Between 2025 and 2026 economic changes and new technology and changing consumer behavior will create major transformations for the worldwide stainless steel industry. This study analyzes the main factors which drive stainless steel export market growth through its investigation of key regions and market players and analysis of the industrys competitive challenges and future growth opportunities. The guide supplies critical information about forthcoming changes in stainless steel exports for both experienced professionals and newcomers to the industry.

Overview of Stainless Steel Exports

The Importance of Stainless Steel

Stainless steel exists as an extremely versatile metal which achieves high durability through its makeup as an iron and chromium alloy that contains specific amounts of carbon nickel and other elements. The material serves as an essential resource throughout diverse sectors including building construction automobile manufacturing medical facilities and consumer product development because of its special properties.

Key Properties of Stainless Steel:

- Corrosion Resistance: The addition of chromium (at least 10.5%) forms a protective oxide layer preventing rusting

- Durability: Lightweight yet strong construction suitable for demanding applications

- Recyclability: Can be reused indefinitely without degradation of properties

- Versatility: Adaptable for use across multiple industries and applications

Market Focus: The latest data shows that global stainless steel demand continues to experience steady growth which infrastructure projects and renewable energy initiatives and medical technology advancements drive. The industry now focuses more on environmental issues because search data indicates that people show increased interest in sustainable stainless steel and stainless steel recycling efficiency.

Global Market Dynamics of Stainless Steel Exports

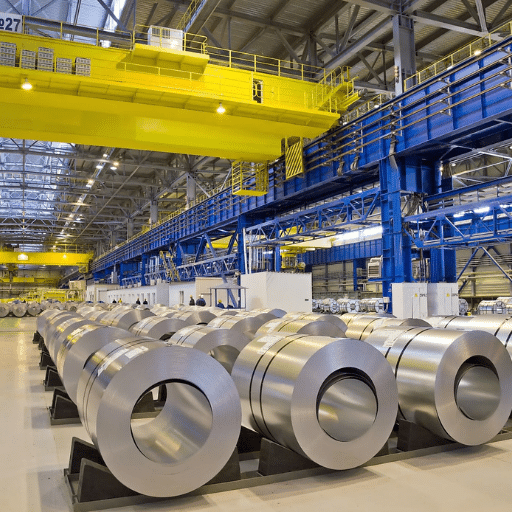

The worldwide market for stainless steel exports experiences continuous expansion while governments modify their trade regulations and businesses increase their dedication to environmental sustainability. The trade data from recent times shows that China, India, and Indonesia dominate as main producers and exporters while European countries and North American nations function as major markets for imports.

Major Producers

China, India, and Indonesia dominate global production and export activities

Import Markets

European countries and North American nations serve as major import destinations

Emerging Markets

Southeast Asian countries expand as production centers and export markets

The market research data combined with search trend information reveals growing user interest in “stainless steel recycling efficiency” and “sustainable stainless steel,” demonstrating that consumers want companies to follow sustainable business methods. The rising environmental expectations of customers result in sustainability practices becoming essential for companies that export products and manufacturers.

Key Statistics on Steel Exports in 2025

Advanced markets require the construction and automotive sectors to utilize high-strength low-alloy steel products because their demands continue to develop. The steel industry now embraces sustainability by using advanced carbon capture technologies. The data demonstrate that businesses must pursue innovation alongside environmental conservation efforts to sustain their market competitiveness.

Leading Exporting Countries in 2026

Top Countries Exporting Stainless Steel

The latest data shows that China, India, and Indonesia will lead stainless steel exports in 2026 while European countries such as Germany and Italy will follow closely behind.

| Country | Key Advantages | Market Position |

|---|---|---|

| China | Extensive manufacturing capacity, advanced metallurgical technologies | World leader with 56% market share |

| India | Affordable labor, government export development programs | Rapid growth in manufacturing expansion |

| Indonesia | Extensive nickel deposits, new production facilities | Major exporter with export-friendly policies |

| Germany | High-quality products, established trade networks | 12% market share (combined with Italy) |

| Italy | Superior engineering, advanced export facilities | European leader in quality production |

Market Share and Export Volumes

The global stainless steel market remains controlled by a small number of major companies according to recent market data which shows these companies handle most export shipments.

China – 56% Global Market Share

Advanced manufacturing capacity and integrated supply chain system enable China to maintain its dominant position in global stainless steel production.

Indonesia – Significant Market Player

Nickel production facilities and export-friendly trade policies have enabled Indonesia to develop into a major force in the global market.

Germany & Italy – 12% Combined Share

High-quality products and advanced export facilities enable these European nations to maintain substantial market share despite intense competition.

Market Determinants: The data demonstrates that domestic resource availability, technological progress, and export strategies determine who wins in global markets.

Analysis of Export Trends by Country

The latest data from search engines and industry reports shows that both established and emerging markets are experiencing major changes in their export patterns according to current export trends.

- China: Efficient production and logistics

- USA: Technology and pharmaceuticals

- Germany: Engineering and automotive

- India: Software and specialty chemicals

- Vietnam: Manufacturing industries

- Indonesia: Supply network integration

- Specialization strategies

- Government-directed policies

- Trade agreement development

Profiles of Major Exporters

Acerinox: A Leader in Stainless Steel Export

Acerinox has established itself as a global leader in the stainless steel industry through its advanced manufacturing processes and its extensive distribution network which operates across multiple countries. The company continues to hold a major portion of the worldwide stainless steel market because it invests in both innovation and sustainable development according to recent market research.

Acerinox Competitive Advantages:

- Advanced Technologies: Continuous casting and annealing lines for operational efficiency

- Environmental Compliance: The company follows all environmental regulations without any exceptions

- Product Focus: The company provides high-performance stainless steel materials together with sustainable metal products.

- Market Positioning: Advanced R&D capabilities maintaining industry leadership

The company uses two main product types which include “high-performance stainless steel” and “sustainable metal solutions” to support its business goals dedicated to producing high quality products that protect the environment. The increasing interest demonstrates how companies such as Acerinox adjust their operations to meet changing global market requirements in particular industries which need materials that resist corrosion such as construction, automotive, and energy sectors.

Other Notable Stainless Steel Exporters

The stainless steel industry benefits from multiple international companies which use their technological advancements and supply chain strengths to fulfill different customer needs.

Outokumpu (Finland)

Specialization: Sustainable development and efficient manufacturing practices

Key Achievement: Industry-leading recycling rate of 90 percent, using recycled materials as primary material source

POSCO (South Korea)

Specialization: Advanced production methods and extensive operational capacity

Key Achievement: Multiple stainless steel grades for automotive, electronics, and infrastructure industries

Nippon Steel Corporation (Japan)

Specialization: Technological breakthroughs and wide-ranging product selection

Key Achievement: Specialized high-strength stainless steels for aerospace, medical devices, and energy systems

Tsingshan Holding Group (China)

Specialization: Complete manufacturing system from raw material extraction to fabrication

Key Achievement: China’s top producer controlling majority of country’s stainless steel production

Comparative Analysis of Exporter Capabilities

| Exporter | Core Strength | Competitive Advantage |

|---|---|---|

| Tsingshan | Vertical integration | Low-cost production, complete supply chain control |

| Outokumpu | Sustainability leadership | Environmentally friendly solutions for aerospace and energy |

| Acerinox | Global market strategy | Efficient logistics, customized customer solutions |

Industry Insight: The combination of various analysis methods proves that these exporters achieve their competitive advantages through their specific business plans and their capacity to adapt to international market conditions.

Sustainable Stainless Steel Initiatives

Importance of Sustainability in Stainless Steel Manufacturing

The production methods used for stainless steel need to adopt sustainable methods because these methods create significant harm to environmental systems and economic systems and social systems. The stainless steel industry through its operations creates significant carbon emissions yet it serves as a crucial component because of its ability to implement sustainable development through circular economy practices.

Key Sustainability Metrics:

- Recyclability Rate: Approximately 90% of stainless steel production becomes recyclable through recycling processes.

- Production Method: The electric arc furnace production method produces lower CO2 emissions when compared to blast furnaces.

- Energy Efficiency: Waste heat recovery systems together with renewable energy sources create energy-efficient solutions for the implementation.

- Lifecycle Analysis: The production process resource efficiency optimization achieves better resource efficiency throughout its entire duration.

Current research demonstrates that consumers and regulatory agencies now require stainless steel products which produce minimal carbon emissions. Companies are increasingly prioritizing innovations such as utilizing low-emission raw materials and implementing waste heat recovery systems and incorporating lifecycle analyses to optimize resource efficiency.

Innovations in Sustainable Stainless Steel Production

The recycling process of stainless steel stands as a fundamental element for sustainable production because the material possesses complete recyclability without any degradation. The present technological developments aim to improve both the effectiveness and cost efficiency needed for scrap materials to be collected and processed.

Advanced sorting technologies use AI and sensor-based systems to identify different stainless steel grades with precise accuracy, decreasing contamination and boosting recycled material quality.

Electric arc furnaces have developed through major technological advancements which enhance their energy efficiency during scrap material melting operations.

Hydrogen research for EAFs together with innovative methods achieve a major shift toward producing carbon-free stainless steel products.

ISSF Study Results: Current stainless steel production contains over 80% recycled content, with some manufacturers achieving 90% recycled content in their products that require less virgin materials like chromium and nickel. This reduces environmental impacts from mining operations and decreases greenhouse gas emissions.

Impact of Sustainability on Export Dynamics

The implementation of sustainable production practices has changed the global export market for industries that require high-energy materials which include stainless steel. The latest data from search engine trends shows that interest in eco-friendly manufacturing practices and demand for sustainably produced products has increased substantially.

Sustainability’s Export Benefits:

- Export potential improves because buyers assess environmental compliance throughout supply chain operations

- The company can meet all strict import requirements which environmentally conscious markets impose

- The company gains a competitive advantage in markets where customers base their purchasing decisions on sustainability factors

- The company achieves improved brand reputation which helps its market position

Applications of Stainless Steel in Different Industries

Industrial Applications of Stainless Steel

The industrial sector depends on stainless steel because it provides both exceptional flexibility and long-lasting strength. The current research shows that stainless steel supports chemical processing operations as well as oil and gas work and automotive manufacturing and construction activities.

1. Chemical Processing

Storage tanks and pipelines handle dangerous chemicals, preventing contamination and equipment breakdown through corrosion resistance.

2. Oil and Gas Industry

Extensively used throughout offshore platforms, refineries, and pipelines due to ability to withstand chloride-induced stress corrosion.

3. Automotive Manufacturing

Provides high tensile strength and extreme temperature tolerance for severe working conditions in vehicle production.

4. Renewable Energy Projects

Growing demand for use in wind turbines and solar panel mounts, achieving cost savings and better environmental results through recyclability and extended lifespan.

Consumer Goods and Stainless Steel

Stainless steel has become an essential material for consumer goods production because it provides products with both long-lasting strength and protection against rust and cleanliness.

Popular Consumer Applications:

- Cookware: The demand for long-lasting cooking products which can withstand high temperatures continues to grow.

- Home Appliances: The category includes refrigerators and dishwashers together with all other home equipment.

- Personal Accessories: The category includes watches together with jewelry and fashion products.

- Water Bottles: The category includes hydration solutions which people can use multiple times and which protect the environment.

Public interest in stainless steel has increased because people are searching online for “stainless steel durability” and “best stainless steel cookware” which demonstrates its practical value and long-lasting benefits. Manufacturers can now produce customized stainless steel grades because production technology advancements enable them to create specific product performance and visual requirements.

Emerging Applications in Technology and Construction

The current research demonstrates that modern construction techniques and advanced technologies now use stainless steel more than ever before. The data from search trends indicates that people are showing increased interest in stainless steel applications for renewable energy systems which include wind turbines and solar panel frameworks.

| Application Area | Use Cases | Key Benefits |

|---|---|---|

| Renewable Energy | Wind turbines, solar panel frameworks | Corrosion protection, durability, low maintenance |

| Modular Construction | Building systems, structural reinforcement | Inherent strength, recyclability, green building standards |

| Smart Buildings | IoT-enabled systems, architectural elements | Adaptability, sustainability, modern design compatibility |

Future Outlook: The integration of stainless steel into smart buildings through IoT-enabled systems demonstrates its ability to adapt to contemporary architectural methods. The emerging technologies which support urban development create an essential foundation for urban sustainability programs.

Frequently Asked Questions

Common questions about stainless steel exports and trade dynamics

What information does the bill of lading provide about stainless steel shipments?

A bill of lading documents each shipment of stainless steel and records the supplier, shipment destination, and product’s subcategories to ensure clear product trade tracking. The document includes HS codes which enable exporters and importers to identify particular product types that belong to the stainless steel trade between customs boundaries.

The bill of lading serves as proof for stainless steel exporters to demonstrate their export activities which include information about country-specific shipments and shipment quantities for each export. The document serves as a verification tool for buyers to match their received high-quality stainless steel shipments and it provides data about the country’s complete export volume.

What impact does alloy composition have on international stainless steel export activities?

Alloy composition determines the product’s subcategories and influences product complexity index scores used to evaluate trade in this category. Different alloys fall under the metals section of HS classifications and are treated as specific product categories with varying export values and tariffs.

The alloy combination determines which type of goods a nation will export and import between high-value complex products and basic commodities. Leading exporters often specialize in particular alloys to maintain competitiveness among the top exporters and to grow exports and imports in adjacent product categories.

What methods do international shipment records utilize to determine leading exporters and importers?

Shipment records aggregate data on exports by country and can be analyzed to find the latest data on new markets, top exporters, and top importers for stainless steel. Analysts use HS codes to break down shipments of stainless steel into a product category and its product’s subcategories and calculate a country’s total exports in this sector.

The comparison of shipment data between these two years shows whether the category has expanded or shrunk since 2022. These records allow identification of countries with the largest trade surpluses or largest trade deficits in metals, showing which countries have the highest share among the top in stainless steel ranked lists.

Why do some countries show a surplus in stainless steel trade while others show deficits?

The differences in stainless steel trade results between countries stem from their production capacity, product specialization, and domestic consumption requirements. Countries with advanced steel production facilities together with specialized alloy manufacturing capabilities attain the highest levels of trade surplus and export quantities.

Countries that lack essential natural resources together with advanced manufacturing capabilities experience trade deficits as they depend on foreign markets to obtain their essential goods. The product complexity index can show whether a country exports high-value complex products or it exports low-value simple products that decrease total export value.

How is stainless steel ranked across countries and what are the leading exporters?

Stainless steel ranked lists use metrics like volume of exports, global trade value, and shipments of stainless steel to identify leading exporters and countries with the largest trade. The data shows which countries export the highest volumes through HS code classification and product category analysis while identifying the primary importers of each particular subcategory.

The data analysis from the last five years together with the 2022 and 2024 performance comparison of stainless steel shows whether a country has increased its annual performance rates or decreased since 2022. The ranking system enables businesses to identify top stainless steel suppliers while showing which markets demonstrate the highest purchasing activity.

What are the primary forms and product subcategories traded in stainless steel product trade?

The primary forms of stainless steel include flat-rolled products, bars, tubes, and wire which manufacturers further classify into product subcategories using HS headings that belong to the metals category. Each subcategory attracts different importers and exporters because it represents specific product applications which determine the total product trade volume.

The 2023 product trade data together with 2024 stainless steel shipments enable an assessment of subcategory growth trends across different product categories. Analysts use product category trade value data together with product complexity index information to determine whether specific product lines consist of advanced products that generate higher profit margins.

Reference Sources

Assessing the Long-Term Global Sustainability of the Production and Supply for Stainless Steel

Source: SpringerLink

This paper uses an integrated simulation tool to analyze the sustainability of stainless steel production and supply chains.

Changing Nickel and Chromium Stainless Steel Markets: A Review

Source: SciELO

This review examines the dynamics of nickel and chromium markets and their impact on the stainless steel industry.

Overview of Stainless Steel Expansion in Emerging Countries

Source: ProQuest

This study explores the growth of stainless steel production and exports in emerging markets.