This comprehensive analysis investigates the major patterns which establish steel import trends between different nations and identifies the elements which cause these trends to emerge. The study will assess current developments in 2024 because they will shape the future which industry leaders and policymakers and business executives will use for their strategic planning process. This analysis gives you the necessary background information and future predictions which you need to handle supply chain problems and learn about international trade patterns.

Overview of Steel Imports

Definition and Importance of Steel Imports

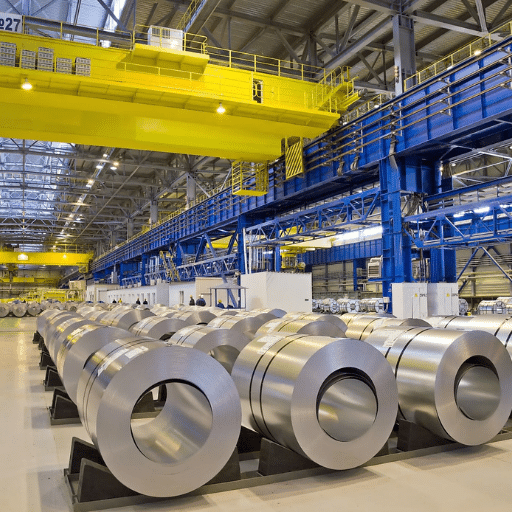

Steel imports involve the transportation of steel products which manufacturers create in one nation to another nation. Steel imports serve as a vital component for economic development because they provide essential materials which domestic production fails to meet. Steel imports play a crucial role for businesses which operate in the automotive manufacturing sector and the infrastructure development field and the machinery manufacturing industry.

Recent search trends show that worldwide demand for steel imports has risen because of post-pandemic recovery efforts and infrastructure modernization projects and the need for high-grade steel used in renewable energy initiatives. Policymakers and business leaders must comprehend steel import dynamics because their organizations need to respond to shifting market conditions and tariff changes and geopolitical factors that affect worldwide supply chains and market prices.

Global Steel Production Statistics

The latest data shows that global crude steel production reached around 1,878 million metric tons in 2022, which indicates the considerable size of this industrial sector. China now dominates metal production because the country provides more than half of the world’s total metal output which accounts for 50 percent of the global market share. The World Steel Association states that production volumes depend on multiple elements which include domestic consumption patterns and available export markets and current energy expenses and existing environmental protection standards.

Industry Insight: As countries seek to achieve environmental sustainability, they actively research green steel manufacturing techniques which help decrease greenhouse gas emissions. The steel industry undergoes transformation through these technological advancements, which introduce environmentally friendly methods for production to an industry that traditionally consumes significant energy.

Key Data Points on Steel Imports by Country

United States

The United States maintains its status as one of the biggest steel importing countries in the world, which obtains its steel supplies primarily from Canada and Mexico and South Korea.

2022 Imports: 22.3 million metric tons

Primary drivers: Construction and automotive sectors

China

China holds the title of the biggest steel producer in the world yet still needs to import special steel products from overseas.

2022 Imports: 12.7 million metric tons

Focus: High-tech construction and manufacturing

Germany

Germany, as a major industrial hub in Europe, relies heavily on regional supply chains with most imports coming from other EU nations.

2022 Imports: 24.7 million metric tons

Source: Primarily EU member nations

India

India stands as a rising steel producer, yet its yearly demand leads to imports because the country lacks domestic production of particular steel grades.

2022 Imports: 7 million metric tons

Applications: Defense and infrastructure development

Japan

Japan imports often fill niche requirements for unique products and alloys used in advanced industries.

2022 Imports: 6 million metric tons

Specialty: Advanced alloys and unique products

How are global steel import trends impacting industrial sustainability efforts?

The current global steel import patterns show a growing trend toward sustainable practices. Nations now emphasize green steel solutions while they establish international collaborations for acquiring materials which produce low carbon emissions and use recycled content.

The European Union created carbon border adjustment mechanisms to promote environmentally friendly steel imports, while multiple countries established rules to limit the carbon emissions of imported goods. These actions demonstrate that industrial development now seeks to fulfill environmental responsibilities.

Major Importing Countries

United States Steel Imports

The United States stands as one of the globe’s top steel importing nations which purchases steel from its main trade partners that include Canada Mexico South Korea and the European Union. According to the latest available data the U. S. imported approximately 22.1 million metric tons of steel in 2022 which marked a slight increase from previous years. The construction and automotive and manufacturing sectors demonstrate strong demand growth.

Through its implementation of tariffs and quotas the U. S. government controls steel imports to achieve a balance between domestic steel manufacturing and international market access. The policies provide assistance to domestic steel manufacturers while enabling businesses to obtain steel products that they cannot find in their own country. U. S. steel imports now require environmental compliance because companies use suppliers with reduced carbon emissions to meet consumer and legislative demands.

China’s Role in Global Steel Imports

China maintains its status as the leading steel producer and exporter worldwide, which enables it to control international steel trade activities. According to recent data, China exported steel products which accounted for approximately 9% of global steel exports in 2022, with Southeast Asia and the Middle East and Africa as its main export markets. China has two steel market functions because it exports a large volume of steel while also importing high-quality steel and unique products which its industries do not manufacture.

Key Considerations:

- The country’s extensive steel production capacity enables it to satisfy international market requirements but it creates apprehension about excessive production capability and market oversupply issues.

- China has developed initiatives to decrease the environmental effects caused by its steel production activities as an obligation to the global demand for reduced carbon emissions.

- The country has started to update its production plants and implement eco-friendly production methods which will lead to new trading trends throughout the world.

European Union Import Trends

The European Union (EU) has experienced major changes in its steel import patterns during the last few years because of global trade policies and economic recovery efforts and sustainability targets. According to the latest data the EU has increased its steel import sources by which it seeks to decrease its reliance on specific regions while protecting its supply chain operations. The European Union imports steel from Turkey and India and South Korea which have emerged as major steel export markets after China restricted its overseas shipments to protect its internal market.

Search engine data indicates that European Union residents currently show greater interest in discovering information about sustainable steel imports. The bloc focuses on developing environmentally friendly manufacturing practices while decreasing carbon emissions throughout various sectors. The European Union receives frequent requests to explain steel import compliance with its regulations and to share information about cleaner production methods that arise from manufacturing countries.

Regional Variations in Steel Imports

North America: Trends and Projections

North American steel production faces major changes because sustainable development goals and technological progress and market evolution drive the sector’s transformation. Current research demonstrates that companies today use more recycled steel while implementing production methods that reduce their total energy consumption. The federal government establishes policies and programs which support domestic manufacturing of sustainable steel products to reduce dependency on imports and achieve environmental sustainability targets.

The main issue to examine concerns how domestic steel production activities measure up against steel import activities when it comes to solving sustainability problems. The most recent information shows that imported steel products come from areas with different environmental standards which creates problems for companies trying to meet North American green standard requirements. North American buyers are now choosing suppliers who follow sustainability standards because of the combination of increased need for supplier transparency and tougher import regulations.

Asia-Pacific Steel Import Dynamics

The Asia-Pacific region serves as the main international steel trade center because it operates two essential functions which include being a key steel production hub and a major steel export terminal. The most recent data shows that China Japan and South Korea control the steel production market with China producing more than half of the worlds steel output. The new United Nations environmental protection standards have created environmental concerns which have resulted in changing trade patterns. Customers now prefer to work with vendors who fulfill their demands for enhanced sustainability practices and superior product quality.

Regional Insight: The latest search data indicates that there is rising interest in sustainable steel production in the Asia-Pacific region and low carbon steel suppliers which shows that the area must shift to environmentally friendly methods. The Asia-Pacific region faces a complex challenge because it needs to maintain its competitive position while meeting increasing global environmental standards.

Latin America and Emerging Markets

Emerging markets together with Latin America now undergo a transformational process because they pursue both global sustainability objectives and their economic development targets. The latest search data shows that search queries about renewable energy investment in Latin America and sustainable infrastructure in emerging markets are becoming more common. The shift demonstrates that people in these regions show increasing interest in environmentally friendly initiatives and sustainable development.

These markets demonstrate a growing tendency to direct their resources toward clean energy technologies and environmentally friendly manufacturing methods and sustainable supply chain management. The initiatives function as essential elements which enable companies to establish market dominance while they work to solve critical environmental problems.

Impact of International Trade Policies

Tariffs and Trade Restrictions on Steel Imports

According to recent data, tariffs and trade restrictions create major disruptions to international steel markets. The latest reports show that these measures resulted in higher production costs and supply chain disruptions which affected multiple industries that depend on steel. Governments that impose tariffs do so to defend their local businesses but this strategy results in both higher costs for consumers and damaged relationships with other countries.

The analysis of search data shows that people are increasingly searching for different materials and environmentally friendly options because manufacturers want to find solutions to the problems created by trade regulations. The results show that trade strategies must achieve two goals by maintaining economic competitiveness and stopping market interruptions.

Trade Agreements Affecting Steel Imports

Recent search engine data shows that more people want to study how trade agreements affect steel import activities. The increase in searches for particular tariff and quota system policies shows that both businesses and consumers have developed greater understanding about these topics. The international steel market has been shaped by trade agreements that include the United States Section 232 and the European Union safeguard measures for steel.

Trade Policy Impacts:

- Domestic industry protection policies usually lead to supply chain difficulties for international businesses.

- The increase in demand for alternative steel suppliers and sustainable materials shows that companies must adapt their operations to comply with new trade restrictions.

- The current trend demands trade agreements that enable economic development while protecting international trading systems from unreasonable disruptions.

Case Studies: USA and China Trade Relations

The United States and China have established a new trade pattern which generates substantial economic impacts throughout the globe. The search trends show that more people are looking for information about how tariffs affect businesses and how to find suppliers from countries outside of China. The existing situation corresponds to the tariff increases which both countries have implemented because these tariffs have resulted in supply chain disruptions which compelled businesses to develop new methods for their operational safety.

The technology industry has experienced a major increase in interest for electronic components, which now goes beyond Vietnam and India because of the USA-China trade conflict. The required goods for operations, which include textiles and machinery and steel, now require industries to learn about sustainable options and local suppliers. The search patterns show that people now understand trade obstacles better and take action to resolve those problems.

The data shows that businesses develop long-term plans while developing immediate responses to existing policies. The case study demonstrates how accessible information and progressive trade agreements are essential forces which determine the direction of international trade during times of economic uncertainty.

Recent Trends in the Global Steel Market

Shifts in Demand and Supply Patterns

The combination of current data with search engine trend analysis shows major transformations in worldwide steel demand and supply systems. The search volume for “steel price trends” and “raw material shortages” shows that people are worried about changing market conditions. The increasing demand for steel arises from infrastructure projects and emerging market growth which supports green technology development. Supply chain disruptions and energy crises and geopolitical tensions have caused major steel-producing countries to reduce their production capacity. The current situation of demand and supply imbalance leads to price fluctuations which require industry professionals to develop new techniques that will stabilize markets while meeting evolving global standards.

Influence of Economic Factors on Steel Imports

The patterns of steel imports from different countries depend on various economic factors which determine their import patterns throughout the world. The recent data shows that inflation rates and currency fluctuations together with trade policy changes create significant effects on steel import expenses and import volumes. The costs of imports increase when a country experiences high currency depreciation, which makes local steel production more appealing to businesses that want to expand operations despite their restricted capacity. Geopolitical events and economic sanctions create trade route disruptions which result in increased shipping expenses and shipment delays.

Market Trend: The latest search trend analysis shows that more people are searching for information about “steel import tariffs” and “global steel demand 2023” because both the public and steel industry professionals want to understand how economic factors affect the steel market. The need for flexible approaches to handle steel imports arises from unpredictable energy costs and other factors which create financial hazards for companies.

Technological Advancements in Steel Production

The steel industry uses technological advancements to solve its current problems which become more apparent through the increasing search volume for “steel import tariffs” and “global steel demand 2023.” The electric arc furnace (EAF) technology enables recycling of scrap metal which benefits the steel industry by decreasing both its need for raw material imports and its production expenses. The combination of advanced automation together with artificial intelligence (AI) technology enables manufacturers to boost their operational efficiency and manage product quality while responding to market demand changes and economic challenges. The steel industry uses these technologies and data trend analyses to develop innovative solutions which help them minimize financial risks while they achieve sustainable growth in the global market competition.

Frequently Asked Questions

Which countries lead steel imports in 2024 and who are the major importers?

The major countries which dominate steel import activities for 2024 steel import activities include the United States and Germany which combined with various Southeast Asian nations. The USA stands as one of the top steel importing nations according to trade data while Thailand and Italy maintain their status as key regional import powers. The steel industry requires annual steel and finished steel product imports based on construction and automotive and manufacturing industry needs. National production cycles and tariff policies and national security reviews determine the fluctuations in export and import balances. The establishment of net flows requires you to examine both steel imports which use HS codes and complete customs records which include details about stainless steel and wire products.

How does steel production in 2023 affect imports by country and world steel balances?

The 2023 crude steel production across the globe affected each country steel imports because it changed both supply levels and international pricing information. The demand for finished steel and specific steel grades such as stainless and wire increases when a single region experiences decreased production capacity. A country with substantial finished steel production capacity may still need to import semi-finished steel products and specialized steel items despite its domestic manufacturing capability. The combination of production data with import statistics enables research to show how different countries shift between becoming net importers and exporters within the global steel market. The December reports together with the monthly reports provide information which shows how production patterns during 2023 resulted in particular import requirements for 2024.

What trade data sources should I use to analyze imports of steel, exports, and import flows?

The main trade data sources identify national customs databases and UN Comtrade and industry reports which provide HS code details for both iron and steel and stainless products. The sources deliver comprehensive monthly and yearly statistics which include December figures for year-to-year assessment and net trading results. The research requires you to combine trade datasets with global crude steel production information and national capacity data which includes EAF electric arc furnace proportions. Steel analysts study the import market through two dimensions which include total weight and product type which consists of finished and semi-finished and wire products. The examination of country notes which explain national security policies and import restrictions needs to occur because it helps in tracking unexpected developments.

How do imports by country interact with export and import patterns in major steel-producing nations like Brazil and Italy?

The import activities of different countries create effects that shape export and import trends between Brazil and Italy while they dominate steel production. The steel import patterns of Brazil and Italy show how both countries create their own domestic steel production systems while they implement their export policies. Brazil exports its ores and semi-finished products while it imports finished steel products and specialized stainless steel grades that have higher value. Italy uses its strong manufacturing capability to export and import special steel products that specific industries require. The trade data demonstrates these patterns because it shows how countries change from being net exporters to net importers based on their yearly steel consumption and the current global steel market prices. The analysis needs to examine finished steel movements between HS classification levels while assessing how Belgian and French suppliers operate within regional trade networks.

How do national security policies affect steel import regulations in the United States and various other nations?

The United States and all other countries need to control certain steel imports because national security requirements demand this while they need to boost local production for essential defense-related industries thus creating new circumstances which affect the steel import market. Governments need to create policies that combine tariffs and quotas together with Buy National requirements to secure critical steel grades in order to achieve their established goals. The biggest trading partners experience these measures through trade pattern changes which lead to reduced exports and imports while creating trade conflicts that result in operational changes to supply chains. Trade analysts monitor policy announcements because they create major shifts to both steel import volumes and category-specific import patterns across HS divisions. The analysis shows total volume changes and product supply preference shifts between Mongolian and Thai suppliers for different product lines.

Which countries are emerging as major importers of specialized steel products, such as stainless steel, and which are the largest suppliers?

Nations that experience rapid industrial development and those building high-value manufacturing capacity represent the main emerging markets for specialized steel imports which include stainless steel, while Southeast Asia and Europe show rising demand. Stainless steel and niche product markets depend on established Asian and European exporters through their supply networks which connect to France and Belgium for product distribution. Market segmentation shows that some countries import raw stainless for domestic processing into finished steel or wire products, affecting the total world trade picture. The identification of specific supplier-buyer relationships together with trade flow patterns that reach 2025 requires trade data at the detailed HS level and monthly total weight reports. The analysis of 2023 steel production patterns together with current demand changes will determine which countries will develop into leading markets for specialized grade imports.

Reference Sources

- Steel Imports, Labor Productivity and Cost Competitiveness

A study analyzing the impact of steel imports on labor productivity and cost competitiveness in major steel-producing countries. - Steel Market and Global Trends of Leading Geo–Economic Players

Research on the relationship between steel consumption and national income, focusing on global trade trends. - Situation on the World Steel Market: Economic and Statistical Analysis

An analysis of global steel production, consumption, and trade dynamics post-2008 economic crisis.