The pricing of stainless steel rods in global markets is reflective of broader dynamics of raw material cost escalations, trade policies, and the industrial demand cycle. Stainless steel remains a vital product in sectors such as construction, automobiles, aerospace, and manufacturing. This full study includes the current stock-level reports, regional disparities, historical extrapolations, and a forward-looking forecast to give potential buyers and other industry stakeholders the utmost comfort in making well-informed decisions.

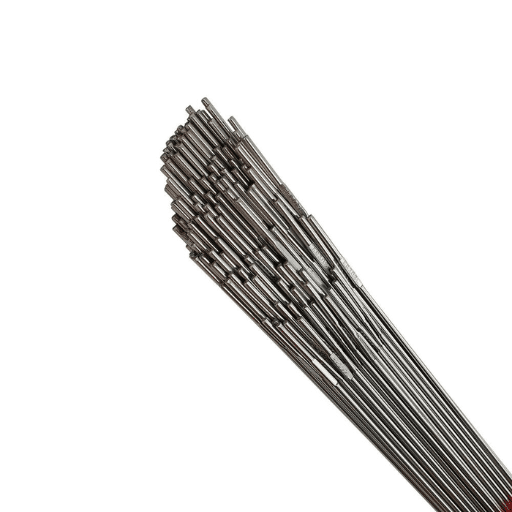

Product Overview

Stainless steel bars are long, cylindrical metal items made by hot rolling, cold drawing, or by forging. They are important feedstock for machinable products, fastener products, and structural applications.

Standard Grades and Specifications

- 300 Series (Austenitic): 304 (1.4301), 316 (1.4401), 321 (1.4541)

- 400 Series (Ferritic/Martensitic): 410 (1.4006), 420 (1.4021), 430 (1.4016)

- Duplex Grades: 2205 (1.4462), 2507 (1.4410)

- Standards: ASTM A276, ASTM A479, EN 10088, JIS G4303, GB/T 1220

Chemical Composition (Grade 304 Example)

| Element | Composition (%) |

|---|---|

| Chromium (Cr) | 18.0–20.0 |

| Nickel (Ni) | 8.0–10.5 |

| Carbon (C) | ≤0.08 |

| Manganese (Mn) | ≤2.0 |

| Silicon (Si) | ≤1.0 |

| Iron (Fe) | Balance |

Key Mechanical Properties (Grade 304)

- Ultimate Tensile Strength: 515–720 MPa

- Yield Strength: ≥205 MPa

- Elongation: ≥40% in 50mm

- Rockwell Hardness: ≤187 HB (in as annealed condition)

Commercial Sizes

- Densitites: 6 mm–300 mm (round bars)

- Lengths: 3m, 6m or any desired length

- Finish: Hot rolled (black), cold drawn (bright), peeled, ground, polished

Major Applications

- Automotive: Drive shafts, fasteners, exhaust systems

- Construction: Reinforcement bars, structural components

- Oil & Gas: Valve Stems, Pump Shafts

- Aerospace: Landing Gear Components, Fasteners

- Food Processing: Equipment Frames, Mixing Shafts

Global Price per Kilogram (Current Snapshot)

As of November 2025, international stainless steel rod prices exhibit moderate stability following volatility in H1 2025.

Latest International Spot Prices (FOB)

304 CD Round Bar (12–50mm Diameter)

- Base Price Range: USD 3.85-4.35/kg (Asian throwing away ports)

- Premium Grades (316/316L): USD 5.20-5.85/kg

Reputable Source Quotes

1.Shanghai Metals Market (SMM) – November 15, 2025

304 bright bar: RMB 27,500-29,000/ton (USD 3.87-4.08/kg)

2. Metal Price Specialist (MEPS International) – November 2025

European 304 bar: EUR 3.60-3.95/kg (at current exchange rate: USD 3.92-4.30)

3. Argus Metals – Week of November 11, 2025

US Gulf 304 stainless bar: USD 4.10-4.50/kg

CIF Premiums to Major Hubs

- Rotterdam (Europe): +USD 0.25-0.35/kg (freight + insurance from Asia)

- Los Angeles (US West Coast): +USD 0.30-0.40/kg

- Shanghai (Import): +USD 0.15-0.20/kg (Southeast Asian origin)

- Dubai (Middle East): +USD 0.30-0.45/kg

Regional Sales & Pricing in Key Markets

| Country/Region | Typical Price (USD/kg) | Main Suppliers | Local Taxes/Duties | Popular Specs |

|---|---|---|---|---|

| China | 3.85–4.20 | Tsingshan, TISCO, Baosteel | 13% VAT | 304/316 bright bars, 6–100mm |

| European Union | 4.30–4.80 | Outokumpu, Acerinox, Aperam | 19–27% VAT, 0% duty (intra-EU) | EN 10088 grades, peeled/ground finish |

| United States | 4.50–5.10 | North American Stainless, ATI | Section 232 tariffs waived (2024), state sales tax | ASTM A276, 304/316L, aerospace grades |

| India | 3.95–4.40 | Jindal Stainless, VISA Steel | 18% GST, 7.5% import duty | 304/316 hot rolled, construction sizes |

| Japan | 4.60–5.20 | Nippon Steel, JFE | 10% consumption tax | JIS G4303, precision tolerance bars |

| Southeast Asia | 4.00–4.55 | Vietnamese/Indonesian mills | 5–10% import duties (ASEAN preferences) | 304 general purpose, cost-driven specs |

Regional Insights

The domestic contrast prevails; with China being the world’s largest producer as well as consumer, it sets the international market price level. Europe enjoys huge quality premium prices by imposing new border carbon adjustments from 2026. US producers look upon this by seeing energy and raw material constraints and logistics feed prices inside the country. India stands to gain further market share by setting up the capacity in leaps and bounds and offering competitive prices to South Asian and Middle Eastern producers. But for aerospace grade materials, Japan is looking for high-performance and hence wider quality range.

Historical Price Volatility (Past 24 Months)

Monthly Average Price Trend (Grade 304, FOB Asia)

USD/kg

5.50 | *

5.25 | * |

5.00 | * | |

4.75 | * | | |

4.50 | * | | | | *

4.25 | * | | | | | * | *

4.00 |_|____|____|____|____|____|____|____|____|____

Nov Jan Mar May Jul Sep Nov Jan Mar May Jul Sep Nov

'23 '24 '24 '24 '24 '24 '24 '25 '25 '25 '25 '25 '25Key Statistics

- Peak: 5.45 US dollars per kilogram (the month of August 2024)

- Trough: 3.72 US dollars per kilogram (the month of February, 2025)

- Overall: +46.5% peak-to-trough swing

Major Price Drivers (2024–2025)

- Q1 2024: The nickel price rose to USD 20,000 per ton pushing the price of 304/316 grades 18% higher relative to the previous quarter.

- Q2 2024: Panic buying was noted due to the restrictions on nickel ore export imposed by Indonesia; the highest was reached in the month of August.

- Q4 2024: The downturn in the Chinese property sector led to the containment of local demand; prices declined by 15%.

- Q1 2025: The industrial slow built into the global market sentiment and destocking brought February back to the level of 2 years ago.

- Q2–Q3 2025: Gradually increasing orders of infrastructure building (EU, India) and restocking.

Short-Term & Long-Term Price Trends

Next 3–6 Months Forecast (November 2025 – April 2026)

Sentiment: Neutral to Slightly bullish

Main Points:

- Suspected nickel stabilization: LME nickel exchanging at USD 16,500–USD 17,800 per ton, setting a base for costing.

- Winter construction slowdown: There is a seasonality-type seasonality in North Hemisphere (December through February).

- Policy uncertainty in trade: There is a potential for the EU Carbon Border Adjustment Mechanism (CBAM) to benefit with an increased cost of EUR 0.15–EUR 0.25/kg for all non-compliant LME prices starting in January of 2026.

- Chinese New Year restocking: The usual pre-holiday (late January 2026) buying could offer price push.

Price Projection: USD 4.00 to 4.50/kg (304 Grade FOB Asia) for January–March 2026 period.

2026–2028 Long-Term Outlook

Important Influencing Factors:

- Green Steel Transition: With the significant increase in the use of electric arc furnaces (EAF), based on the use of scrap-based feedstock instead of nickel pig iron, the nickel intensity of these metals could reduce totally. However, at the same time, the severity in terms of energy consumption might increase. According to the CRU Group, 55% of the global stainless-steel production in 2028 is expected to be EAF based, as opposed to 48% in 2024.

- Electric Vehicle (EV) Demand: The GIF competes for nickel with battery-grade material for making stainless. However, the stainless consumption through 2028 is expected to accelerate at a compounded annual growth rate of +4.2%, driven by EV components (battery enclosures, structural parts), as per the World Stainless Association.

- Infrastructure Megaprojects: The U. S. Infrastructure Investment and Jobs Act, the EU’s REPowerEU, and India’s National Infrastructure Pipeline together represent projects worth over USD 3 trillion that are stainless-intensive until 2030.

- Geopolitical Fragmentation: Friend-shoring trends are fractionalizing supply chains and introducing regional price disparities. According to Wood Mackenzie, trade bloc formation could make nonaffiliated buyers pay premiums of 10–15%.

Analyst Consensus:

- CRU Group (October 2025): “We anticipate that the 304 price will range between USD 4.20 and USD 4.60/kg throughout 2026-2027. There is now an upside risk to prices due to nickel supply constraints.”

- Fastmarkets (November 2025): “Long-term equilibrium price of 304 bar: USD 4.40/kg (in real 2025 dollars), assuming a nickel price inflation rate of 2% annually.”

Buying Tips & Risk Hedging

Procurement Best Practices

Minimum Order Quantities (MOQ):

- Domestic distributors: 1-5 tons (mixed sizes)

- Direct mill purchases: 25-100 tons (single specification)

- Import containers: 20-25 tons (20ft/40ft FCL)

Lead Times:

- Stock items: 0-3 weeks

- Custom sizes/finishes: 6-12 weeks

- Specialty alloys (duplex, super austenitic): 12-20 weeks

Payment Terms:

- Spot buyers: 30-50% deposit, balance against B/L

- Long-term contracts: Quarterly pricing reviews w/base price+alloy surchg frmula

- Letters of Credit: Common for international transactions (USD 50,000+ val)

Price Risk Hedging Strategies

- Forward Contracts:To enter and lock in prices for 3-12 months hence with mills or traders, 10-20% deposit will typically be needed.

- LME Nickel Futures:Every Grade 304 bar contains ~8% nickel. Therefore, if you bar 100 tons of 304 bars, you must hedge 8 tons of nickel using 3-month LME futures.

- Supplier Price Protection Agreements: It is a bargaining technique to determine quarterly maximum price caps against 50 distributors. These are regularly granted in automotive or aerospace supply chains.

- Inventory Diversification: Maintain at least 30 days worth of stock during a price trough but reduce inventory as prices go up.

Quality Assurance Red Flags

Counterfeit Material Indicators:

- Prices >15% below market average without verifiable documentation

- Missing mill test certificates (MTC) per EN 10204 3.1 or ASTM A276

- Vague country-of-origin labeling (“Asian origin” without specific mill)

- Surface finish inconsistencies (cold-drawn bars with hot-rolled appearance)

Verification Steps:

- Ask for a PMI (Positive Material Identification) verification using XRF or other analyzer

- Ask for traceability of the heat number to the original mill

- Check for appropriate markings of bar ends in compliance to ASTM/EN standards

- Look for ISO 9001/AS9100-certified distributors for critical applications.

Conclusion

The sanwtermarket mra meaning stainless steel rod is at a crossroads as prices have started to stabilize post-nickel volatility of 2024 but are beaten by massive structural changes due to decarbonization, geopolitical realugments, and dynamic industrial demand. It is in the best interest of buyers to act these moments of relative stability to lock in advantageous prices on contracts and show more resilience in their supply chains by adopting multiple sources and strategic hedging. Quality-conscious preoccupation has ever remained quite high-up especially in those periods of time wherein investors could see it back!

In these sequence of upcoming months, the buyer groups must negotiate as hard as they can in the procurement of prices. Long before any extra premiums, if imposed through CBAM legislation, step in together construction restart in Q2 of 2026.

Sources & References:

- Chinese Securities and Monetary (CSM) – Shandong Huajin April-July 2021 rankings

- Fastmarkets – The world’s largest nickel producers in 2018

- CRU Group – Stainless Steel World Conference 2020

- Metal Expert (MEPS International) – Stainless steel price forecasts and long-term outlook

- Argus Media – “World to see the impact of Chinese capacity closures”

- Magna Adum – “Shaping of Future Metals Market China” (May 2025 updates)

Disclaimer: Prices and forecasts in this article reflect data available as of November 5, 2025, and are subject to change without notice. This analysis is for informational purposes and does not constitute financial, legal, or commercial advice. Always verify current spot prices and contractual terms directly with suppliers and industry pricing services.