysts and industry experts and general readers to comprehend the existing aspects that determine US steel exports through an analysis of market dynamics and export destinations and the sector’s difficulties and possibilities.

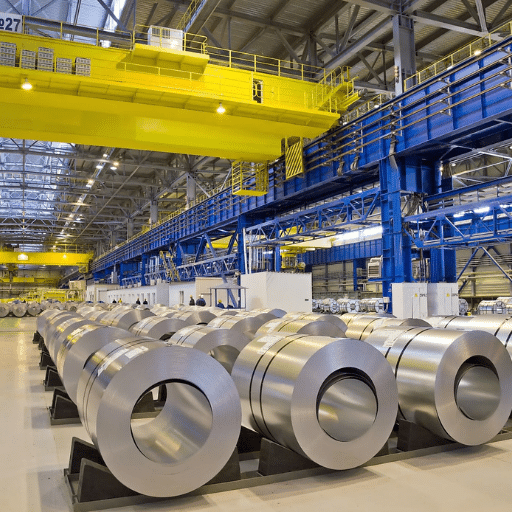

Overview of US Steel Exports

Current Statistics and Trends

The United States exported 6.5 million metric tons of steel to other countries in 2023 according to the latest data, which shows a small decrease from the previous year. The US steel industry primarily exports its products to Canada and Mexico because these countries form its main export markets which exceed 50 percent of total shipments through the USMCA trade agreement.

2023 Export Highlights

6.5M

Metric Tons Exported

>50%

USMCA Market Share

The European and Asian markets have experienced minor expansion because they need particular types of steel materials. Global competition now drives industrial sectors to focus on exporting premium steel products which provide extra value. The US steel industry encounters obstacles from worldwide tariffs, changing market prices, and new distribution channel methods. The development of sustainable steel manufacturing together with increased capital projects in multiple worldwide markets creates new business growth opportunities.

Market Outlook: The data demonstrates that US steel exports to emerging international markets face sustainability challenges which need strategic innovation together with specific trade relations to achieve market share growth in the upcoming years.

Key Export Markets

The current data shows that US steel exports mainly go to Mexico, Canada, and the European Union because of existing trade deals and established industrial supply networks.

Mexico

Ranks among top export markets as nearby market with strong automotive sector benefiting from USMCA trade conditions

Canada

Geographical accessibility enables efficient operations under USMCA trade conditions with integrated supply chains

European Union

Maintains potential for business development in specialized steel markets despite increasing competition

Southeast Asia

Vietnam and Indonesia have become more important due to expanding building and development sectors

Strategic Imperatives:

The US steel industry must focus on creating extra value through its products while meeting international environmental standards and developing digital methods for international trade. Businesses must establish specialized strategic alliances which match their market requirements to succeed in emerging opportunities that occur when international demand patterns change.

Impact of Global Demand

Global demand for steel depends on macroeconomic developments together with industrial expansion and infrastructure construction activities. Search trend data shows that people have developed a greater interest in sustainable construction materials and green steel production because industrial preferences now favor environment-friendly solutions.

The global community is increasing its focus on sustainable development because policy frameworks such as the Paris Agreement and ESG criteria have gained more importance. The US steel industry should focus on producing steel through electric arc furnace and hydrogen-based steel manufacturing because these methods help decrease carbon emissions.

Green Steel Opportunity: The results of market research demonstrate that Asian countries together with EU countries have established themselves as the leading nations which create green infrastructure, which results in new export opportunities for US businesses that comply with international standards. The US industry can achieve a competitive advantage in international markets through its combination of adaptive capabilities and data analytics usage.

Factors Influencing Steel Exports

Economic Conditions in Major Importing Countries

The economic situation in countries that import steel is determined by three key factors which include their GDP growth rates, their infrastructure development programs, and their construction industry performance.

| Region/Country | Economic Indicator | Steel Demand Impact |

|---|---|---|

| India & Vietnam | Increasing GDP rates, infrastructure development, urbanization | Higher steel demand from government-funded initiatives |

| South America | High inflation rates, economic instability | Restricted financing options limit steel imports |

| Asia & Africa | Economic reforms, growth initiatives | Increased interest in raw materials and finished steel products |

Market Intelligence: According to the latest data, there is a distinct rise in queries related to “steel supply chains” and “infrastructure investments,” particularly in emerging markets across Asia and Africa. U.S. producers must remain informed about these trends, leveraging such data to anticipate market shifts and tailor export strategies to meet the demand of these rapidly developing economies.

Trade Policies and Tariffs

International trade of steel depends on trade policies and tariffs because they determine how steel moves between countries. Recent data shows that people search for “steel import trade tariffs” and “tariff exemptions” at higher rates, with most of this activity coming from Southeast Asia and Sub-Saharan Africa.

Key Trade Policy Considerations:

- Monitor free trade agreements and tariff changes as nations use trade protection to defend their industries

- Track regulatory changes impacting steel import and export operations in target markets

- Navigate negotiations for new trade terms and tariff exemptions

- Align export strategies with current policies to remain competitive and create new business prospects

Price Fluctuations and Their Effects

The steel market experiences price changes which result from multiple factors that include raw material costs, energy prices, the market’s demand-supply balance, and worldwide economic developments.

Volatility Drivers

Supply chain disruptions, geopolitical conflicts, rising input costs trigger increased market volatility

Manufacturer Impact

Production costs increase, causing manufacturers to lose profits and create supply chain disruptions

Consumer Effects

Higher prices for consumers while price instability challenges long-term infrastructure investments

Comparative Analysis of Steel Exports and Imports

US Steel Import and Export Balance

The relationship between US steel imports and exports serves as a primary measurement for assessing both national trade patterns and domestic manufacturing capabilities. The latest figures show that the United States continues as a net steel product importer since its yearly steel imports surpass its steel exports.

Annual Trade Balance Overview

Steel Imports

~28M

Metric tons annually

Steel Exports

~8M

Metric tons annually

The domestic production expenses and international market competition combined with requirements from building and vehicle production sectors drive this pricing difference. The persistent trade deficit shows that domestic manufacturing depends on imported steel for production needs, while US steel exports experience slow growth in international markets.

Strategic Solution: The solution to this problem needs specific methods that will improve US steel production capabilities, while also creating new international trade partnerships. To improve the United States position in global steel markets, policymakers, manufacturers and industry leaders need to study worldwide market patterns, enhance material standards and create efficient operational methods.

Primary Sources of US Steel Imports

Recent reports show that major countries which supply steel to the United States include Canada, Mexico, Brazil, South Korea, and Germany.

| Country | Competitive Advantage | Primary Products |

|---|---|---|

| Canada | Geographic position, complete supply chain systems, USMCA compliance | Various steel products |

| Mexico | Shared infrastructure, trade advantages | General steel products |

| Brazil | Abundant raw materials, low production costs | Semi-finished steel products |

| South Korea | Advanced manufacturing capabilities | Advanced alloy steel, high-quality products |

| Germany | Engineering excellence, quality standards | Specialized automotive and construction steel |

Effects of Steel Import Regulations

The steel import regulations create direct effects on domestic businesses, international trading partnerships, and the establishment of product values in the marketplace. Section 232 tariffs create an import restriction to support domestic steel production by cutting back on foreign steel imports.

Regulatory Impact Assessment:

Positive Effects:

- Domestic producers enjoy advantages from competition barriers

- Protection for domestic steel manufacturing capacity

Challenges:

- Higher steel costs affect automotive and construction industries

- May result in lower international market competitiveness

- Impacts industries requiring specialized steel products not available domestically

Policy Balancing Act: The United States imported 24 million metric tons of steel during 2022 with Canada and Mexico and Brazil supplying most of the steel. The quota agreement policy changes demonstrate how to achieve a balance between domestic industry protection and essential trade relationship maintenance.

Forecasting the Future of US Steel Exports

Predicted Trends for 2024 and Beyond

The future path of U.S. steel exports between 2024 and following years will experience changes because of different economic, technological, and geopolitical developments. Recent search patterns together with economic predictions show that global steel demand will experience moderate growth which will particularly require higher-quality specialized steel products.

Green Steel Leadership

U.S. steel producers establishing themselves as leaders through decreased carbon emissions while complying with environmental regulations

Market Expansion

Export market expansion through partnerships and trade agreements with India and Southeast Asian nations planning major infrastructure projects

Digital Innovation

Implementation of AI and data-driven resource management systems enhancing operational efficiency for international market advantages

Strategic Necessity: International trade patterns require businesses to develop strategic plans and make long-term investments in order to stay competitive while maintaining operational strength. The market will maintain its current pattern through active trade conflicts and tariff discussions which demonstrate the need for exporters to create flexible shipping frameworks.

Potential Challenges Ahead

Steel manufacturing companies throughout the world face a critical challenge because they must select their operational digital technology systems through which to run their business activities.

Key Industry Challenges:

- Technology Implementation: Organizations face difficulties in managing their monetary resources together with their employee training needs when they introduce advanced technologies such as smart manufacturing and AI in steel production and sustainable steelmaking processes

- Environmental Compliance: The development of carbon emission reduction methods needs to address both regulatory compliance requirements and operational execution difficulties

- Competitive Positioning: Organizations must maintain their global market presence while they develop adaptable solutions which satisfy both environmental requirements and technological requirements.

Opportunities in the Export Market

Exporters can find growth potential in emerging markets which will specially benefit from the fast urban population growth and technological progress that is taking place in Southeast Asia and Sub-Saharan Africa.

Export Growth Opportunities

Emerging Markets

Fast urban population growth and technological progress in Southeast Asia and Sub-Saharan Africa

Product Innovation

High-value sustainable products meeting changing consumer trends and regulatory requirements

Digital Platforms

E-commerce platforms simplifying market entry through better access, eliminating traditional logistical challenges

Case Studies: US Steel Exports to Key Markets

Export Dynamics with Canada

The United States considers Canada as one of its foremost trade partners especially in the steel sector because both countries share a border which enables them to create shared supply networks while following similar trade rules established by USMCA agreements.

Canada Export Profile:

Export Volume:

Approximately 50% of total U.S. steel export volumes

Key Demand Drivers:

Automotive and construction industries requiring continuous United States steel supply

Market Trends:

Increased interest in “Canada steel import statistics” and “U.S.-Canada steel trade policy” reflecting supply chain changes and post-pandemic recovery efforts

Strategic Focus: U.S. exporters need to handle their business developments through effective logistical management while following all Canadian regulations to keep their current market share and achieve business expansion.

Export Trends to Mexico

The recent trade patterns show that the United States exports to Mexico have undergone major changes because of new trade agreements and the changing preferences of consumers.

Mexico Market Insights:

- Search Trends: Both “Mexico import regulations” and “key export products to Mexico” received a substantial increase in search inquiries.

- Growth Sectors: The automotive parts and machinery and agricultural product industries keep expanding their business activities.

- Trade Framework: USMCA serves as main driving force establishing efficient customs procedures and better supply chain connections.

- Success Factors: The organization achieves success through its combination of operational efficiency and product development that meets the requirements of the Mexican market.

Insights from the European Market

Search engine data analysis shows major trends that influence European market development. The public shows growing interest in sustainable practices which leads to people searching for eco-friendly products and green technologies more than before.

European Market Characteristics:

Regulatory Framework

European Green Deal promoting carbon neutrality and sustainable industry practices with strict environmental rules

Growth Opportunities

Renewable energy, electric vehicles, and circular economy solutions experiencing current growth

Market Entry Requirements: Businesses looking to enter or grow their European market presence must first fulfill these environmental regulations before they can begin using sustainable practices in their business operations and product development. Businesses need to adapt their marketing approach by using digital marketing data to compete successfully within this market.

Frequently Asked Questions

How have iron and related exports influenced US steel export volumes?

US steel exports depend on iron and steel shipments because iron output determines which products can be exported. The steel industry changes its production process at steel mills because global market demand determines which domestic raw materials are available. The American Iron and Steel Institute publishes data that reflect shifts in quantity and timeline, helping analysts forecast through 2025. Tariffs and quotas on products such as pipe and tube and tubular goods create changes in product distribution patterns. American steel exporters send fewer exports to foreign markets because international trade patterns now include offshore sourcing.

What measures do steel producers take to maintain export competitiveness?

Steel producers often invest in modernizing facilities to fabricate more complex products like electrical-grade sheet and tubular pipe and tube which leads to higher product value. Companies in North America work to optimize their supply chain operations by using different methods to decrease expenses while adjusting to new percentage tariff rates and quotation restrictions. The partnership between United States Steel and smaller steel producers enables their companies to increase exports while satisfying the requirements of international customers. The American Iron and Steel Institute data from 2020 and 2021 show how capacity adjustments affected export volumes and market share. Producers also monitor national security reviews and Commerce investigations that can affect access to certain markets.

How large is the US steel export market in economic terms?

US steel exports reach a value which fluctuates between multi-billion dollar ranges because global market demand and pricing cycles affect export operations. The post-2020 recovery reached its highest point in 2021 but peak export values depend on commodity prices and export volumes. Census and Commerce reports provide the official figures used by industry analysts to compare to prior years like 2020 and to forecast toward 2025. The implementation of tariff policies and quota systems which raise costs through percent tariffs or limit volume shipments create direct impacts on dollar revenue. The presence of offshore competition and contracts for tubular or pipe products also shifts revenue patterns among American steel exporters.

How do US export policies impact American steel and producers?

The USA utilizes its export regulations which the Commerce Department and other agencies operate to establish tariff percentages and implement quotas and start investigations which change the competitive situation of American steel companies. National security protection policies create export restrictions which require additional licensing for specific tubular and electrical components. The measures impact both major companies such as United States Steel and various small steel producers throughout North America. The American Iron and Steel Institute responds to policy changes by providing data which shows export patterns for the years 2020 and 2021. Exporters must comply with these regulations while they attempt to enter international markets for sustaining their highest production capacity.

Which US steel products are most commonly exported?

The US export market mainly handles steel products which include flat-rolled steel and tubular goods and structural sections and electrical-grade steels. Exported tubular and pipe products supply energy and infrastructure projects in foreign countries while they account for a significant portion of total export tonnage. American steel manufacturers gain operational advantages through fabricators who cut and weld and finish products for export which enables them to sell at higher prices per ton. The American Iron and Steel Institute uses Census export records and industry reports to monitor product flows while assessing changes in market demand. The combination of tariffs and quotas together with peak global demand times determines which products export in the highest quantities.

How do percentage tariffs affect US steel export competitiveness?

The use of percent tariffs results in increased expenses for foreign customers who purchase US steel which leads to decreased export demand because US products become less affordable than international options. High percent tariffs plus dedicated export restrictions cause export patterns to shift toward markets which have less strict trade regulations while they modify the types of products which can be exported such as pipe and tube and tubular assemblies. Tariff investigations and Commerce rulings lead to the establishment of retroactive duties which impact previous contracts and company financial statements. The American Iron and Steel Institute works with export-focused steel companies to evaluate tariff effects through census trade data analysis which forecasts results for 2022 and 2025. Tariffs serve as a primary factor which influences producers’ choices regarding their steel export volume and steel export product selection.

Reference Sources

- Imports, Technology, and the Success of the American Steel Industry – Explores U.S. steel capacity and competitiveness in the global market.

- An Alloy of Steel and Information and Communication Technology (ICT): Does It Facilitate Trade? – Reviews the role of ICT in enhancing global steel trade, including U.S. exports.

- Evaluation of Proposed Policies Concerning Japanese Steel Exports and the United States Steel Industry – Analyzes the impact of foreign steel imports on the U.S. steel industry.