In a year when Covid-19 destabilized the steel industry, the price of 202 steel has played a central role in the decision-making processes of manufacturers around the world. This cheap austenitic grade is competing aggressively to capture a part of the market generally steered by the products with higher nickel content. For global supply chains that have balanced in 2025, expertise in transactions involving this class of stainless steel enters the critical category for this interest group to maintain the quality of its materials while minimizing costs.

Product Overview

Full Material Name: 202 Austenitic Stainless Steel (Low-Nickel, Manganese-Substituted Grade)

Relevant Standards and Grades:

- ASTM: A240/A240M (plate, sheet and strip), A479/A479M (bar)

- EN: 1.4373 (X12CrMnNiN17-7-5)

- JIS: SUS202 (Japanese Industrial Standard)

- Chinese Standard: 1Cr18Mn8Ni5N (GB/T 3280, GB/T 4237)

Typical Chemical Composition (weight %):

| Element | Range |

|---|---|

| Carbon (C) | 0.08–0.15 |

| Chromium (Cr) | 17.0–19.0 |

| Nickel (Ni) | 4.0–6.0 |

| Manganese (Mn) | 7.5–10.0 |

| Nitrogen (N) | 0.15–0.30 |

| Silicon (Si) | ≤1.0 |

| Phosphorus (P) | ≤0.06 |

| Sulfur (S) | ≤0.03 |

Key Mechanical Properties:

- Tensile Strength: 520-750 MPa (75,000-110,000 psi)

- Yield Strength: ≥275 MPa (40,000 psi)

- Percent Elongation: ≥40% (50 mm gauge length)

- Hardness: HB 200 max. (Brinell); HRB 95 max. (Rockwell B)

- Impact Resistance: Medium (inferior relative to 304 at low temperatures)

Typical Sizes:

- Sheet/Plate: Thickness 0.3-6.0 mm, width up to 1500 mm

- Coil: 0.3-3.0 mm × 1000-1500 mm, standard coil weight 3-8 tonnes

- Bar/Rod: Diameter 6-300 mm, length up to 6 m

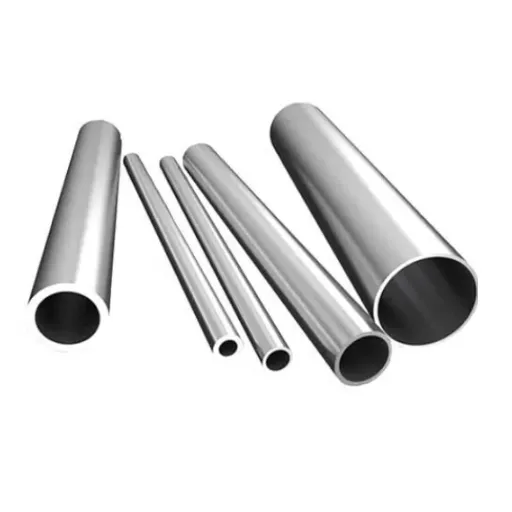

- Tube/Pipe: OD 6-219 mm, wall thickness from 0.5 to 10 mm

Ideal Applications and Industries:

- Building and Construction: Structured cladding, railings, elevator/opening-cars

- Kitchenware and Appliances: Sinks, cookware, refrigerator liners, dishwasher components

- Non-Critical Automobile Parts: Body trims, decorative exhaust systems, emblems

- Rail Transport: Interior fitting rail fittings, handrails, coach panels.

- Food service equipment: Laborer’s kitchen tables, stainless steel in many cases (non-corrosive)

- Utilities: Leather watch bands, zippers, hardware, or furniture produced from EXTERNAL

Global Price per Kilogram (Current Snapshot)

Current International Price Bands: USD 2.15-2.65/kg FOB (Asia-Origin, in cold-rolled 2B finish for November 2025).

Well-attested Source Quotations:

- Shanghai Metal Market (SMM) – 15 November 2025: 202 CR coil from China at CNY 15,200-16,800/tonne (USD 2.13-2.35/kg) ex-works Wuxi

- MEPS International – November 2025 Report: 202 sheet exports for Asia at USD 2,300-2,550/tonne FOB (USD 2.30-2.55/kg)

- Argus Metals – 18 November 2025: India-sourced 202 stainless coil at USD 2,400-2,700/tonne FOB Mumbai (USD 2.40-2.70/kg)

CIF Premium to Key Import Hubs:

- Rotterdam (EU): +USD 180-220/tonne (freight + insurance) = USD 2.48-2.87/kg CIF

- Los Angeles (USA): +USD 150-200/tonne = USD 2.45-2.85/kg CIF

- Dubai (Middle East): +USD 100-140/tonne = USD 2.35-2.79/kg CIF

- Santos, Brazil: +USD 220-280/tonne = USD 2.52-2.93/kg CIF

Note: Prices vary greatly on surface finish or no., thickness and order size.

Regional Sales & Pricing in Key Markets

| Country/Region | Typical Price (USD/kg) | Main Suppliers | Local Taxes/Duties | Popular Specs |

|---|---|---|---|---|

| China | 2.10–2.40 | Tsingshan, TISCO, Hongwang | 13% VAT | 2B cold-rolled coil, 1.0–2.0 mm |

| India | 2.35–2.75 | Jindal Stainless, SAIL, JSPL | 18% GST | 2B/BA sheet, 0.8–3.0 mm |

| Southeast Asia | 2.50–2.90 | Chinese imports, local mills | 5–10% import duty + VAT | 2B coil, decorative finishes |

| European Union | 2.85–3.35 | Outokumpu, Aperam, Asian imports | 10–25% AD duty (China), 21–27% VAT | EN 1.4373, BA/2B sheet |

| United States | 3.10–3.60 | Domestic mills, Korean/Taiwanese imports | Section 232 tariffs (25% on some origins) | ASTM A240, cold-rolled sheet |

| Middle East | 2.60–3.10 | Chinese/Indian imports | 5% duty + 5% VAT | 2B finish, construction grades |

Regional Insights:

- China is one of the leading countries in world soda ash production by taking control of the market with over 60 percent. The country has the most competitive prices as far as Asia is concerned, because of the well-organized supply chain and low labor costs.

- India has emerged as the second largest manufacturer, with competitive pricing for export markets, demand at home is also on the rise.

- Prices in the EU/USA include anti-dumping duties on Asian imports to safeguard domestic mills, but this has driven up costs for the end-users in the surplus. Local premiums soar USD 0.50 to 1.00 a kg above the Asian FOB range.

Historical Price Volatility (Past 24 Months)

Monthly Average 202 Steel Price (USD/kg FOB Asia) – Nov 2023 to Nov 2025:

2023: N |D

2.45|2.38

2024: J |F |M |A |M |J |J |A |S |O| N |D

2.32|2.28|2.35|2.42|2.55|2.68|2.72|2.65|2.58|2.50|2.45|2.38

2025: J |F |M |A |M |J |J |A |S |O |N

2.35|2.30|2.25|2.28|2.32|2.38|2.42|2.48|2.52|2.58|2.60Key Statistics:

- Peak: $2.72 per kilogram in July 2024 after nickel prices surged and ore exports from Indonesia were restricted.

- Trough: $2.25 per kg in March 2025 after the demand slumped following the Chinese New Year.

- Total volatility: swing of 20.9% peak to trough.

- Current Position: At +15.6% since the 24-month demand low and -4.4% below peak.

Major Events Affecting Prices:

- Q2 2024 – Nickel’s price Spike: The Indonesian government slashed new nickel ore export quotas pushing up NPI (nickel pig iron) prices by 35% and, cumulatively, bolstering in 202 premiums for alternative nickel supplies.

- July-August 2024 – Energy Crisis in India: The monsoon power shortages witnessed an 8 to 12% increase in Indian production costs, with thickening Asian export availability.

- Q4 2024 – Chinese Property Sector Stimulus: The Beijing housing rescue package was a solid boost for construction demand, clearing the domestic 202 inventories and bringing some support in price.

- March 2025 – Inventory Overhang: Chinese mills overproduced through all winter, triggering a stinging correction as buyers deferred purchases in hope of further price falls.

- September-November 2025 – Raw Material Stabilization: Zhangdian ferrochrome and manganese prices stabilized again, decreasing volatility and permitting continued price recovery in tune with the seasonal pickup of demand.

Short-Term & Long-Term Price Trends

Next 3–6 Months Forecast (December 2025 – May 2026): Neutral to Slightly Bullish

Main Drivers:

- Seasonal Demand: Asian traditional Q1 replenishment and pre-construction season buying in North American/European markets to uphold prices within the range of USD 2.50-2.75/kg FOB.

- Raw Material Costs: Ferrochrome prices are bound to stay limited within the narrow band of USD 1.10-1.25 per pound, which will probably cap the upside but protect part of the downside as well.

- Chinese Production Discipline: Many argue that randomness in production is but an indication rather that stability. As the guidelines of recent CSISA (China Stainless Steel Industrial Association) suggest, capacity rationalization will potentially cut the supply glut.

- Currency Effects: A cheaper CNY could make Chinese exports more competitive and, in turn, depress international prices anywhere from 3% to 5%.

Analyst Views:

- CRU Group (October 2025 Report): “We, therefore, forecast the average price for Asian 202 in Q1 2026 at USD 2,550/tonne (USD 2.55/kg), up 5% Q/Q, due to restocking and stable scrap costs.”

- Argus Consulting (November 2025): “Expect limited upside through March 2026; 202 will track broader stainless trends but maintain a 15-20% discount to 304 due to substitution dynamics.”

2026–2028 Outlook: Moderate Growth with Structural Headwinds

Medium-term forecast: USD 2.60–3.00/kg FOB average (2026–2028), representing +8–12% CAGR from the current levels.

Overswaying factors:

- Green-Steel transition: Scrap usage under EAF will increase, not the only cardinal structural factor in driving pricing. Even if 202 prices remain volatile, it will see a decline from a significantly null contribution towards net prices. Given a wide range of possible configurations for furnaces for reasonable energy consumption. For now, we assume scrap costs are cheap and steel production will dominate usage. The alloy could find a place given some other substitute material is cheaper combined with no adverse influence on major metal purchases when further refining activities.

- Demand from EV & battery sectors: 202 steel is being used for multiple, unique applications. The demand will only grow as fast, anywhere from 2 to 3 percent per annum.

- Infrastructure Investment: Both U. S. Infrastructure Investment and Jobs Act and the EU’s REPowerEU initiative hair down supply construction oriented demand upward by 2027, more probably at a decorative and non-structural level where it is competitive.

- Substitution Risk: With the dropping nickel price (LME nickel averaging $16,000–18,000 per ton vs. +$22,000 by 2024), the cost advantage of 202 vis-a-vis 304 would narrow, stalling global market penetration in price-sensitive segments, and possible sustenance could be gauged through Taiwanese mills benefiting from the accelerated adoption.

Forever enjoyed the following expert views:

- World Steel Association (Mid-Year Outlook 2025): “Austenitic stainless demand grows at 3.5% a year to 2028, with 200-series capturing 28–30% of the world market (up from 25% in 2023) mainly in Asia-Pacific.”

- MEPS International (2025 Long-Term Forecast): “202 prices will continue to be structurally 18–22% lower than those of 304, but absolute price levels will inch up as raw material floors strengthen and environmental compliance costs increase across Asian supply chains.”

Buying Tips & Risk Hedging

Procurement Best Practices

Minimum Order Quantity and Lead Times:

- Asean Mills: The minimum ordering quantity is generally around 25 to 100 tonnes on the specifications at 30-45 days for standard qualities and 60-90 days for specific finishings.

- European/US Distributors: Usually ranging from 5 to 10 tonnes, with the lead times of 6-12 weeks including ocean freight.

- Spot Market: Smaller quantities (attached to grades) are also for sale at premiums of USD 0.10–0.20/kg over contract price.

Payment Terms:

- Standard: 30% deposit, 70% for B/L or L/C at sight.

- Established Buyers: Net 30-60 days terms are usually available from major suppliers with credit approval.

- Spot Purchases: Often require 100% advance payment or cash against documents (CAD).

Price Risk Hedging Strategies

- Forward Contracts: Prices locked for 3-12 months with suppliers; typically volume commitment depends on annual supply volume of 500+ tonnes. Current forward premiums are at +USD 0.05-0.08/kg per quarter.

- LME Nickel: LME 3-month nickel can hedge a max correlation coefficient with historical data of ~0.65, even though 202 is less concentrated in nickel content. Ratio hedge 0.4:1 (0.4 tonnes LME per 1 ton 202).

- Price Protection Agreements (PPAs) with Suppliers: Look into the ability to negotiate elements within the PPA that limit monthly price escalation to ≤+5% or dictate prices based on a published index (SMM, Argus) to ensure transparency.

- Multi-Sourcing: It is best to have standing relationships with 2-3 different suppliers from various regions across the globe to take better advantage of arbitrage-based strategies and reduce supply chain risks. One option might be to choose an Asian primary source with a European or Indian backup.

Quality Control & Red Flags

Identifying Counterfeit/Low-Quality Materials:

- Analysis: The mill test certificates solicited must fulfill ASTM A480 or EN 10204 3.1. cross-examine the content of nitrogen (should be 0.15–0.30%; content less than 0.10% with low nitrogen indicates inferior quality of corrosion resistance).

- Surface Defects: Excessive pitting, uneven finish, or delamination could imply the improper cold rolling of a contaminate input.

- Hardness Testing: Portable Rockwell tester-guided field-test is recommended with authentic grade 202 measuring 85–95 HRB. Readings above these values may suggest over-hardening or a wrong grade substituted for the genuine.

- Magnetic Response: Grade 202 in the annealed condition should be weakly magnetic. A higher magnetic response suggests contamination by 400 series or excessive cold work.

- If it’s Too Good to Be True: More than 15% below the market average is usually a good sign for off-spec material, mixed grades, or misrepresented origin. Always inspect if ready to pay finally.

Third-Party Verifications:

- Engage SGS, Bureau Veritas, or Intertek with pre-shipment inspection (PSI) on orders >50 tonnes.

- Require photographic documentation of coil/bundle markings, edge quality, and packaging condition.

Conclusion

In late 2025, the steel price landscape of 202 reflects a market that is growing; this maturity, however, has notified by the costs to the performance balance. Halting at USD 2.15–2.65/kg, the Asian FOB prices and regional premiums that entail through trade policy and logistic factors need adept procurement strategies that balance spot and hedging. As a much evolved stainless steel world looks very cleverly at energy transition and changing consumer demand patterns, 202 grade’s cost to effectiveness ratio is ensuring further relevance in sectors that are associated with construction, appliances, and decor. Buyers are recommended to make the best use of the situational stability to get in the market on agreeable prices for both price properties and quality vigilance without losing the diversification of supplies.

Data Sources:

- Shanghai Metals Market (SMM) – Daily pricing data, November 2025

- MEPS International Steel Review – Monthly reports, 2023-2025

- Argus Metals – Weekly Asian stainless steel assessments

- CRU Group – Stainless Steel Market Outlook Q4 2025

- World Steel Association – Statistical Yearbook and forecasts

- LME-London Metal Exchange-Nickel and ferrochrome pricing

- CSISA-China Stainless Steel Industrial Association-Production guidelines

Disclaimer: Prices and forecasts in this article reflect data available as of November 5, 2025, and are subject to change without notice. This analysis is for informational purposes and does not constitute financial, legal, or commercial advice. Always verify current spot prices and contractual terms directly with suppliers and industry pricing services.