An awareness of the landscape of 202 SS sheet price is essential for manufacturers and procurement managers trying to find cheaper alternatives to the costly 300 series stainless steel. A nickel-conserving austenitic grade, 202 stainless steel, performs similarly to 304 in numerous applications while saving 20-35% in material costs. This exposes deep insights into the current global price dynamics, regional market conditions, historical volatility, and strategic buying considerations for 202-grade stainless steel sheets by the end of 2025.

Product Overview

Material’s name: 202 stainless steel sheet (Austenitic Chromium-Nickel-Manganese Stainless Steel)

Common Grades & Standards:

- ASTM: A240/A240M Grade 202, A314, A276

- AISI: 202

- EN/DIN: 1.4373 (X12CrMnNiN17-7-5)

- JIS: SUS202

- UNS: S20200

- GB: 1Cr18Mn8Ni5N (Chinese national standard)

Typical Chemical Composition:

| Element | Composition (%) |

|---|---|

| Carbon (C) | ≤0.15 |

| Chromium (Cr) | 17.0–19.0 |

| Nickel (Ni) | 4.0–6.0 |

| Manganese (Mn) | 7.5–10.0 |

| Nitrogen (N) | ≤0.25 |

| Silicon (Si) | ≤1.0 |

| Phosphorus (P) | ≤0.060 |

| Sulfur (S) | ≤0.030 |

Key Differentiation: Grade 202 substitutes expensive nickel, with the introduction of manganese and nitrogen. It is a comparatively cheaper alternative to the standard chromium-nickel stainless steels like the type 301 and 304 Swing Stainless Angeles when we talk in the context of stainless sheets.

Key Material Properties:

- Tensile Strength: 750 MPa – 109 ksi.

- Yield Strength: 40 ksi ≥ 275 MPa at 0.2% offset

- Elongation: Greater than or equal to 40% (in 50mm gauge length)

- Hardness: 187 HB (Brinell) maximum; nor more than 90 HRB (Rockwell B-scale) in the annealed state

- Elastic Modulus: 193 GPa

Types of Shape and Thickness Commercially Available:

- Thickness: 0.3mm-6.0mm (standard sheet); 0.012mm-25mm (specialized applications)

- Width: 1000mm, 1219mm (4′), 1250mm, 1500mm,2000mm, or 3500mm

- Length: 2000mm, 2438mm (8′), 2500mm, 3000mm, 6000mm (coil-to-length)

- Standard sheet sizes: 4’×8′ (1219×2438mm), 1000×2000mm, 1250×2500mm, 1500×3000mm

- Finish: 2B (cold-rolled, bright annealed), 2D (Dull), BA (bright annealed), No. 4 (brushed/satin), NO. 8 (mirror polish), no. 8 with either matte or PVD-coated decorative finish

Principal Applications & Industries:

- Kitchenware & Food Service: Sinks, cookware, restaurant equipment, serving counter, utensils, food processing equipment

- Architecture & Construction: Interior wall cladding, elevator panels, decorative trim, railings

- Automotive: Non-structural trim parts, exhaust elements, decorative elements

- Appliances: Washing machine drums, refrigerator liners, oven components

- Furniture & Fixtures: Frames, tabletops, decorative hardware

- Rails: Train interiors, trailers

Limits: Due to its lower nickel content, 202 grade is susceptible to salt solutions, acids, bases, and organics, while air pollution or chemical corrosion should also be noted. This material is mostly not recommended by Sanghvienterprise for marine environments, coastal applications, or high-temperature services above 400 °C because of its compromised corrosion durability due to the said-nickel content.

Global Price per Kilogram (Current Snapshot)

As of November 2025, the price of the 202 stainless steel sheet flutters somewhere between 1.30 and 1.80 per kilogram FOB for 1st-grade cold-rolled 2B finish material MFG ShopKDM, thus presenting a discount of 20–30% compared to 304-level material.

Latest International Spot Price Ranges (November 2025):

ASTM A240 202 Cold-rolled Sheet (1.0–2.0 mm, 2B finish):

- FOB Asia (China/India): USD 1.30–1.50/kg

- FOB Taiwan/Korea: USD 1.45–1.65/kg

- Ex-works Europe: USD 1.60–1.85/kg

- US Domestic: USD 1.70–2.00/kg

CIF Premium to Major Importing Hubs (add Proportionate FOB pricing):

- Rotterdam (Europe): +USD 0.12–0.18/kg

- Los Angeles (US West Coast): +USD 0.10–0.15/kg

- Dubai (Middle East): +USD 0.08–0.12/kg

- Santos (Brazil): +USD 0.15–0.22/kg

Freight premiums sections: It changes in line with changes in bunker fuel costs, container availability and seasonal demand.

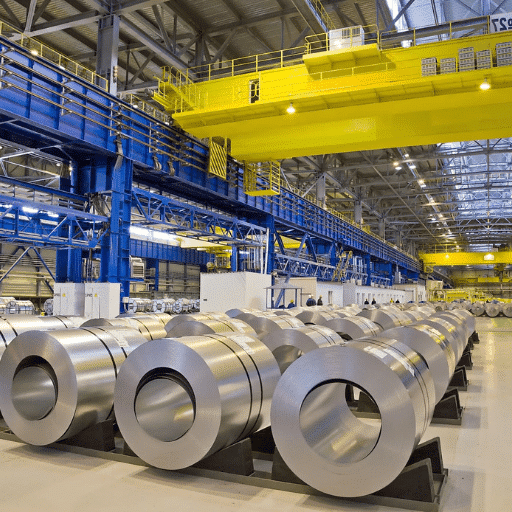

Regional Sales & Pricing in Key Markets

| Country/Region | Typical Price (USD/kg) | Main Suppliers | Local Taxes/Duties | Popular Specifications |

|---|---|---|---|---|

| China | 1.30–1.50 | Tsingshan, Baosteel, local mills | 13% VAT (domestic); Export duty-free | 1.0–2.0mm, 2B/BA finish, 1219×2438mm |

| India | 1.75–2.25 | Jindal, local importers/traders | 18% GST + 10–12.5% import duty (if imported) | 0.8–1.5mm, 2B/Mirror/Matt, 1250×2500mm |

| South Korea/Taiwan | 1.45–1.70 | POSCO, Yieh United | Minimal for exports; 10% VAT domestic | High-quality 2B/BA, 1.2–2.0mm, tight tolerances |

| Europe (EU) | 1.80–2.10 | Imports from Asia; limited local production | CBAM carbon tariff +8–12%; Standard VAT 19–25% | 1.0–1.5mm, 2B/No.4 brushed, EN 1.4373 |

| United States | 1.85–2.15 | Imports (Section 232 tariff applied); limited domestic | 25% Section 232 tariff on imports; State sales tax | ASTM A240 Grade 202, 1.0–2.0mm, 2B/No.4 |

| Middle East (UAE/Saudi) | 1.55–1.85 | Re-export from India/China; local traders | 5% VAT; Duty-free import (GCC) | 1.0–1.5mm, Mirror/2B, cut-to-size services |

Regional Market Insights:

- China seemingly comprises a huge supplier of secure lowest prices for its integrated 202 production loop. However, wide quality inconsistencies are witnessed between prominent tier-1 mills and smaller producers.

- India presently accommodates one of the largest consumers of 202 for consumption and re-processing operations. The national price for the 202 product ranges from around Rs 110–185/kg depending on the finish and the supplier. The 18% GST and anti-dumping charges on Chinese products further lead to an increase in the domestic price of alloy.

- In Europe, gradually implemented Carbon Border Adjustment Mechanism (CBAM) rates, which add an 8–12% premium on imported material at most on the imported material, are diverting customers towards recycled or certified grades of low-carbon content.

- The United States’ Section 232 tariffs on steel (25% on importations) have had a distinctly increasing effect on the 202 market prices and are leading to domestic substitution or a switch to USMCA-compliant sourcing from Mexico/Canada.

Historical Price Volatility (Past 24 Months)

Monthly Average 202 CR Sheet Price (USD/kg, FOB Asia)

Nov Jan Mar May Jul Sep Nov

2023 2024 2024 2024 2024 2025 2025

1.60 │

1.55 │ ╭────╮

1.50 │ ╱ ╲ ╭──

1.45 │ ────╯ ╲ ╱

1.40 │ ╲ ╭────╮ ╱

1.35 │ ╲ ╱ ╲ ╱

1.30 │ ╲____╱ ╲__╯

1.25 │

1.20 │

└────────────────────────────────────────────Key Price Milestones:

- Peak (Mar 2024): $1.58/kg (+18% over Nov 2023 baseline at $1.34/kg)

- Trough (Aug 2024): $1.28/kg (-19% from the peak; -4.5% YoY)

- Current (Nov 2025): $1.42/kg (+6% YoY recovery, with Q3–Q4 2025 remaining stable)

- 24-Month Price Band: $1.28–1.58/kg (23% peak-to-trough volatility)

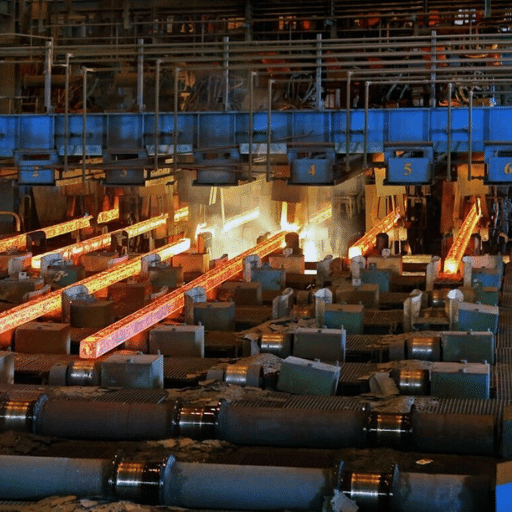

Significant Price-Driving Events (2023–2025):

- Nickel Prices Skyrocket (Q1 2024): LME nickel hit USD 21,500/ton, despite lower nickel content compared with 304, pushing up costs in 300 series stainless steel and thereby generating upward pressure on 202 as a substitute at DAPU Metal Materials, on the demand-substitution front.

- Chinese Property Market Downturn (Q2–Q3 2024): Collapse of Evergrande and building slowdown precipitated reduced internal demand for stainless steel, as Chinese mills intensified export drives with distressed pricing at DAPU Metal Material, creating a 12% price correction for 202 sheets.

- Indonesian Export Restrictions on Nickel (Mid-2024): Supply chain bottlenecks led to price volatility across all austenitic grades, which resulted in surges in the 202, while buyers considered alternatives.

- India Anti-Dumping Duty (August 2024): India slipped in anti-dumping duties of 12.5 percent on Chinese cold-rolled stainless imports to momentarily tighten Asian markets DAPU Metal Materials and uphold regional 202 prices.

- Manufacturing PMI Bounce (2025): Slowly improved manufacturing PMIs in the US, the EU, and Asia have created a restocking wave, driving upward price movement as of August 2025 DAPU Metal Materials.

Short-Term & Long-Term Price Trends

Next 3–6 Months Forecast (Q1–Q2 2026): NEUTRAL TO SLIGHTLY BULLISH

Expected Price Range: USD 1.40 to 1.60/kg FOB Asia (±7% from current levels)

Key Drivers:

- Manganese & Chromium Costs: Stable ferrochrome supply from South Africa and Kazakhstan have been supporting baselines until now. Chromium prices are a little stable these days; however, commitment of South African suppliers remains too low Fastmarkets.

- Seasonal Demand: Q1 typically experiences construction for stock inventory in the temperate markets fostering light upward movement (2–4%).

- Chinese Production Discipline: The slowdown in Chinese stainless growth output must continue through 2025 if producers are to rebalance the market Fastmarkets, thereby limiting upside price risk.

- Energy Cost: With energy costs in Asia, particularly natural gas and electricity pricing, remaining unchanged, very secure production economics continue to provide competition.

Analyst Consensus

- Fastmarkets (April 2025): Despite steady confidence among producers, the present two waves of inflation combine with weak demand to create a mixed outlook for stainless steel Fastmarkets, inclusive of 202.

- CRU Group: Expects the pricing to be range-bound with little upside on account of global overcapacity but with a price floor from raw material costs.

2026–2028 Long-Term Outlook: GRADUAL APPRECIATION (+8–12% cumulative)

On the projected 2028 Pricing: USD 1.55–1.75/kg FOB Asia (baseline scenario)

Structural Factors:

- Green Steel Transition: As decarbonization regulations in the EU and ESG constraints grow, DAPU Metal Materials on hydrogenated DRI processing costs and will hike the costs by a compound 8–12%, thereby slowly pushing price floors for even economy-size stainless steel grade 202.

- Nickel Substitution Demand: Given the increasing pace of nickel absorption for EV battery demand, the cost of nickel is now forecast to fluctuate between $15,000 and $20,000/ton ~ 2025 with Fastmarkets, while still reigning with cost pressure on 304/316 and somewhat on 202 for affordability and backup demand.

- Emerging Market Infrastructure: Urbanization in India, Southeast Asia, and Africa would boost bench demand growth of 3–5% for economy-grade stainless going into infrastructure and appliances.

- Capacity Rationalization: Policies laid out by the Chinese government concerning outdated capacity have successfully paid off in creating reduced surplus supply, thereby providing the required support to price stabilization.

Industry Reports Mentioned:

- World Steel Association: Crude stainless steel production is expected to rise to 24–26 million metric tonnes by 2025 at a 2.8% CAGR through 2027 by DAPU Metal Materials.

- Fastmarkets (2025): Further protective measures from the EU before the calendar year ends are expected to result in very high recognition of European producers by Fastmarkets. In an indirect manner, this will lead to increased global discipline in pricing.

Risk Scenarios:

- Bearish Case: A global recession or collapse of Chinese demand would drive prices towards USD 1.20–1.30/kg (–12–15%).

- Bullish Case: Carbon tax policies drastically fail to stop price dumping, and nickel supply ends due to massive disruption, with nickel pig iron shutting down, leading toward USD 1.80–1.95/kg (+25–30%).

Buying Tips & Risk Hedging

Minimum Order Quantities & Lead Times:

- Importers/Traders: 5-25 MT typical MOQs but 15-30 days lead time

- Mills Direct (China/India): 25-100 MT MOQ; 30-45 days production + shipping

- Spot Market: 1-5 MT available but expect 15-25% price premium

- Custom Processing (cutting, polishing): Add 7-14 days of lead time

Payment Terms:

- Standard International: 30% T/T deposit, 70% against B/L copy

- Established Relationships: 60-90 day payment terms with credit approval

- Letter of Credit: Common for first-time large orders (USD 50K+)

- Trade Assurance Platforms: Pivotal for orders under USD 20K for risk management

How to Lock in Prices (Hedging Strategies):

- Forward Contracts (2-4 months): Broker fixed price agreements with suppliers for delivery windows; owing to premium at 2-5% over spot, plans afford predictable pricing

- Quarterly Framework Agreements: Set prices with suppliers in agreements with minimum commitments that allow adjustment with indexes like Platts ferrochrome, SHFE stainless futures

- LME Nickel Futures (Indirect Hedge): When 202 has most exposure to nickel, buyers can use three-month LME contracts accordingly to manage the remaining nickel price risk on a large scale (minimum 6-ton lots).

- Supplier Power Purchase Agreements: Negotiate annual contracts for the very large consumers (500+ MT annually) with monthly or quarterly price resets, with agreements being based on formulas that have been agreed.

- Multi-Sourcing Strategy: Keep 2–3 suppliers qualified for their supplies from different regions to leverage their competiveness in pricing and minimize risk from supply disruption.

Red Flags for Counterfeit/Low-Quality Material:

Material Verification Matters:

- Ensure Mill Test Certificates (MTCs), with lot number tracing and heat information for every shipment.

- Third-Party Testing: PMI (Positive Material Identification) spectrometry provides proof of composition. Budget USD50 to USD150 per test.

- Visual Inspection: 202 should not exhibit rust staining or excessive surface defects in 2B finish.

- Magnetic Testing: Annealed 202 should be weakly magnetic and strongly magnetic material indicates faulty processing or grade swap.

Common Issues

- Grade Misidentification: Disreputable suppliers may send the 201 grade with nickel of even poorer quality but claiming it is 202. Test the chromium content (202: 17–19% vs. 201: 16–18%).

- Nickel Content Defects: True 202 contains 4–6% Ni; anything below 3.5% from the test results indicates nonconforming material.

- Improper Finish: The 2B finish shall be evidently smooth, uniform, and free of pitting. It is always to reject materials with too much orange peel or embedded scale.

- Thickness level: ASTM A240 allows 13mm tolerance for ≤3mm sheet, verify by micrometer sampling. S

Supplier diligence:

✓ ISO 9001:2015 certification (quality management)

✓ Mill audit reports or third-party inspection reports

✓ At least 3 years in the stainless steel business, with recommendations to demonstrate this

✓ Checking of physical location of both buyer and seller (avoid entities that simply exist on paper without any warehouse)

✓ Clear warranty statement (typically 12-18 months from delivery)

✓ Clear and transparent price structuring, which is the sum of base material + processing + freight charges

Cost-Optimization Strategies:

- Timing: Wherever possible, the procurement should be concentrated during the seasonal slumps, i.e., third (July, August, and September) and fourth quarter (October, November, and December), whereby the normal demand of the construction industry slows down.

- Consolidation: A larger quantity of different SKUs/finishes can be combined and transported as one shipment to reduce per-kg freight cost.

- Tolerances: Accept standard mill tolerances rather than opting for very tight specifications, at a 5-10% premium.

- Finish Selection: 2B finish is 10-15% cheaper than No. 4 brushed and 20-30% cheaper than mirror polish.

- Negotiate Scrap Buyback: Arrange return of offcuts/scrap at 40–50% of purchase price to mills for recycling.

Conclusion

Moving forward into 2025, the 202 SS sheet price market would suggest stabilization around USD 1.30/kg to USD 1.50/kg for FOB Asia standard cold-rolled material pricing, so that it can nonetheless be considered an affordable option for price-sensitive applications in comparison to 304 quality. Short-term prices are expected to cluster around this level, making it largely a sideways movement with some slight weight to the upside through the first quarter of 2026. Long-term structural gains, under the momentum of the green steel mandate, nickel market fundamentals, and demand boosts in emerging markets potentially will drive all prices upward by 8-12% until 2028.

Focusing typically on quality checks, multivendor sourcing, and forward buying during price weakness is critical for minimizing the total landed cost. 202 stainless steel sheet is a perfect choice for specifications matching and vendor resource management for architectural (interior only), kitchenware, light industry applications, where marine-grade corrosion resistance is not needed, thereby offering a trade-off for performance and quality optimization vis-a-vis expenditure.

Disclaimer: Prices and forecasts reflect market conditions as of November 21, 2025, and are subject to change. This analysis is for informational purposes only and does not constitute investment, procurement, or commercial advice. Always conduct independent due diligence and consult qualified professionals before making purchasing decisions.