Current steel rod pricing should be kept under continuous surveillance by manufacturers, distributors, and procurement experts who must navigate the choppy waters of the contemporary metals market. The rebounding of industrial activities around the globe, coupled with volatility in raw material costs, make an analysis of resolutions regarding steel rod pricing of utmost importance toward sourcing decisions with insight. The analysis covers the spread of steel rod prices across the major markets, in a nutshell; historical volatility in pricing; and various suggested procurement strategies working from 2025 and beyond.

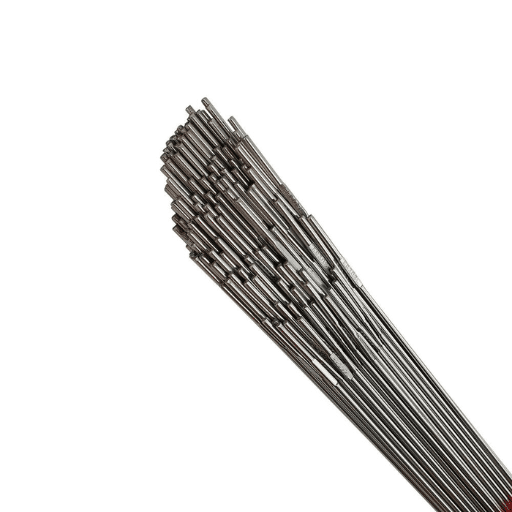

Product Overview

Solid chrome-nickel stainless steel bars are bars produced from iron-chrome alloys that are resistant to rust, and that may be obtained in finish states of hot-worked, cold-worked, or ground. These are excellent raw materials for office machine parts, fastener manufacturing, and structural applications in a number of industries.

Type of steel:

- Austenitic series: 304/304L (ASTM A276, EN 1.4301), 316/316L (ASTM A479, EN 1.4401/1.4404)

- Ferritic Series: 430 (ASTM A582, EN 1.4016)

- Martensitic Series: 410 (ASTM A276, JIS SUS410)

- Duplex/Super Duplex: 2205 (ASTM A479, EN 1.4462), 2507 (UNS S32750)

Chemical Composition of Selective Grades (Example 316L)

- Chromium (Cr): 16.0–18.0%

- Nickel (Ni): 10.0–14.0%

- Molybdenum (Mo): 2.0–3.0%

- Carbon (C): ≤0.03%

- Manganese (Mn): ≤2.0%

- Iron (Fe): Balanced

Mechanical Properties of Selective Grades in the annealed condition

- Tensile strength: 485–620 MPa

- Yield stress: ≥170 MPa

- Elongation: ≥40% in 50 mm

- Hardness: ≤217 HB (Brinell)

Typical Size Considerations

The diameters of rounded bars usually range somewhere from 6mm to over 300mm; the lengths run around 3m, 6m, or custom cut-to-length. The tolerances may be on-order for h9 or h11 (cold-drawn) or they conform to hot-rolled mill standards.

Key Applications

- Automotive components (shafts, fasteners, fuel systems)

- Marine hardware and offshore platforms

- Food processing equipment

- Chemical/petrochemical-related valves and pumps

- Medical instruments and surgical implants

- Aerospace fasteners and structural elements.

Global Price per Kilogram

Latest International Spot Price Range (USD/kg)

The amounts of stainless steel rod sales are very significant depending on the type and area of the product:

For 304/304L Standards (Commonly References):

- FOB Asia (China) 1.70-2.10 per kilogram.

- FOB Europe 2.80-3.20 per kilogram

- FOB North America 3.10-3.60 per kilogram

For 316/316L Premium Grades:

- FOB Asia 2.40-2.90 per kilogram.

- FOB Europe 3.60-4.20 per kilogram.

- FOB North America 4.00-4.80 per kilogram.

CIF Premiums to Major Hubs

The rod products usually carry a 35-65 percent premium over flat-rolled coil because of the process involved, heat treatment, and precision machining:

- Rotterdam (Europe): Adding a CIF premium of $0.60-0.90/kg

- Los Angeles (USA): Adding a CIF premium of $0.70-1.10/kg

- Shanghai (China): Adding a CIF premium of $0.30-0.50/kg

- Mumbai (India): Adding a CIF premium of $0.40-0.65/kg

Regional Sales & Pricing in Key Markets

| Country/Region | Typical Price (USD/kg) | Main Suppliers | Local Taxes/Duties | Popular Specs |

|---|---|---|---|---|

| China | $1.85–$2.30 | Tsingshan, TISCO, Baosteel | 13% VAT | 304, 316L, 2205 (6–100mm) |

| United States | $3.40–$4.20 | North American Stainless, Outokumpu, ATI | 25% Section 232 tariff on imports | 304L, 316L, 410 (cold-drawn) |

| Germany | $3.10–$3.90 | Outokumpu, ThyssenKrupp, ArcelorMittal | 19% MwSt, CBAM carbon fee | EN 1.4301, 1.4404, 1.4462 |

| India | $2.50–$3.10 | Jindal Stainless, SAIL, JSW Steel | 18% GST, 12.5% anti-dumping on Chinese imports | 304, 316, 202 (hot-rolled) |

| South Korea | $3.60–$4.30 | POSCO, Hyundai Steel | 10% VAT | 304, 316L, 2205 duplex |

| Southeast Asia (Thailand/Vietnam) | $2.60–$3.30 | Chinese imports, local mills | 7–10% VAT, ASEAN trade preferences | 304, 201, 430 |

Regional Insights:

By June 2025, U. S. stainless steel round bar prices reached $6,405 per metric ton ($6.41 per kg) during Q2, influenced by fluctuations in nickel and chromium input costs IMARC, while China’s prices reached $1,860 per metric ton ($1.86 per kg) shaped by shifts in ferroalloy costs IMARC. Europe has seen persistent inflation in energy costs affecting mill economics, while Asia is graced with lower input costs for labor and energy but growth in environmental compliance costs.

Historical Price Volatility (Past 24 Months)

ASCII Price Chart (Monthly Average, 304 Grade, FOB China)

USD/kg

3.20 | *

3.00 | * / \

2.80 | * / \ / \

2.60 | * / \ / * \

2.40 | * / \ / * \ *

2.20 | \/ * \ / \

2.00 | * \___*___

1.80 | \___*___*

+------------------------------------------------

N D J F M A M J J A S O N D J F M A M J J A S O N

2023 2024 2025Key Price Movements

- Peak: $3.15 per kilogram in March 2024, coincided with the LME saccharification of nickel.

- Trough: $1.72 per kilogram, since November 2025 till December 2026 – the present stabilization.

- Total Change: -45.4% from peak to current levels.

Major Price Drivers (2024–2025)

- Nickel Price Boom (Q1 2024): LME nickel prices reached the $22,000/tonne mark hit in March 2024 due to the Indonesian export ban, which pushed up stainless steel tube prices by a whopping 28% during the quarter, according to DAPU Metal Materials.

- Chinese Property Slowdown (Q2-Q3 2024): The Evergrande bankruptcy and the contraction due to the construction sector weighed in on domestic demand, leading to dumping overseas and a 15% global price correction DAPU Metal Materials

- EU Carbon Border Adjustment Mechanism (October 2024): In the DAPU case, CBAM compliance costs brought an 8–12% premium on low-carbon certified materials.

- India Anti-Dumping Duties (August 2024): Imposing 12.5% duties on receiving Chinese imports of cold-rolled stainless steel realigned the supply chain to briefly tighten the Asian markets.

- Indonesian Nickel Supply Expansion (2025): The increase in nickel cost stabilization is attributed to the increased capacity for the production of laterite ore. This is because, essentially, no given foresight predicts the value to go beyond $15,000/tonne.

Short-Term & Long-Term Price Trends

Next 3–6 Months Forecast: Neutral To Slightly Bearish

Main Drivers:

- Drivers: Weakness in demand The stainless steel market at global level showed no signs of recovery in Q3 2025 with weak demand conditions. There is also no expectation for a short-term reversal. AG Metal Miner

- Inventory sail: Outokumpu experienced a 12% decline in European shipments from Q2 and a decrease of over 10% from Q3 2024 as low-cost supplemented by some Asian imports dragged product prices substantially down. AG Metal Miner

- Nickel Stability: Nickel fell to the level of $14,880/tonne on November 14, 2025, a decrease of 3.98% year-over-year TRADING ECONOMICS, limiting gains

- Seasonal Slowdown: Typically, Q4 finds minimal construction and manufacturing activity across Northern Hemisphere markets

Expected Price Range (Q1 2026): $1.65-$2.10/kg (304 FOB Asia); $3.00-$3.50/kg (North America)

2026–2028 Outlook: Moderately Bullish (Long-term)

Among the major factors for structural growth figure:

- Green Steel Transition: CRU projects that low-carbon SS production would inject $150 to $200/t ($0.15–0.20/kg) in costs by 2026, as EAFs are mandated and the price of carbon credits makes its mark DAPU Metal Materials.

- Infrastructure Mega-Projects: World Steel Association has forecast about 4.2% in CAGR for stainless demand until about 2028 owing to the water infrastructure and hydrogen pipeline networks with DAPU Metal Materials.

- Supply Consolidation: China’s dual-carbon policy has shut down up to 15% of inefficient capacities, and more are to be closed by 2027. DAPU Metal Materials also argues for price floors.

- EV and Renewable Energy Demand: Battery-grade stainless fasteners and fuel-cell components carry specialty grade premiums.

Cross-Industry Analyst Projections:

- CRU Stainless Steel Service (October 2025)—If one predicts a 6–9% price hike through 2027, following decarbonization costs and Asian capacity rationalization.

- The steel market is expected to reach $261.5 billion by 2033 at a CAGR of 5.04% during 2025–2033 as estimated by IMARC Group.

Buying Tips & Risk Hedging Strategies

Procurement Best Practices

Minimum Order Quantities (MOQs):

- 10-25 tonnes (full container load): Direct from Mills

- 500 kg -2 tonnes: Distributors/ Service Centers

- 5-10 tonnes: Specialty Grades (Duplex, Super Duplex)

Lead Times:

- 4-8 weeks ex-mill: Standard Grades (304/316)

- 8-12 weeks: Custom diameters/finishes

- Add 6-8 weeks to ship US/EU: Credits: Asian imports to US/EU

Payment Terms:

- 30% deposit, balance against B/L copy: Spot purchases if you’re new

- Net 30-60 days with credit approval: Established buyers

- Quarterly price reviews with base-escalation clauses: Large contracts

Price Risk Management

- Hedging in LME Nickel Futures: It’s wise to hedge about 60–70% of the exposure to nickel supplies using LME 3-month contracts since nickel comprises about 35–45% of the cost of producing austenitic stainless rod.

- Essentially equivalent to the forward purchase contracts: typically, during price troughs, there is a preference for negotiating 6 to 12-month adaptation contracts with the mills in the current market scenario (Nov 2025) for holding of H1 2026 books.

- Supplier Diversification: Dealings may be placed preferably with 40% Asia-basis suppliers so as to balance cost versus supply chain resilience, 30% for U. S. mills (lead times), and 30% for Europe (quality).

- Index-Linked Pricing: Publishers of indexes linked to nickel/chrome pricing (such as Allegheny Ludlum surcharge on North American contracts) are guessed to be leading factors.

Quality Assurance Red Flags

Warning Signs for Non-Authentic or Low-Grade Material:

- Pricing: Anything more than 15% below the regional price benchmark is a guaranteed sign that the material is off-spec

- Certificates: Those who deliberately withhold mill test certificates (MTCs) showing heat number traceability are misusing the ISO 10474 3.1 certificates

- Surface: Excessive scaling, pitting, or discoloration always communicates inappropriate heat treatment

- Magnet: A hint of magnetism is OK, provided it is weak for the 304/316 series; shouldn’t be ferromagnetic

- PMI test: Handheld XRF analysis tests are a must upon receipt; verify Ni/Cr/Mo to correspond to the given specification

Test Protocol Recommended:

- PMI scan (100% of heats)

- Dimensional Tolerance Check (Random Sampling-5% of parts)

- Hardness Testing (according to ASTM E18-spot check)

- Tensile Testing (quarterly batch validation for critical applications)

Strategic Timing Considerations

Current Market Positioning (November 2025):

Prices for nickel remain near 24-month lows with weak demand; therefore, buyers can look for potential strategic inventories for the second quarter of 2006, following the typical rebound in seasonal ferro-nickel activity. With an early downside breakout, the sense will last if prices breach $16,500 per tonne.

Disclaimer: All pricing data reflects market conditions as of mid-November 2025 and is subject to change. This analysis is for informational purposes and does not constitute investment, procurement, or commercial advice. Always conduct independent due diligence and consult with qualified professionals before making purchasing decisions.