The global steel industry functions as the essential foundation which enables modern infrastructure development to support progress in construction automotive and energy sectors. The industry faces fundamental transformations during 2024 because technological changes together with economic difficulties and sustainable development requirements result in new market demands. The study investigates major steel producers to discover their production patterns while identifying advanced technologies which drive industrial transformation and assessing how environmental sustainability practices are affecting steel production processes.

Overview of the Global Steel Industry

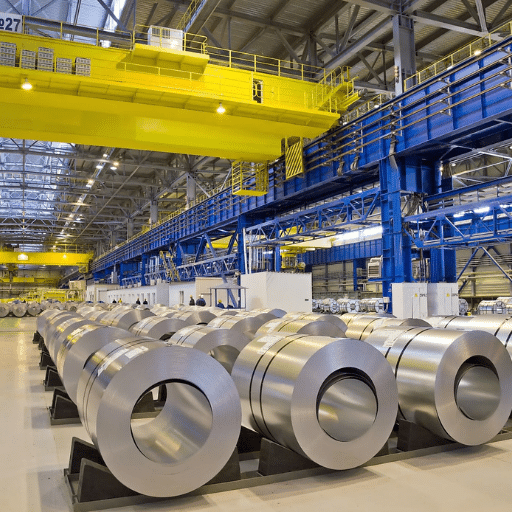

Current State of Steel Production

The steel industry serves as an essential foundation for the worldwide infrastructure and manufacturing sectors, as the industry adjusts its production methods to satisfy different economic and environmental requirements. The latest data shows that global crude steel production reached about 1.9 billion metric tons in 2022, which represents a consistent increase compared to earlier years.

Global Production Distribution

70%+

Asian region contribution to worldwide steel production, led by China

Industry Transformation Drivers:

- Technological Progress: Implementation of electric arc furnaces and hybrid systems as carbon reduction solutions

- Sustainable Development: Green steel products driving extensive R&D in hydrogen-based manufacturing

- Paris Agreement Commitments: Carbon reduction solutions aligned with international climate goals

- Market Challenges: Shifting material prices, energy expenses, and international political conflicts

Organizations now pursue environmental protection through new operational practices which enable them to achieve sustainable development as well as meet their international supply chain responsibilities. Organizations need to establish cooperative partnerships which will help them fulfill their market needs while achieving their environmental goals and operational performance targets.

Key Players in the Market

The global market operates through major corporations which drive industry evolution by introducing new developments and expanding their operations and establishing their market presence.

| Major Corporation | Market Strength | Strategic Focus |

|---|---|---|

| BASF SE | Broad product offerings, global distribution | Bio-based materials research |

| Dow Inc. | Research capabilities, worldwide presence | Circular economy principles |

| DuPont de Nemours Inc. | Innovation leadership, market power | Sustainable product development |

| ExxonMobil Corporation | Extensive assets, technological capabilities | Environmentally friendly technologies |

| LyondellBasell Industries | Global market fulfillment capabilities | Environmental footprint reduction |

The latest market analysis shows that leading market participants are increasing their dedication toward diversification by developing sustainable products and environmentally friendly technologies. The market now supports businesses which develop their eco-friendly products through innovative methods that help them respond to future industry developments.

Trends Shaping the Steel Sector

The steel sector currently experiences a period of transformation which occurs because of technological growth, sustainability pressures, and changing market requirements.

Green Steel Production

Hydrogen-based direct reduced iron methods operating at lower carbon emission levels than traditional blast furnaces. ArcelorMittal and SSAB leading investments.

Digital Solutions

AI-powered predictive maintenance and intelligent manufacturing systems achieving higher operational performance with reduced equipment failure.

Circular Practices

Steel recycling and scrap utilization gaining economic advantages, supported by European Green Deal policy frameworks.

Market Interest Surge: The latest Trends data shows that public interest in sustainable steel production and carbon-neutral steel has increased by fifty percent since two years ago, demonstrating a growing interest in sustainable steel practices from both the public and industry. Organizations in the steel sector must develop their operational structures to meet modern market demands which have now become more complex and unpredictable.

Leading Steel Producers in 2024

ArcelorMittal: Global Leader in Steel Production

ArcelorMittal remains the largest and most influential steel producer worldwide, with production capabilities that exceed 88 million metric tons of steel per year according to the latest information. The company operates from its Luxembourg headquarters while maintaining a broad network of integrated steel plants and mining operations which extend across 60 different nations.

Strategic Innovation Focus:

- Extensive funding of decarbonization technologies

- Hydrogen-based steel production implementation

- Carbon Capture and Storage (CCS) systems development

- Strong supply chain system with vertical business operations

- Effective cost control and consistent material standards

Through these measures ArcelorMittal establishes itself as a sustainable steel production leader which meets worldwide climate objectives. The company achieves effective cost control and maintains consistent material standards through its strong supply chain system which gives it an advantage over its competitors in a changing marketplace.

Tata Steel: Innovations and Contributions

Tata Steel has earned its reputation as a worldwide leader in steel production through its ongoing dedication to developing new ideas while protecting the environment. The company has made significant strides in adopting advanced technologies, such as the use of artificial intelligence (AI) and machine learning (ML) to optimize manufacturing processes, enhancing both efficiency and product quality.

Sustainability Initiatives

Electric arc furnaces implementation

High-grade recycled scrap utilization increase

Target: Carbon neutrality by 2045

Materials Innovation

Lightweight materials development

High-strength alloys for automotive and construction

Technology: IoT for predictive maintenance

Tata Steel demonstrates its commitment to technological progress through these groundbreaking innovations which also establish the company as a key player in the worldwide shift toward sustainable industrial operations.

Nippon Steel: Production Capacity and Market Influence

Nippon Steel Corporation ranks among the top steel producers in the world because of its extensive production capabilities and substantial market presence. Nippon Steel produces more than 40 million metric tons of crude steel each year which makes it one of the largest steel producers in the world based on current production data.

High-Value Product Portfolio:

- Advanced high-strength steel for automotive industry

- Corrosion-resistant sheets for construction applications

- Specialty alloys for energy sector

- Research and development for lightweight materials and carbon neutrality targets

The company operates advanced production facilities throughout Japan together with its various international production sites which demonstrate its ability to operate worldwide. Nippon Steel establishes itself as an essential participant in the worldwide steel market while it supports sustainable economic development through this method.

Production Capacities of Major Steel Companies

Production Volume Comparison

A small group of large companies controls most of the global steel industry because their production capabilities create substantial effects on market operations.

| Steel Producer | Annual Production | Competitive Advantages |

|---|---|---|

| China Baowu Steel Group | Over 120 million metric tons | Strategic mergers and domestic policy advantages |

| ArcelorMittal | Over 70 million metric tons | Global presence and integrated operations |

| Nippon Steel | Approximately 50 million metric tons | Research programs and operational efficiency |

The industry comparison shows that companies drive their business operations toward consolidation and efficiency growth because they want to achieve global material supply goals while meeting their sustainability targets for reducing carbon emissions and energy use.

Technological Innovations in Production Processes

The steel industry experiences a major transformation because modern production innovations enable companies to produce steel with better operational results and higher product quality and improved ecological results.

Leading Innovation Categories:

AI and Machine Learning Integration

Optimize workflows and predictive maintenance systems, analyzing extensive data collections to predict equipment breakdowns and decrease operational expenses and downtime

Electric Arc Furnaces (EAF)

Power supply systems gaining traction as companies decrease dependence on traditional blast furnace systems with high carbon emissions

Hydrogen-Based Production

Employs hydrogen as primary reductant instead of standard coke, enabling major reduction in emissions. SSAB and Thyssenkrupp testing through pilot projects

3D Printing Technologies

Enables more accurate steel amounts which helps decrease material waste during manufacturing

Market Interest Indicator: According to the latest data trends, searches for “low-carbon steel manufacturing” and “green steel technologies” have surged by 35% in the past year, reflecting increased interest and investment in sustainable practices.

How Production Capacities Impact Market Dynamics

Production capacities serve as the fundamental drivers of market changes which occur in the steel industry because they determine both supply levels and pricing structures and the intensity of competitive competition.

Supply and Pricing

Substantial capacity growth leads to increased supply and decreased steel prices, benefiting downstream industries like construction and automotive

Market Optimization

Industry stakeholders prioritizing “steel production optimization” and “energy-efficient manufacturing technologies” for sustainable capacity scaling

Technology Investment

Capacity management reflects industry investment in new technologies and dedication to meeting environmental standards

The market will need sustainable steel solutions which make capacity management essential for market balance and global demand fulfillment.

Sustainability in the Steel Industry

Green Steel Initiatives and Carbon Reduction

Green steel initiatives seek to reduce carbon emissions from steel production by implementing contemporary technologies which produce less emissions than current coal-based production methods.

Key Carbon Reduction Strategies:

- Hydrogen-Based Direct Reduced Iron (DRI) uses renewable hydrogen to substitute fossil fuels during reduction which produces water as its only product. The system enables up to 90 percent reduction in carbon emissions when applied together with renewable energy resources.

- Electric Arc Furnaces (EAF) with Recycled Steel use 30 percent less energy while creating 30 percent lower emissions when compared to blast furnaces. Currently EAFs produce 30 percent of global steel output which will increase as recycling facilities expand throughout the world.

- Carbon Capture Utilization and Storage (CCUS) technology extracts remaining emissions from standard steel production processes while it stores carbon dioxide for industrial usage or safe underground storage. The company shows its dedication to achieving higher environmental standards which support the Paris Agreement.

The global steel industry uses hydrogen-based production together with recycling and CCUS technology to achieve net-zero carbon emissions through its hydrogen-based production process which top producers implement to create new steel manufacturing processes.

Circular Economy Principles in Steel Production

Steel production uses circular economy principles to reduce waste while increasing resource efficiency and prolonging the lifespan of materials. Steel operates as the most appropriate material for this system because of its complete ability to be recycled.

Global Steel Recycling Rate

85%+

of global steel is recycled at end of life cycle, making it one of the most recycled materials worldwide

Modern Circular Economy Approaches:

- Closed-loop recycling systems gathering scrap steel for melting and creating fresh products maintaining original quality

- Smart tracking systems through digitalization enabling better material movement management

- Chemical recycling technology for extracting valuable alloying elements

- Future implementation of digitized supply chains and cross-sector partnerships

The environmental advantages of these practices together with improved resource management create pathways for sustainable development which supports the main objectives of a circular economy.

Future of Sustainable Practices in Steel Companies

Steel companies will develop sustainable practices through their adoption of new technologies that work together with existing policy frameworks and partnerships among different industries. The steel sector currently generates approximately 7-9% of global CO₂ emissions based on recent data which creates an urgent need for carbon reduction initiatives.

Green Hydrogen Technology

Popular replacement for fossil fuels during reduction processes, creating low or zero carbon emission steel products

Policy Frameworks

Carbon pricing policies and environmental compliance requirements guiding operational decisions with government incentives

Digital Transformation

AI-powered predictive maintenance and blockchain-based supply chain tracking for resource optimization and waste reduction

The market for eco-friendly steel products will expand because consumers prefer sustainable materials which create a strong business rationale for companies to implement environmentally friendly practices. Steel companies can achieve substantial progress toward worldwide sustainability goals while sustaining their business success by implementing cutting-edge technologies and following government regulations and satisfying changing consumer needs.

Future Projections for the Steel Industry

Forecasting Demand and Supply Dynamics

The steel industry will experience changes in its demand and supply operations because of macroeconomic factors and government regulations and technological progress. The latest data shows that global steel demand will increase steadily because of urban development and infrastructure projects and the need for steel in renewable energy systems.

Demand Drivers:

- Urban development and infrastructure projects globally

- Renewable energy systems including wind turbines and solar farms

- Emerging economies in Asia and Africa contributing substantially

- Growing interest in sustainable methods and green steel production

Supply Challenges:

- Changing raw material prices affecting production costs

- Compliance with carbon emissions reduction regulations

- Adoption of Electric Arc Furnace (EAF) technology for efficiency

- Need for quick adaptation to environmental requirements and market demands

The current market situation shows that demand will remain steady but producers must prepare for quick changes which will help them meet environmental requirements and market demands.

Geopolitical Influences Impacting Steel Production

Steel production processes experience major alterations because of geopolitical factors which establish new supply chains and develop trade regulations and determine manufacturing costs.

| Geopolitical Factor | Impact on Industry | Market Response |

|---|---|---|

| Trade Restrictions | Tariffs and quotas affecting global steel movement | Material cost and availability challenges |

| Political Instability | Obstacles in extraction and shipment of essential materials | Supply chain disruptions and cost fluctuations |

| Trade Agreements | Preferential policies affecting pricing and production | Strategic positioning for market advantages |

Search Trend Analysis: Latest Trends data shows that searches for “steel tariffs effects” and “supply chain disruptions steel” have increased because people want to understand more about trade policies and geopolitical risks. The search data demonstrates how geopolitics and market forces interact with each other which steel producers must understand to develop operational approaches that protect their business during uncertain times in the global market.

Emerging Markets and Opportunities in Steel Production

Latest search data reveals a growing interest in steel production within emerging markets such as Southeast Asia, Africa, and South America. The regions experience rising infrastructure development and population growth and industrial expansion which provide steel producers with chances to develop their business operations.

Southeast Asia

Focus Areas: Indonesia and Vietnam construction projects

Structural steel demand driving large-scale investment

Africa

Focus Areas: Nigeria and Kenya development

City development and renewable energy infrastructure

Strategic Positioning

Approach: Local production centers and government partnerships

Sustainable production technologies for competitive advantage

Steel producers can use adaptable and resilient strategies to develop their business operations in these areas while minimizing dangers from international political and economic instability. Establishing local production centers and developing collaborations with national governments and local businesses can help companies gain market access and minimize distribution expenses.

Frequently Asked Questions

Who is the largest steel producer in 2024 and which companies in the world lead production?

The world’s largest steel producer in 2024 operated through a Chinese company which is China Baowu Group. The global steel production rankings include major companies such as Ansteel Group HBIS Group and JSW Steel while POSCO Holdings and Nippon Steel maintain their status as important players in the industry. The World Steel Association together with company reports provides data on steel production which enables identification of top steel producers through various production metrics. The companies in this industry supply their products to customers who operate in both the construction industry and manufacturing sector. The market capitalization of companies together with their North American market presence determines how people perceive their business size, while actual production figures remain a secondary factor.

What role do US companies like Nucor and Steel Dynamics play among the top steel producers in the world?

The two biggest independent steel manufacturers in North America are Nucor Corporation and Steel Dynamics which operate as essential players in both national and global markets. The steel producers operate their steel mills through efficient methods and their production system relies on electric arc furnaces which produce products that serve both construction and manufacturing needs. The U. S. steel companies face challenges in matching Chinese and Indian giants who produce higher volumes of crude steel yet they outperform those competitors in market capitalization which leads their listed steel companies to be recognized for their innovations in steel production and supply chain operations. Domestic steel demand together with U. S. steel sourcing policies provide both Nucor and Steel Dynamics with advantages. Their presence in the market creates competitive pressure which extends to other international companies including Tata Steel Group and POSCO.

Which steel-producing countries account for the largest steel production and how does China compare?

China holds the position of being the world most dominant steel producer because its companies account for the highest portion of worldwide crude steel manufacturing while its steel firms frequently secure positions on lists ranking the largest steel enterprises. The major steel-producing countries include India, Japan, South Korea, and the United States, while South Korean companies, such as POSCO and South Korean steelmakers, including Nippon Steel, operate at their respective roles. The World Steel Association compiles annual totals that show each country produced millions of tons and those totals create a list that identifies the top producing nations. The ranking system will experience changes because domestic construction activities and export policies and steel demand patterns will shift from 2023 to 2024. The global capacity of steel production includes substantial contributions from both Russia’s Severstal and China’s Shagang.

How do Tata Steel Group, JSW Steel and POSCO compare among largest steel companies and steel-producing companies in the world?

Tata Steel Group maintains its dedication to sustainable practices and innovative solutions by running production facilities throughout Europe and India which specialize in advanced material development. JSW Steel operates multiple plants throughout India while expanding its production capacity. POSCO (which functions as POSCO Holdings) stands as one of South Korea’s leading steel manufacturers and maintains its position among the top steel production companies worldwide together with Nippon Steel from Japan and China Baowu Group. The analysis requires an overview of the companies which will examine their production capacity and market value and product selection and vertical integration throughout their steel manufacturing operations. The 2023 and 2024 company reports contain complete details about production volume and product distribution which demonstrate the various ways companies serve industries from automotive to construction industry. The upcoming financial performance will show how the company leads its market through economic factors which include steel demand and manufacturing sector changes.

Which steel companies produce the most steel in the world and who ranks as the leading producers of steel throughout the globe?

The largest steel companies in the world produce steel through their operations with China Baowu Group, Ansteel Group, HBIS Group, Nippon Steel, and ArcelorMittal leading the industry while Shagang and JSW Steel follow closely behind. The world’s top steelmakers are ranked by crude steel production which measures their output in millions of tons throughout the year and includes both state-owned and private company contributions. The 2023 and 2024 data comparisons demonstrate how changes in domestic steel demand and export markets and supply chain challenges affect company standings. Steel-producing companies differ in their product offerings because they produce both bulk commodity steel and products that meet the needs of various industries including construction industry and automotive manufacturing. The evaluation of a company’s global presence requires understanding its market capitalization and regional reach which applies to the largest steel companies in America.

What are the main trends which drive present-day steel production together with improvements to steel manufacturing processes throughout the world?

Steelmaking involves the greater use of electric arc furnaces which enable scrap recycling together with facilities that develop decarbonization solutions for traditional blast furnace methods. The largest steel manufacturers face operational challenges because their business processes depend on steel demand patterns and domestic supply networks and governmental regulations and sustainable steel production practices which determine their investment strategies. Nucor Corporation and Steel Dynamics operate efficient flexible plants while China Baowu Group focuses on developing large-scale integrated production facilities for all iron and steel manufacturing operations. The World Steel Association tracks metal production which results in annual reports showing organizations to extract operating data for production at their facilities. South Korean and Japanese companies maintain superior technological capabilities whereas Chinese enterprises dominate the market because of their operational efficiency.