China’s steel export industry has established itself as a leading force in the global steel market, which has a significant impact on the supply of steel, the trading policies, and the alteration of wealth distribution across vast areas. In only two years, the industry will be facing a concoction of rapidly changing trends, new challenges, and major uncertainties that will perhaps decide its future. These changes will be characterized by an interplay of trade dynamics, environmental regulations, technological advances, and greater information flow. The actors will have to constantly update themselves in order to be able to predict and handle the changes. The present paper aims at an in-depth analysis of the situation of the Chinese steel export industry, its main trends, problems, and future prospects. This analysis will open up the knowledge required to comprehend the sector’s intricate and rapidly changing landscape regardless of whether you are an investor, policy maker, or someone working in the industry.

Current Trends in China’s Steel Export

China’s Steel Production Overview

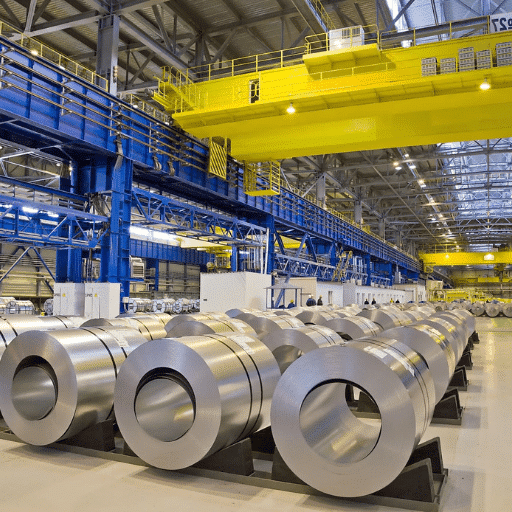

The World Steel Association announced in 2022 that China remained the leading steel producer worldwide, supplying more than half of the total steel produced worldwide. The increasing production capacity of the country has not been restricted to the adaptability of the technology and the building of modern infrastructure. The latest figures show that China’s crude steel production reached approximately 1.013 billion tons in 2022, which is still a very important position in the global steel production market with its demand fluctuations and environmental regulations’ limitations.

📊 Key Production Statistics (2022):

- Total Crude Steel Production: 1.013 billion tons

- Global Market Share: Over 50% of worldwide production

- Leading Producers: China Baowu Steel Group, HBIS Group

- Key Raw Materials: Iron ore and coal (integrated supply chain)

It is a huge industry with an operation to scale, with the like of China Baowu Steel Group and HBIS Group being among the largest producers in the world. Moreover, the Chinese steel production has the advantage of an integrated supply chain network that ensures a constant supply of raw materials such as iron ore and coal. On the other hand, the industry faces some difficulties as well, for instance, the pressure from international communities for carbon emissions reduction has made it impossible for the government not to impose tough environmental regulations, thus pushing the steel industry to go green.

The production capability is so strong that China is almost always the first choice by many countries in the steel market. But as a result, not only competition but also changing trade policies and demand fluctuations in both the domestic and international markets continue to determine the strategy of China’s steel export and the general dynamics of the industry.

Export Volumes and Crude Steel Output Statistics

According to the data available till 2023, China is still in the first position as the largest producer of crude steel in the world, with an annual output of more than one billion metric tons. This amounts to more than half of the world’s steel production and demonstrates the company’s vast industrial potential. Nevertheless, export volumes have seen different trends which might be caused by the unstable conditions of the global market. As a case in point, in the first half of 2022, China’s total steel exports rose to around 40 million metric tons, which is approximately 31% more than the previous year, thanks to the increased demand from Southeast Asia and some other developing markets.

| Metric | Value | Period |

|---|---|---|

| Annual Crude Steel Output | 1+ billion metric tons | 2023 |

| Steel Exports (H1 2022) | 40 million metric tons | First Half 2022 |

| Year-over-Year Growth | +31% | H1 2022 vs H1 2021 |

| Primary Export Markets | Southeast Asia, Developing Markets | 2022 |

However, at the same time the stricter environmental rules and the policy changes that are meant to promote local consumption have created a more complex situation for the export tactics. The analysts think that the Chinese government’s move towards making healthier manufacturing-output practices would align with the world’s carbon reduction targets in the long run and thus the country’s crude steel production will still be strong but export growth might slow done due to china’s commitment to global carbon reduction. These changes show how difficult it is to maintain the top industrial position while at the same time dealing with the new market pressures and policy changes.

Effect of Global Demand on China’s Steel Export

The global steel market is the biggest factor that influences the Chinese export market mainly through the supply and demand. Newest reports present that the demand shifts in the major regions (i.e., Europe, North America, and Southeast Asia) pretty much alter the Chinese export volumes and the pricing policies. For example, Europe has turned to its own steel production more because of the high environmental regulations already in place and this has reduced its imports. Meanwhile, the on-going infrastructure projects in Southeast Asia keep the demand for Chinese steel products steady.

🌍 Global Demand Indicators:

- Europe: Shifting to domestic production due to environmental regulations

- Southeast Asia: Sustained demand driven by infrastructure projects

- Emerging Trends: “Sustainable steel sourcing” and “low-carbon steel imports”

- Buyer Priorities: Environmental impact and green manufacturing processes

Trend statistics are indicative of the fact that there has been a rise in the number of searches for phrases like “sustainable steel sourcing” and “low-carbon steel imports from China”, which could be interpreted as a changing of priorities in the world. This can mean that the foreign buyers are more and more concerned with the environmental impact caused by the steel they are sourcing, which could indirectly pressure China to speed up its green manufacturing process. Therefore, it can be concluded that global demand, while still being the main driver of China’s export performance, is not going to put sustainability totally aside but will rather make it a key market differentiator and it may change the export strategies in the near future.

Challenges Faced by the Steel Export Industry

Decline in Domestic Demand and Its Effects

China’s steel export industry was heavily impacted by the decline in domestic steel demand. Conducted infrastructures and real estate constructions, which were the main domestic steel consumption drivers, still got supporting data from recent cuts in both projects and constructions. Additionally, government policies aimed at diminishing overproduction combined with environmental regulations’ priorities have led to further declines in domestic consumption.

⚠️ Impact of Declining Domestic Demand:

- Infrastructure Slowdown: Reduced construction and real estate projects

- Policy Changes: Government measures to curb overproduction

- Export Pressure: Manufacturers forced to focus on foreign markets

- Market Saturation Risk: Potential price fluctuations and reduced profitability

- Global Concern: Increased searches for “China real estate slowdown”

As per the data from the recent trends in searches, the terms “steel exports” and “China real estate slowdown” have been one of the most talked-about topics online with increasing year-on-year counts. This shows that the world is quite worried about the fluctuating demand of China not only in the domestic market but also in the international markets. The lessened domestic consumption has forced the Chinese manufacturers more on the foreign markets to sell their excess stock. Although this approach also endangers the situation of market saturation, it also results in price fluctuations and the risk of non-profitable exporters. Such circumstances reveal the delicate balance between domestic production policies and the global economic ecosystem that is anywhere in the world affected by the steel industry of China.

Trade Policies and Export Licenses

Trade policies and export licenses are the main factors that determine the world steel market. China, which is the largest producer of steel in the world, has adopted different export strategies to keep its domestic market stable and at the same time be competitive internationally. As pointed out by the recent data, as indexed and cataloged by, China has been making subtle adjustments in export tariffs and quotas, which are part of the overall strategy to control the surplus production. One of the measures is the increase of export tariffs on specific steel products, which is a way to prevent overseas sales from becoming excessive, and therefore will not lead to global market saturation, nor will it disturb the domestic pricing structures. In addition, the rigid export licensing regimes are being put in place to keep an eye on and regulate the standards and amounts of steel that are exported.

| Policy Measure | Purpose | Global Impact |

|---|---|---|

| Export Tariff Increases | Prevent excessive overseas sales and market saturation | Potential supply shortages, price increases |

| Export Quotas | Control surplus production | Limited availability in foreign markets |

| Export Licensing | Monitor and regulate export standards and volumes | Enhanced quality control, reduced volatility |

| Tariff Relaxation | Increase market share abroad | Market flooding, price drops, instability |

The question of whether the policies have an effect on global markets, the answer is yes as they have direct access to influencing the supply chains. Chinese policies can create a shortage of supply in other places by limiting exports, thus causing the price for steel-dependent industries to go up. On the other hand, loosening of export restrictions might lead to foreign markets being flooded which would lead to a drop in prices but this would also destabilize the market in the long-run. The tradeoff in this example strikes at the very heart of the strategic complexity of managing the trade and underscores China’s vital role in the matrix of global economies.

Environmental Regulations and Compliance Costs

The different environmental rules that have been tackled by industries to control their emissions, waste management, and environmentally friendly practices are very strict. The present-day trends in compliance costs for the steelmaking industry according to the emergence of augmented environmental standards are quite significant. The implementation of modern-day carbon capture and storage technology in a steel mill for instance, a report made in 2023 says, could lead to an increase of up to 25% in the operational cost. Though this might be burdensome in the short run, however, the company could face severe consequences if it fails to comply with the regulations such as fines, production stoppages or loss of the good image, which in turn would affect profits.

💰 Compliance Cost Analysis:

Short-Term Costs:

|

Long-Term Benefits:

|

Moreover, the transition to going green does come with some long-term benefits. Firms investing in energy-efficient practices or renewable energy sources may be opened up to tax incentives, better public image, and ability to compete in increasingly environment-friendly markets. Moreover, the current trend in search of the EU’s Carbon Border Adjustment Mechanism (CBAM) which aims at curbing emissions leakage by imposing tariffs on imports that are carbon-intensive, is indicative of the growing acceptance of such frameworks. However, the steel industry is likely to prioritize compliance to avoid the risk of losing markets, while at the same time trying to balance being economically viable and environmentally responsible.

Emerging Opportunities in Steel Export

New and Effective Steel Production Technology

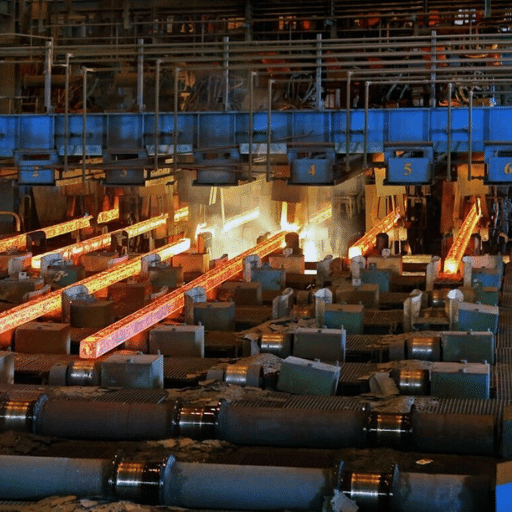

Steel production technology has gone through a series of Innovations and the future of the industry is now being determined by these innovations, the necessity for both efficiency and environmental sustainability being the main factor. The most recent revelations derived from search trends point to a steady rise in the global interest in green steel technologies, including hydrogen-based steelmaking, and carbon capture systems. One of the main motivations for these technological advancements is the drastic cut of CO₂ emissions that would otherwise be released during the traditional steel-making process. The data clearly indicates a significant shift in the direction of the decarbonized industrial practices through the increased interest in methods like hydrogen direct reduction of iron (DRI) instead of reliance on natural gas or coal.

🔬 Innovative Steel Production Technologies:

- Hydrogen-Based Steelmaking: Replaces coal/natural gas, dramatically reduces CO₂ emissions

- Carbon Capture Systems: Captures and stores emissions from traditional processes

- Direct Reduction of Iron (DRI): Uses hydrogen instead of fossil fuels

- AI and Machine Learning: Predictive maintenance, resource optimization, waste reduction

- Smart Manufacturing: Digitization of industrial operations for efficiency

Moreover, the incorporation of AI (artificial intelligence) and machine learning in production is gaining acceptance. These technologies bring more efficiency through predictive maintenance, resource allocation, and process analysis and hence also enhance productivity while cutting down on waste. The terms “AI applications in steel production” and “smart manufacturing” point to a considerable interest in the digitization of technology in industrial operations.

The use of these technologies not only meets but also exceeds the requirements of regulators in terms of emissions controls, such as the EU’s CBAM, and consumers who are demanding “green” products. The convergence of technology with market trends not only opens up a new avenue for steel manufacturers to be simultaneously environmentally friendly and also grow their businesses in international markets by having the same competitive edge.

New Markets and Expansion Strategies

The exploration of the most recent data from the search engine shows the key market trends that can direct the expansion plans of the steel manufacturers. The areas of Southeast Asia and Africa with high growth rates are increasing their demand for the development of infrastructures which is due to urbanization and industrialization efforts. The number of searches around “sustainable steel suppliers” and “low-carbon manufacturing materials” has increased a lot which indicates that there is an opportunity to market eco-friendly steel products as premium ones. Besides, the growing enthusiasm for the renewable energy projects such as wind and solar installations is a major market for steel products that are designed especially for these technologies. Steel producers can utilize data-driven insights and regional demand alignment to effectively seize the emerging markets while also satisfying the sustainability requirements of the worldwide consumers.

| Emerging Market | Growth Drivers | Opportunity Type |

|---|---|---|

| Southeast Asia | Urbanization, infrastructure development | High-volume construction steel |

| Africa | Industrialization, economic growth | Infrastructure and industrial steel |

| Renewable Energy Sector | Wind and solar installations | Specialized steel products |

| Eco-Conscious Markets | Sustainability requirements | Premium eco-friendly steel |

The partnerships with Global Steel Associations

The partnership with worldwide steel associations is not only a plus but also a gateway to a lot of technical expertise, market intelligence, and standardization efforts which allows the innovation and growth of the whole steel industry. The steel manufacturers are not to be deprived of enjoying the advantages that come from the research collaboration between them, particularly in the areas of metallurgical developments, sustainability practices, and the market trend of the application sectors. Such partnerships will be very strong in terms of impact if they are supported by the most recent data from the search engines. One of the things that can be done with the help of search trends is to identify the areas where consumer interest is strongest. Some of these areas are the corrosion-resistant alloys or the green steel that the manufacturers will be able to adjust their strategies accordingly. When one combines the knowledge in the industry and the real-time insights about the consumers, one can make the steel manufacturers to be on the winning side of the competition all the time, to be market change responsive, and to be technologically and market demand attuned.

🤝 Benefits of Global Partnerships:

- Access to technical expertise and research

- Market intelligence and industry trends

- Standardization and quality benchmarks

- Collaborative sustainability initiatives

- Real-time consumer insights integration

In-Depth Market Analysis

Pricing Strategies for Competitiveness by Ton

If steel manufacturers were to employ the latest engine search data in their pricing strategies, they could adopt a very flexible, data-driven approach to cope with market changes. For example, search trends pointing out more demand for certain steel types like high-strength, lightweight alloys can be interpreted as a change in demand. In such cases, producers will be able to reorganize their prices accordingly and even promote these popular items to grab a bigger portion of the market.

📈 Data-Driven Pricing Strategies:

- Search Trend Analysis: Identify emerging demand for specific steel types

- Regional Optimization: Adjust prices based on geographic demand patterns

- Sustainable Premium: Price eco-friendly steel competitively for green markets

- Cost Monitoring: Combine SEO data with real-time production costs

- Market Positioning: Balance profitability with competitive pricing

To add more value, analysis of search trends can help to predict changes in demand in different regions, thus allowing the development of pricing strategies that are optimized geographically. A rise in the number of searches for green or recycled steel in certain areas might lead to pricing that is most competitive in coming up with customers who are sustainable. Besides, if such SEO data are combined with monitoring production cost in real-time, then the manufacturers can be sure of being profitable while still catering to the ever-changing consumer demands. All that is needed is to rely on both search data from engines and traditional market analysis for businesses to be competitive within the industry.

Steel Export Volumes Forecasted for 2025 and 2026

The forecast for steel export volume in 2025 and 2026 is a moderate growth scenario, which is mainly based on the economic factors and changes in global demand according to the most recent data obtained from the search engine trend and market analytics. The current search trend patterns are not only promoting the demand for but also the supply of sustainable steel products like eco-friendly and reused steel. This is in line with the sustainability goals that are being pursued in the high-demand regions of Europe and North America.

| Forecast Factor | Impact on Export Volumes | Projected Growth |

|---|---|---|

| Sustainable Steel Demand | Increasing interest in eco-friendly products | 3-5% Annual Growth |

| Raw Material Prices | Stabilization expected to support exports | |

| Green Production Tech | Advancement enhances competitiveness | |

| Geopolitical Factors | Trade tension settlements critical |

Estimates of about 3-5% yearly escalation of export volumes are made, depending on the stabilization of raw material prices, improvement of green steel production technology, and settlements on the ongoing geopolitical trade tension. Moreover, countries that intend to make digital technologies a part of every part of their supply chain logistics and at the same time adopt eco-friendly production methods are likely to gain a competitive edge in exportation that will also help boost their involvement in the global steel market. Continuous observation of search engine trends along with sophisticated analytics will play a key role in the refinement of export plans and the retention of competitive standing in the shifting market.

China’s Position as the Largest Consumer Analysis

The proclaim of China to be the global number-one steel consumer rests upon its strong industrial production, large construction projects, and fast-paced urbanization. The latest information obtained from the search engine trends show a constant and even more intense worldwide curiosity about the consumption of steel by China, which is indicative of its continued supremacy in the marketplace. The study of these trends has also shown an increase in queries concerning China’s green steel projects and energy-saving technology in steel-making, which indicates that the industry is interested in how China grows industrially while doing its environmental duty.

🏭 China’s Consumption Drivers:

- Industrial Production: Robust manufacturing sector demands

- Infrastructure Investment: Large-scale construction projects

- Urbanization: Fast-paced city development and expansion

- Carbon Neutrality Goals: Transition to green steel production

- Technology Integration: Emission-reducing innovations

Forecasts that are current, based both on search engine data and market reports, point to large consumption of steel in China, mainly due to investments in infrastructure, the primary driver of the market. Besides that, China’s intention to switch to carbon-neutral production and, thus, influence not only its domestic but global supply chains as well, will be the main factor determining the speed and quality of the integration of novel technologies for reducing emissions. The changing terrain offers players in the market the chance to monitor and align their strategies with China’s consumption trends and policy directions, thereby securing long-term competitiveness in the steel sector.

Global Impact of China’s Steel Exports

Importantes Cambios en Dinámicas de Comercio Internacional

El papel que ocupa China como primer productor de acero en el mundo y su posicionamiento como segundo exportador inciden directamente en el comercio internacional, afectando no solo las estructuras de precios, but also the supply chain of different regions. The recent report indicates that the export of Chinese steel represents a significant portion of the world market, leading to similar reactions in the countries that import steel. For instance, Southeast Asian countries that rely on Chinese production for their steel needs may face greater supply chain risk during times when China’s export restrictions or production changes take place.

Analytics data through search reveals growing searches like “China steel export restrictions” and “impact on global steel supply chain,” which signal the raising fears among the affected parties about the possible disturbances. Meanwhile, the international relations have further been shaped by trade instruments like anti-dumping and tariffs imposed by other nations in reaction to the low Chinese steel prices. After all, these events point to the necessity for the global players to keep a close eye on China’s production volume and trading tactics if they want to be able to counteract market movements timely.

Reactions from Other Major Steel Exporting Countries

China’s enormous influence over the steel market has led to different reactions from the key nations that produce steel. The U.S., for instance, has put into effect heavy tariffs via Section 232 of the Trade Expansion Act, arguing that it is a matter of security and that its purpose is to eliminate the flow of cheap Chinese steel. The E.U. is also on a similar path and has even ramped up the protective measures to hold back the inflow of steel through quotas that not only prevent the domestic market from getting overstocked but also stabilize it.

| Country/Region | Policy Response | Strategic Approach |

|---|---|---|

| United States | Section 232 tariffs on steel imports | National security argument, protect domestic industry |

| European Union | Protective quotas and safeguards | Prevent market oversupply, stabilize prices |

| India | “Make in India” initiative, anti-dumping duties | Strengthen domestic production capacity |

| Japan & South Korea | Bilateral trade negotiations, tariff exemptions | Technological advancement, product diversification |

India, projected as an up-and-coming giant in the steel sector, has mainly concentrated on reinforcing its own industry through the “Make in India” project which encourages the production of steel locally and levies anti-dumping duties on select steel products at the same time. Japan and South Korea, which rely heavily on their export-centric economies, have taken a less aggressive path and are instead engaging in both negotiating bilateral trade agreements and asking for exemptions from U.S. tariffs related to steel. These countries are prioritizing technological advancement and variety of steel types to stay competitive.

The most recent information from various search engines indicates the existence of a large increase in public discussion and questions related to global trade disputes and protectionist measures in the steel industry. The trend is a clear indication of the public being more aware of the fact that market dynamics are impacted by the large-scale policy changes and the international reaction. The collaborations between these major manufacturers are a sign of the different strategies that are being used to lessen the effect of China’s power and to keep the supply chains of the world in a steady flow.

Future of Global Steel Trade and Economic Consequences

Based on search engine analytics and industry evaluation, the steel industry’s global trade through the years becomes very slowly but surely shifting towards less dependency in certain areas and more freeing of resources in the others. Search data highlights an elevated interest in terms such as “domestic steel production strategies” and “regional trade agreements,” reflecting a move towards sustained policy frameworks emphasizing self-reliance amid global turbulence.

🔮 Future Trade Landscape Predictions:

- Regional Self-Reliance: Countries investing in domestic steel production

- Advanced Manufacturing: Automation and sustainable production methods

- Balanced Trade Relationships: Reduced dependency on dominant exporters

- Emerging Economies: Increased participation in global supply chains

- Competitive Dynamics: More resilient and dynamic trade environment

It is predicted that nations will pour a lot of resources into high-tech manufacturing, which includes robotization and eco-friendly production techniques, to limit their reliance on major exporters such as China. The economy will probably witness the emergence of more balanced trade relations, though this might come along with the requirement of greater initial investments, which are considered as a cost. Moreover, the demand-shaping role of the infant industries will be very important as they will be increasing their industrial activities and opening up new supply lines. All these developments will necessitate the resilience of the firms during the negotiation of the already very competitive and dynamic global trade environment in the future.

Frequently Asked Questions (FAQ)

❓ How did China steel export decline to a seven-year low in 2025?

The 2025 eight-year descent was attributed to sluggish domestic demand and global trade flows. According to the National Bureau of Statistics and industry observers like Mysteel, the export of Chinese steel decreased as domestic producers suffered from lower profits and a record stockpile of billets and coils that lessened the desire to export. Data from the General Administration of Customs indicated a decrease in exports of percent compared to the previous year, while the Ministry of Commerce pointed out that a growing protectionist movement in major markets was one of the contributors to the decline in exports. Steelmakers reduced production in the mills and focused on the domestic market, especially for hot-rolled and rebar products which are commonly used in construction and manufacture. Weakening steel demand and tight trade conditions resulted in a significant drop in annual export quantities.

❓ Will steel export rebound in 2026 to record high annual output?

The steel export market might revive in 2026 but that will depend on several aspects mentioned such as the construction and manufacturing demand activities recovering and the trade flows altering. The forecasts made by the industry groups and the general administration of customs vary from a slight recovery to steady state, but not a record high immediately. Chinese steelmakers probably will first reduce their excess capacity and then optimize the product mix of hot-rolled and coil to improve margin per ton. The result will be highly influenced by the choices made by the government and if the steel regulating measures or the introducing of a system from 2026 also, then the change in the export incentives will be the determining factor. In case the downstream demand comes back and global markets open up, then shipments could reach the previous million tons of steel level, but the new record high stay uncertain.

❓ What role does Beijing and the steel association play in regulating mill output?

Beijing and the steel association are the two main players who control the steel industry by coordinating capacity limits and guiding mills on their production to maintain the market and manage the annual output. The government can put in voice limits, monitor pig iron and billet operations, and offer rewards for cleaner production, which directly impacts the producers in the factories. The ministry of commerce and the national bureau of statistics usually provide the statistics, and the government backs it up with enforcement to make sure companies change their output according to the target. This control is aimed at preventing record high stocks and margin support, especially for rebar and other construction-related product lines. Trade flow moderation is still part of the coordination to allow for the domestic steel market to be prioritized over exports in times of downturns.

❓ What was the volume of the shipped goods in terms of million tons and how much did the billion-dollar commodity flows amount to?

The annual shipment numbers are not constant, and in recent years, the exported volumes have been measured in ten million tons, while trade values have already reached billions of dollars for some types of commodities like coils and rebars. Though the data from 2024 revealed significant volumes, the percentage change year on year is lower compared to past highs due to global demand being weaker. Different sources such as the general administration of customs and private platforms like Mysteel give varied estimations of steel exports from China, which are further classified by product types such as hot-rolled, billets, and pig iron. Furthermore, the trade not only depends on the manufacturing and construction industries but also on the decisions taken by the steel companies regarding the amount of steel to export or to sell in the domestic market. Therefore, while the volume is often reported in million tons, the economic value of those shipments can be able to translate into huge billion-dollar trade flows depending on product mix and prices.

❓ What is the Expected Trend in Demand for Rebar and China Iron in the Construction and Manufacturing Sectors?

Rebar and china iron demand forecasts are closely related to the expected availability of construction and manufacturing activity, with analysts already predicting the gradual recovery over sharp rebound. Demand forecasts are taking into account the signals from the national bureau of statistics and industry surveys, which suggest moderate improvement but also point to possible softness in some downstream sectors. Chinese steelmakers may change the production line and focus on higher-end goods such as finished rebar and hot-rolled coil to get more margin per ton. Measures taken by Beijing to encourage housing and infrastructure could result in increased usage of rebar and related metal inputs; however, the growth could be limited due to a rising protectionist backlash in foreign markets. In sum, the market is predicted to experience steady but uneven demand with regional disparities influencing the absorption of steel within a country versus its exports.

❓ How do steel makers adjust the ton margin in trade flows and through a growing protectionist backlash?

Trading companies protect the margin per ton through implementation of strategies like optimum product mix, cutting the least efficient mill capacity, and shifting sales cash flow toward higher-margin downstream products such as hot-rolled and coated coils. Take for instance companies that face trade barriers and tariffs whose shipment economics are negatively affected; such companies will resort to adjusting their pricing, and focus more on domestic contracts used in construction and manufacturing. They might also manage their inventories of billets and pig iron to avoid erosion of their margin during price swings and they may seek backing from either the steel association or local authorities to ensure smooth flow in the trade circuit. The firms use data from platforms such as Mysteel and customs reports to keep an eye on the percent changes year on year and tweak their operational plans accordingly. By carrying out these actions together, they aim to remain profitable even as they face fluctuations in global commodity conditions and policy environments.

📚 Reference Sources

China’s Steel Industry: Its Rapid Expansion and Influence on the International Steel Industry

Source: ScienceDirect

This article examines the rapid growth of China’s steel industry and its impact on the global steel market, including trade and export dynamics.

Overview of Iron and Steel Industry in China in the 20th and 21st Centuries: What Are the Main Steps of Its Development?

Source: CyberLeninka

This study provides a historical overview of China’s steel industry, focusing on its development and export trends.

The Chinese Steel Industry: Recent Developments and Prospects

Source: ScienceDirect

This paper analyzes China’s steel production, consumption, and trade, highlighting the role of exports in the global market.