Some automotive manufacturers, metal fabrication shops in the exhaust systems field, and industrial buyers must keep themselves apprised of 409 stainless steel pricing in the current turbulent precious metals market. This ferritic stainless grade eventually came to be associated as viable wisdom for high-temperature applications, having its price dynamics clearly influenced by raw-material rates, regional demand cycles, and every now altering environmental legislation.

Product Overview

Full Material Designation: 409 Ferritic Stainless Steel (Low-Carbon, Stabilized Grade)’

Common Grades and Specifications:

- ASTM: A240 Type 409, A268 TP409

- EN: 1.4512 (X2CrTi12)

- JIS: SUS 409L

- GB (China): 00Cr11Ti, 06Cr11Ti

Chemical Composition (Meaningful Range):

- Carbon (C): =< 0.08%

- Chromium (Cr): 10.5% – 11.75%

- Titanium (Ti): Minimum 6 times C to a maximum of 0.75%

- Manganese (Mn): =< 1%

- Silicon (Si): =< 1%

- Phosphorus (P): =< 0.045%

- Sulfur (S): =< 0.03%

- Iron (Fe): Balance

Mechanical Properties:

- Tensile strength: 380 MPa – 550 MPa

- Yield strength: 205MPa – 275MPa

- Elonqation in 50mm: 20% – 25%

- Hardness: ≤183 HB (Brinell), ≤88 HRB (Rockwell B)

- Elastic modulus: 200 GPa

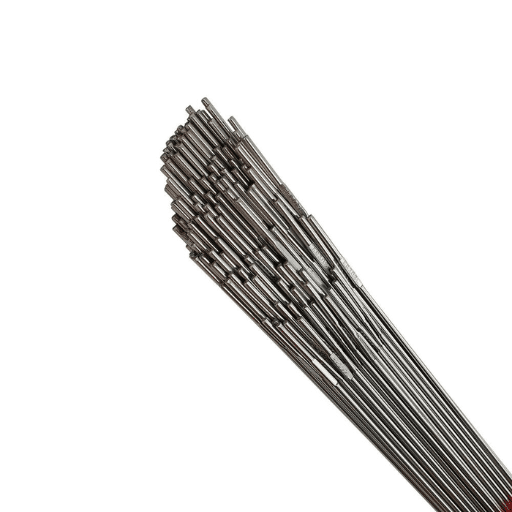

Common Commercial Sizes:

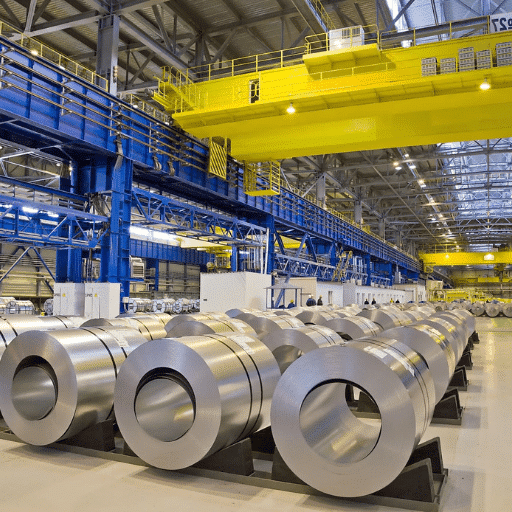

- Coils: 0.4mm – 3.0 mm-1,000mm – 1,500mm

- Sheets/Plates: 0.5–6.0 mm × 1,219 mm × 2,438 mm (4′ × 8′)

- Strips: 0.3–2.0 mm, 20–600 mm width

- Pipes/Tubes: OD 25-219 mm, wall thickness 1.0-6.0 mm

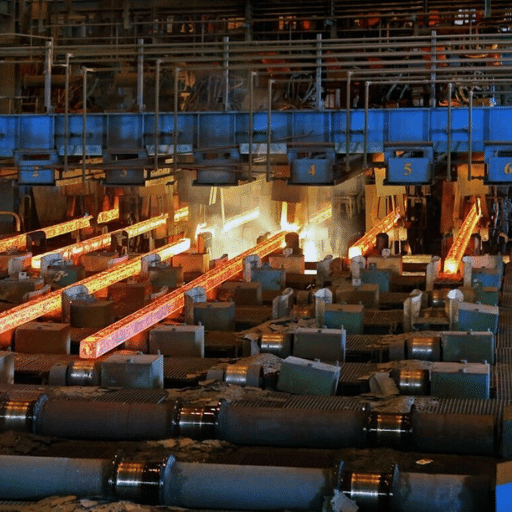

Main Applications and Industries:

- Automotive: Catalytic converter housings, exhaust manifolds, mufflers, tailpipes (comprising about 65% of the world’s 409 consumption)

- HVAC: Heat exchangers, ductwork, burner components

- Home appliances: Oven liner, dishwasher tub, water heater tub

- Industrial: Furnace parts, kilns parts, heat treatment equipment

Global Price per Kilogram (Current Snapshot)

Authoritative Price Reporting:

- MEPS International –Global stainless steel prices monitoring; this site uses ex-works prices from recycling for 400 series ferritic grade (Exact subscription is required for 409 and it was done in nov 2025).

- Argus Metals – Publishes weekly 409/410 scrap and mill price for US processors in November 2025

- SteelBenchmarker – Offers bi-monthly indices on pricing for carbon and stainless steel (November 2025)

CIF Premiums to Major Hubs (FOB Asia plus cost of freight and insurance):

- Rotterdam (Europe): +USD 0.25-0.35/kg (total ~USD 2.40-2.55/kg CIF)

- Los Angeles (US West Coast): +USD 0.15-0.25/kg (total ~USD 2.30-2.45/kg CIF)

- Shanghai (China domestic): N/A—generally quoted ex-works at USD 1.80-2.10/kg

- Dubai (Middle East): +USD 0.30-0.40/kg (total ~USD 2.45-2.60/kg CIF)

Regional Sales & Pricing in Key Markets

| Country/Region | Typical Price (USD/kg) | Main Suppliers | Local Taxes/Duties | Popular Specs |

|---|---|---|---|---|

| China | 1.80–2.10 (ex-works) | Tsingshan, TISCO, Baosteel | 13% VAT, 0% export rebate | 0.6–1.5 mm coils, BA/2B finish |

| United States | 2.80–3.50 (FOB mill) | AK Steel (Cleveland-Cliffs), Outokumpu | 25% Section 232 tariff (non-USMCA), state sales tax | 20ga–14ga sheets, #1 finish |

| Germany/EU | 2.60–3.20 (ex-works) | Outokumpu, Aperam, ThyssenKrupp | 19–25% VAT, safeguard measures | EN 1.4512, 0.8–2.0 mm, 2B/BA |

| India | 2.00–2.40 (ex-works) | JSPL, Jindal Stainless | 18% GST, 7.5% import duty | 0.5–1.2 mm coils, 2B finish |

| South Korea | 2.20–2.70 (FOB) | POSCO, Hyundai Steel | 10% VAT, Free Trade Agreements (RCEP) | SUS 409L, 0.6–1.5 mm automotive grades |

| Brazil | 2.50–3.00 (ex-works) | Aperam South America | 17% ICMS, 12% IPI | ABNT 409, 0.8–2.0 mm, cold-rolled |

Regional Insights: China leads the world in production of 409, with a market share hovering around 45%, in a perfect example of ‘low ex-works cost @ the lowest’. The pricing in the US market features high premium alongside high Section 232 tariffs and the accompanying higher labor/ecological/conformity cost. Europe is marked by extreme focus on auto exhaust quality certification standards with very stringent business norms. India’s production is designed for aggressive tiering within Southeast Asia and the Middle east.

Historical Price Volatility (Past 24 Months)

Monthly Average 409 Stainless Steel Price Trend (USD/kg, FOB Asia)

Nov 2023: 2.05 ███████████████████████

Dec 2023: 2.10 █████████████████████████

Jan 2024: 2.20 ████████████████████████████

Feb 2024: 2.35 █████████████████████████████████ ← Peak

Mar 2024: 2.28 ████████████████████████████████

Apr 2024: 2.15 ██████████████████████████

May 2024: 2.05 ███████████████████████

Jun 2024: 1.95 ████████████████████

Jul 2024: 1.88 ██████████████████

Aug 2024: 1.85 █████████████████ ← Trough

Sep 2024: 1.92 ███████████████████

Oct 2024: 2.00 █████████████████████

Nov 2024: 2.08 ████████████████████████

Dec 2024: 2.15 ██████████████████████████

Jan 2025: 2.18 ███████████████████████████

Feb 2025: 2.22 ████████████████████████████

...

Nov 2025: 2.25 ████████████████████████████ (current)Key Statistics:

- 24-Month High: USD 2.35/kg (February 2024)

- 24-Month Low: USD 1.85/kg (August 2024)

- Overall Percentage Range: 27% (High to Low)

- Current -24 Months Delta: +9.8%

PrincipalMarket Movers:

- Extension of Indonesian Nickel Export Ban (Q1 2024): This speculative bit did not end late but drove interest across all stainless instead. The ban pushed up buying to the tune of 14% on 409, as traders firmly believed in downstream substitutions and feared shortages from ferrochrome.

- Deepening of China Real Estate Crisis (Q2–Q3 2024): Havoc in the construction site dropped stainless steel demand by 18% in China and left 409 with a big 21% slide from peak to trough as mills curtail production with liquidation of inventories.

- EU Implementing CBAM (Q4 2024): Now a differential cost given back, new carbon indemnification of imports in Europe channels EU sales to around USD 0.15-0.25/kg over non-EU imports on 409; hence the actual interchange of various commercial areas and prop up mill prices for the Europeans.

- Global Automotive Recovery (Q1 2025): Light vehicle production rebounded 8% globally, with a steady price recovery of 12% driven by 409 demand (primary application) for exhaust system from the August 2024 lows.

- Chromium Supply Disturbance from South Africa (Q2 2025): Anticipating hard times in South Africa, labor strike closes major ferrochrome producers, causing 12% scaledown up to 409 production raw materials, with USD 0.10–0.15/kg added to spot market prices.

Short-Term & Long-Term Price Trends

Next 3–6 Months Forecast (December 2025–May 2026): Neutral to Slightly Bullish

It is anticipated that 409 stainless steel prices would be ranged between USD 2.15 and USD2.50/kg till Q2 2026, with slight upward bias, supported by:

- Support from the raw material: The price stabilization of ferrochrome at USD 1.35-1.45—after supply chain disruptions in South Africa—and maintaining the floor price for triautic stainless production.

- Automotive Demand Seasonality: Traditional North America and Europe spring production-increasing orders for the exhaust system parts are expected to see a demand increase of about 5–8% in Q1.

- Chinese Export Competition: Continued overcapacity, estimated at 2.5 million tonnes in the excess ferritic capacity, will put a lid on prices, particularly in the Asian spot markets where Chinese mills are pricing aggressively to keep their capacity utilization above 75%.

- Volatility in Energy Prices: European natural gas price is about 40% higher than those levels immediately before the year 2022; hence the production costs remain elevated for the EU mills, limiting too aggressive price competition.

Risk Factors: Acute escalation in US tariffs under the new trade policies ( bargaining for an extra 25%-type tariffs on steel) could cause an increased fragmentation in global prices; also, on the other hand, any higher-than-expected stimulation in China might result in the removal of excess steel capacity.

2026–2028 Outlook: Moderately Bullish with Structural Headwinds

Structural Bullish Factors:

- Emission Legislation Demand Creation: The growing stringency of the Euro 7 and China VI emission norms, which are demanding more intricate after-treatment systems, is anticipated to push up 409 stainless steel consumption per vehicle by 15–20%.

- Electric Vehicle’s Transition Snowball: While a long-term headwind, ICE vehicle production is forecasted to be above 70 million units every year till 2028, continuing to support the base demand of 409.

- Greening Steel Premia: Pressure to decarbonize stainless production is expected to further add USD 0.20–0.35/kg to offerings of low-carbon 409 by 2027, as buyers look to support Scope 3 emissions reductions.

Structural Bearish Factors:

- Irrelevance to Electric Vehicles: Battery electric vehicles with no exhaust systems take up 35–40% of new car sales by 2028, up from 18% in 2024, effectively perhaps eating 800,000–1.2 million tonnes of 409 a year.

- Material Substitution: Advanced composite materials and aluminum alloys are becoming more acceptable in high-performance exhaust applications where a loss of weight for the 409-grade steel material is worth a 20–30% added cost.

- Someday Chinese Excess Capacity: Plethora of Excessive capacities will persist, kept open by limited domestic growth and lack of volition to shut down inefficient capacities. Instead, this excess will keep the pressure on global pricing until 2026–2027.

Industry Predictions:

- CRU Group (Stainless Steel Market Outlook, October 2025): Projects 409 prices to average USD 2,350–2,550/tonne (USD 2.35–2.55/kg) in 2026, inditing “a well-balanced market condition with modest 2–3% annual demand growth, counterbalanced by a capacity rationalization in China.

- World Steel Association (Short Range Outlook, April 2025): Expects global stainless steel demand to grow 3.8% in 2025 and 3.2% in 2026, with ferritic grades (including the 409) to lag slightly behind because of changes in the automotive sector.

- Long-term Price Band Forecast: $2.30 to $2.80 per kg (average 2026-2028), thereby presenting a 5 percent to 10 percent price premium over 2024, primarily due to environmental compliance costs plus the expected selective demand growth in emerging markets outpacing a decline in the developed markets.

Buying Tips & Risk Hedging

Procurement Best Practices:

Minimum Order Quantity and Lead Time:

- Asian Mills: 25–50 tons minimum per spec (thickness/width/finish); 45–60 days lead time for standard coils, and 75–90 days for custom slit widths or specialty finishes.

- European/US Service Centers: 5–10 mts minimums and 2–4 wk delivery for stock; mills-direct orders = 60–90 days.

- Spot Market Purchases: Available in 1–3 mt lots at 8–15% premium over mill base prices through metal trading platforms and distributors.

Concerning Payment:

- Standard Payment: 30% down payment and 70% against B/L from new suppliers, while established connections could go for 30–60 days net settlement.

- Letter of Credit: It is advisable to credit for transactions greater than USD 100,000 with little-known vendors at a rate of 0.5 % to 1.5 % of the billing cost.

- Cash discounts: Cold rolling mills mostly offer discounts from 2% to 3% for full cash payment on agreements during dull demand cycles; Q3 is the most appropriate season for this.

Price hedging strategies:

- Forward Purchase Agreements: You negotiate some fixed-price contracts for 3–12 month delivery schedules for the times when the market seems to be directing towards high price.

- Metal Surcharge Indexing: Structure contracts with base price + monthly nickel and chromium surcharges linked to publicly quoted indices (LME nickel, ferrochrome spot prices); both shield the buyer and seller from raw material market fluctuations, while capping the conversion margins.

- Options and Hedging (Advanced Buyers): Given the absence of a direct 409/ferrochrome futures contract, buyers can proxy-for and hedge their ferrochrome price exposure by trading derivative instruments on the existing FeCr benchmark prices or making use of LME steel HRC as an imperfect but correlated hedge.

- Supplier Partnership Agreements (SPAs): Investment in a minimum annual commitment (500-2000 tonnes) will pay back in the form of well-preferred pricing (typically 3-7% below spot), availability when supply is tight, and, at times, quarterly price agreements as opposed to arbitrary price escalation.

Quality Assurance & Counterfeit Detection:

Red Flags for Below-Par Material:

- Below Market Pricing by More than 12%: Real 409 cannot be sold significantly below market prices and stay profitable; unless the price is labeled to be in that territory, there might be something wrong. The added discount seems to give rise to a material substitution issue (430 mislabeled as 409), recycled/secondary inputs, material-chasing systems that do not fully conform with chemistry.

- No Mill Test Certificates (MTCs): Authentic vendors would provide you with a live list of EN 10204 3.1 or 3.2 test certificates with heat numbers, chemical analysis, and mechanical testing results. Not having any would reflect a high potential for issues of phoney 409.

- Surface Observation Tests: Many bumps and cavities, a rough finish, and color variations can suggest a bunch of improper annealing or a mistaken grade (200 austenitic, for example, are misrepresented alsœ recycled scrap containers).

Verification Processes:

- PMI Testing (Positive Material Identification): With a handheld XRF, check the chromium to read in the range of 10.5-11.75%. If any nickel more than 0.5% is present, it is a grade substitution.

- Magnetic Data: At grade 409, the material has quite strong magnetic reaction. Rethink strongly about any entirely nonmagnetic or weakly magnetic material: it may give reason to suspect the far worse grade mislabeling case involving austenitic stainless steels (304/316 counterfeiting).

- Third-Party Inspection: For orders probably exceeding 50 tonnes, organizations may consider any of SGS, Bureau Veritas, or TÜV. Inspections can be performed prior to shipment with regard to determining chemistry, dimensions, and surface quality for approximately $800-$1500 to ensure that everything is perfectly in line.

- Supplier Due Diligence: Verify ISO 9001 certification, customer references, and reference-capacity data from industry databases (SBB, Metal Bulletin) in order to preempt broker fraud and phantom inventory at full credibility.

Recommended Supplier Vetting Checklist:

- ISO 9001/14001 certificates in quality is required

- Valid documented mill-level equipment and production proof

- This supplier is willing to provide notarized MTCs and heat traceability documents

- Supplier mill visit must be performed or a third-party facility audit needs to be available

- Supplier must have been on the market for no less than five years and must come with trade references that are possibly ascertainable.

- Readily accessible grievance redressal and exclusions were all somehow problematic for such buyers of refractories.

Conclusion: The late 2025 price environment of 409 stainless steel reflects a market in transition considering the tug-of-war between China’s perennial overcapacity and the rising compliance costs and changing automotive demand patterns. Buyers are required to show preference to long-term supplier relationships, run plan for very stringent quality validation, and at least consider hedging, when dealing with large-volume commitments. As the automotive industry is halfway through transitioning from the old internal combustion engine (ICE) to electric vehicle (EV) era within the next 3–5 years, the shaping of 409 steel prices will likely be more evident on the palm of the mills as they see diversification in other applications aside from just automotive while addressing relatively green issues.

Disclaimer: Prices and forecasts in this article reflect data available as of November 5, 2025, and are subject to change without notice. This analysis is for informational purposes and does not constitute financial, legal, or commercial advice. Always verify current spot prices and contractual terms directly with suppliers and industry pricing services.