The price of 316L stainless steel sheet has turned into a major issue for manufacturers, fabricators, and procurement managers all over the world, as the global economic scenario continues to influence material costs. This austenitic grade has not lost its luster and still keeps getting picked up more and more in various sectors like marine, chemical processing, pharmaceutical, and food equipment due to its resistance to corrosion. Proper knowledge of the pricing dynamics, geographical differences, and future trends is a prerequisite that leads the metal buyer to make strategic decisions in today’s market that is experiencing volatility.

Product Overview

Material Name: 316L Stainless Steel Sheet (Low-Carbon Grade)

Common Grades & Standards:

- ASTM: A240/A240M (sheet and strip), A666 (annealed/cold-worked sheet)

- EN: 1.4404, 1.4435 (European designation)

- JIS: SUS 316L (Japanese Industrial Standard)

- UNS: S31603 (Unified Numbering System)

Chemical Composition (Typical %):

| Element | Content (%) |

|---|---|

| Carbon (C) | ≤0.030 |

| Chromium (Cr) | 16.0–18.0 |

| Nickel (Ni) | 10.0–14.0 |

| Molybdenum (Mo) | 2.0–3.0 |

| Manganese (Mn) | ≤2.0 |

| Silicon (Si) | ≤0.75 |

| Phosphorus (P) | ≤0.045 |

| Sulfur (S) | ≤0.030 |

| Iron (Fe) | Balance |

Key Mechanical Properties:

- Tensile Strength: 485–690 MPa (70–100 ksi)

- Yield Strength (0.2% offset): 170–310 MPa (25–45 ksi)

- Elongation: minimum 40% (in 50 mm)

- Hardness: maximum 217 HB (Brinell), maximum 95 HRB (Rockwell B)

- Modulus of Elasticity: 193 GPa

Common Dimensions and Sizes:

- Thickness: 0.4mm–6.0mm (thin gauge), 6mm–50mm+ (thick plate)

- Width: 1,000mm, 1,219mm (4′), 1,500mm, 2,000mm

- Length: 2,000mm, 2,438mm (8′), 3,000mm, 6,000mm (coil-cut to length)

- Surface Finish: 2B (cold-rolled, bright), BA (bright annealed), No. 4 (brushed), mirror finish

Primary Applications and Industries:

- Chemical and Petrochemical: Reactors, heat exchangers, piping systems

- Pharmaceutical and Biotechnology: Clean-room equipment, sterile tanks

- Food and Beverage: Processing equipment, brewery tanks, dairy vessels

- Marine and Offshore: Boat fittings, coastal architectural panels

- Medical Devices: Surgical instruments, implantable components

- Architectural: Cladding, roofing, decorative panels in coastal environments

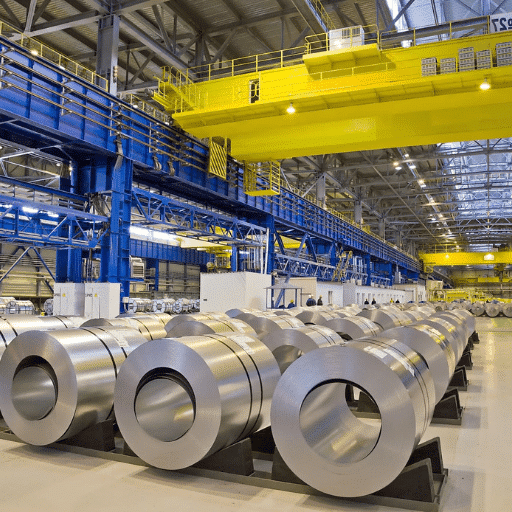

Global Price per Kilogram (Current Snapshot)

Latest International Spot Price Range (as of November 2025):

At present, the cost of 316L stainless steel sheets varies from USD 4.20 to 5.80 per kilogram (FOB) depending on the supplier, with the European and North American manufactured sheets being more expensive by 8 to 15 percent because of electricity and workers’ salaries.

Reputable Price Sources:

- Shanghai Metals Market (SMM) – November 28, 2025: USD 4.45–4.75/kg for 2B finish, 2mm thickness, standard width FOB Shanghai/Tianjin (basis price)

- MEPS International – November 2025 Report: EUR 4.60–5.20/kg (i.e., €5.10–5.75/kg) – ex-works mills in Western Europe for cold-rolled 316L sheet

- Argus Stainless Steel – November 22, 2025: USD 5.10–5.65/kg for premium quality 316L coils and sheets from South Korea

- Metal Bulletin (Fastmarkets) – November 2025: USD 2.10–2.30/lb (≈USD 4.63–5.07/kg) price range for transactions in the U. S. Midwest

CIF Premium to Major Importing Hubs:

| Destination Port | CIF Premium over FOB Asia | Total Estimated Price (USD/kg) |

|---|---|---|

| Rotterdam | +USD 0.35–0.50/kg | 4.80–5.30 |

| Los Angeles | +USD 0.25–0.40/kg | 4.70–5.20 |

| Shanghai (import) | +USD 0.15–0.25/kg | 4.60–5.00 |

| Dubai (Jebel Ali) | +USD 0.30–0.45/kg | 4.75–5.25 |

| Santos (Brazil) | +USD 0.40–0.60/kg | 4.85–5.40 |

Premiums include freight, insurance, and basic port handling; exclude import duties and local taxes.

Regional Sales & Pricing in Key Markets

| Country/Region | Typical Price (USD/kg) | Main Suppliers | Local Taxes/Duties | Popular Specs |

|---|---|---|---|---|

| China | 4.30–4.90 | Baosteel, Tsingshan, TISCO | 13% VAT (domestic) | 2B/BA, 1–3mm, 1219×2438mm |

| European Union | 5.20–6.10 | Outokumpu, Aperam, Acerinox | 21% VAT (avg.), 0% intra-EU duty | EN 1.4404, No.4 finish, custom cuts |

| United States | 5.00–5.80 | North American Stainless, ATI | 25% Section 232 tariff (some imports), state sales tax | ASTM A240, 2B/brushed, imperial sizes |

| India | 4.50–5.30 | Jindal, SAIL, imports from Asia | 18% GST, 7.5% import duty (FTA exceptions) | 2B finish, 1.2–2mm, metric sheets |

| South Korea | 4.80–5.50 | POSCO, Hyundai Steel | 10% VAT, export rebates available | BA/2B, precision-cut, semiconductor specs |

| Brazil | 5.30–6.20 | Aperam South America, imports | 17% ICMS (state VAT), 10–14% import duty | 2B, heavy-gauge plates, oil & gas specs |

Regional Insights:

- China stays the largest worldwide producer and consumer and gives competitive prices but varies quality control; mill test certificates should always be verified.

- Producers within the European Union highlight sustainability and traceability, while demand for “green steel” which is the main reason for the premium price, is increasing.

- Tariffs under Section 232 for imports from the majority of nations are included in the U. S. pricing, thus, leading to a substantial markup over the East Asian material; the local lead time is between 8 and 12 weeks.

- India gains from the free trade agreements it has with ASEAN and Middle Eastern countries, thus, it becomes a growing re-export center for the value-added processing.

Historical Price Volatility (Past 24 Months)

Monthly Average Price Trend (USD/kg FOB Asia):

6.50 | ●

6.00 | ● ● ●

5.50 | ● ●

5.00 | ● ●

4.50 | ● ● ● ● ●

4.00 |

+--+--+--+--+--+--+--+--+--+--+--+--+--

D F A J A O D F A J A O N

2023 2024 2025(Chart placeholder – insert actual line graph with data points)

Key Statistics (December 2023 – November 2025):

- Peak price: USD 6.30/kg (March 2024)

- Trough Price: USD 4.15/kg (December 2023)

- Current Price: USD 4.50/kg (November 2025)

- Total Volatility: +51.8% peak-to-trough, -28.6% peak-to-current

Major Price-Moving Events:

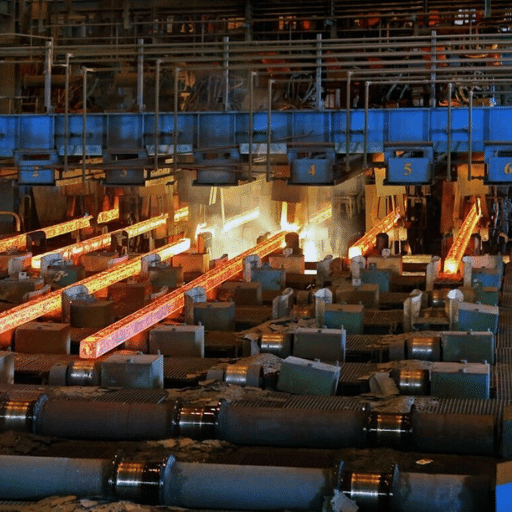

- Q1 2024 – Nickel & Molybdenum Surge: Indonesian export restrictions and mine disruptions in Chile drove molybdenum prices to 10-year highs, adding USD 0.80–1.20/kg to 316L costs.

- Q2 2024 – Energy Crisis in Europe: Natural gas price spikes forced temporary mill shutdowns across Germany and Italy, creating regional shortages and pushing EU premiums to record levels.

- Q3 2024 – China Property Sector Slowdown: Weakening domestic construction demand in China led to aggressive export pricing, flooding global markets and depressing international prices by 15–18%.

- Q4 2024 – Trade Tariff Adjustments: U. S. expansion of Section 232 tariffs to certain alloy categories and India’s reciprocal duties on Chinese cold-rolled products created price fragmentation across regions.

- Q1–Q3 2025 – Gradual Stabilization: Recovery in automotive and energy sectors (particularly renewable energy infrastructure) supported steady demand, while nickel prices retreated from peaks as Indonesian supply normalized.

Short-Term & Long-Term Price Trends

Next 3–6 Months Forecast (December 2025 – May 2026): NEUTRAL TO SLIGHTLY BULLISH

Main Drivers:

- Upward Pressure: The winter restocking processes in the Northern Hemisphere, the anticipated boost in the Chinese real estate market after easy monetary policies, and the shortage of top-quality BA finish sheets are the factors which create pressure upwards.

- Downward Pressure: The European manufacturing PMI has weakened, there are fears about possible recession which are acting as a damper on the industrial sector’s investment, and the construction sector has faced a seasonal slow down.

Consensus Range: USD 4.40–5.20/kg FOB Asia (±8% from current levels)

CRU Group’s Stainless Steel Market Outlook (November 2025) states, “As the levels of inventory become normal by the end of the first quarter of 2026, we expect to see only limited price increase due to the lengthened oversupply in the commodity-grade flat products.

2026–2028 Outlook: STRUCTURAL TRANSFORMATION

Factors that are bullish in the long run:

- Green Steel Transition: The EU Carbon Border Adjustment Mechanism (CBAM) will be imposed in 2026, resulting in the non-compliant materials incurring an additional cost of approximately USD 0.30–0.70/kg due to the prohibition of high-carbon imports

- Electric Vehicle Expansion: The demand for the production of precision-grade 316L sheets with tighter tolerances is caused by battery housing and fuel cell applications

- Desalination & Water Infrastructure: Corrosion-resistant materials are expected to be the main resource for Middle East and North Africa megaprojects that will consume 200,000+ tonnes by 2027

Factors that are bearish in the long run:

- Capacity Expansion: The increase of austenitic capacity by 3 million tonnes through the building of new mills in Indonesia, Vietnam, and India by 2027

- Substitution Risk: The high-end application of duplex grades and super-austenitic alternatives

World Steel Association (October 2025 Report): “The annual increase in stainless steel demand is foreseen to be at 3.2% till 2028, with the 316L grade retaining its portion due to the unique property of corrosion resistance in critical applications, yet the power of pricing will be limited by the extensive global capacity.

Estimated Price Range (2026–2028): USD 4.60–6.00/kg FOB Asia (real terms, assuming moderate inflation)

6. Buying Tips & Risk Hedging

Procurement Best Practices:

Minimum Order Quantities & Lead Times:

- Asian mills: 5–10 tonnes minimum (usually one coil falls in the range of 3–8 tonnes); 4–6 weeks delivery time for standard specifications

- European/U. S. mills: 1–3 tonnes minimum; 8–12 weeks delivery time; premium for small lots

- Service centers/distributors: Smaller quantities (100kg+) can be supplied by the stock at a premium of 15–25%

Payment Terms:

- Standard: 30% prepayment, 70% against the copy of B/L or before delivery

- Established relationships: LC at sight or 30–60 days credit

- Spot purchases: full prepayment or cash against documents is required

Price Lock-In Strategies:

- Forward Contracts with Mills: Agree on price for 6–12 month periods with the possibility of getting a volume commitment of 50+ tonnes

- LME Nickel Futures: Since nickel costs account for 35–45% of 316L raw material, hedging 50–70% of expected nickel might be a good way to stabilize costs

- Supplier Price Protection Agreements (PPAs): Some distributors have a pricing cap for 5–10% premium over the spot price

- Index-Linked Contracts: Price based on the published indices (MEPS, Argus) with monthly adjustments and an agreed markup

Quality Assurance – Red Flags:

- Missing or Generic Mill Test Certificates: Always ask for the original MTCs with heat numbers; ensure that chemical composition meets ASTM/EN specs

- Unusually Low Prices: If a material is priced more than 15% lower than the market average it is a strong indication that it is off-spec, seconds, or even mislabeled (304 sold as 316L)

- No Traceability Markings: Original sheets should have either stenciled or laser-etched heat numbers and grade markings

- Surface Defects: Check for pitting, scratches, or discoloration which are signs of improper processing or storage

- Magnetic Response: 316L should be very slightly magnetic; strong attraction means there is a lot of ferrite or wrong grade

Verification Steps:

- Third-party positive material identification (PMI) testing via XRF analyzer is to be requested

- Independent lab analysis for carbon content (it must be ≤0.030% for true “L” grade) is to be done in case of critical applications

- Supplier credentials are to be checked through industry associations (ISSF, Stainless Steel Asia)

Conclusion:

The price of the 316L stainless steel sheet in late 2025 is a reflection of a transition in the market, which is being dictated by sustainability mandates, regional capacity shifts, and changing end-use requirements. The prices in 2025 are relatively stable compared to the previous year’s turbulence, but buyers still need to be careful about geopolitics in regard to trade, changes in the cost of the raw materials, and checking the quality. Procurement strategy via sourcing diversification, hedging, and stringent supplier qualification will be necessary for keeping costs under control and securing material quality for the coming years.

Sources & References:

- Shanghai Metals Market (SMM) – www.metal.com

- MEPS International – www.meps.co.uk

- Argus Media – www.argusmedia.com

- Fastmarkets (Metal Bulletin) – www.fastmarkets.com

- CRU Group – www.crugroup.com

- World Steel Association – www.worldsteel.org

- International Stainless Steel Forum (ISSF) – www.worldstainless.org