The price of 1.2 mm stainless steel sheets is now considered a vital standard for manufacturers of different industries such as automotive, construction, and food processing. By the time global supply chains fully recover after the pandemic and raw material prices rise and fall, understanding current pricing dynamics will be equally important for purchasers and investors. The report provides a comprehensive examination of the 1.2 mm stainless steel sheet price trends, geographical differences, and buying strategies suggested by the newest market data.

Product Overview

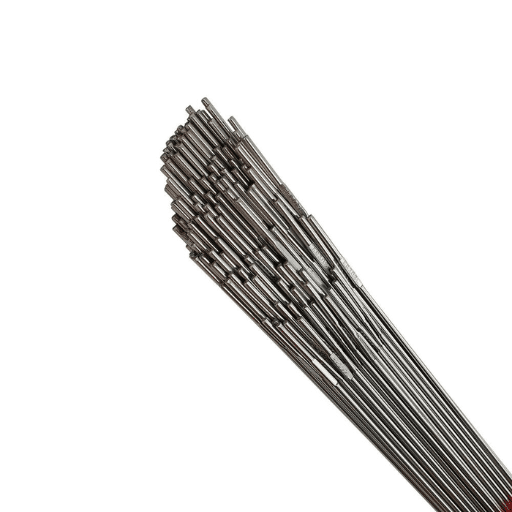

Material Name: 1.2 mm Cold-Rolled Stainless Steel Sheet

Common Grades/Standards:

- ASTM A240/A480 (USA)—Grades 304, 304L, 316, 316L, 430

- EN 10088-2 (Europe)—1.4301 (304), 1.4404 (316L), 1.4016 (430)

- JIS G4305 (Japan)—SUS304, SUS316L, SUS430

- GB/T 3280 (China)—0Cr18Ni9 (304), 00Cr17Ni14Mo2 (316L)

Typical Chemical Composition (Grade 304 example):

- Chromium (Cr): 18.0-20.0%

- Nickel (Ni): 8.0-10.5%

- Carbon (C): ≤0.08%

- Manganese (Mn): ≤2.0%

- Silicon (Si): ≤1.0%

- Iron (Fe): Balance

Key Mechanical Properties (Grade 304, annealed):

- Tensile Strength: 515-720 MPa

- Yield Strength: ≥205 MPa

- Elongation: ≥40%

- Hardness: ≤200 HB (Brinell), ≤92 HRB (Rockwell B)

Common Dimensions/Sizes:

- Thickness: 1.2 mm (tolerance ±0.05–0.10 mm)

- Width: 1,000 mm, 1,219 mm (4 ft), 1,500 mm, 2,000 mm

- Length: 2,000 mm, 2,438 mm (8 ft), 3,000 mm, 6,000 mm

- Surface Finish: 2B (mill finish), BA (bright annealed), No. 4 (brushed), mirror

Primary Applications:

- Food & Beverage: Industrial kitchen equipment, brewing tanks, dairy processing

- Automotive: Exhaust systems, trim components, electric vehicle battery enclosures

- Architecture: Façade cladding, elevator interiors, handrails

- Chemical: Heat exchangers, pharmaceutical equipment, storage vessels

- Electronics: Appliance casings, semiconductor tooling

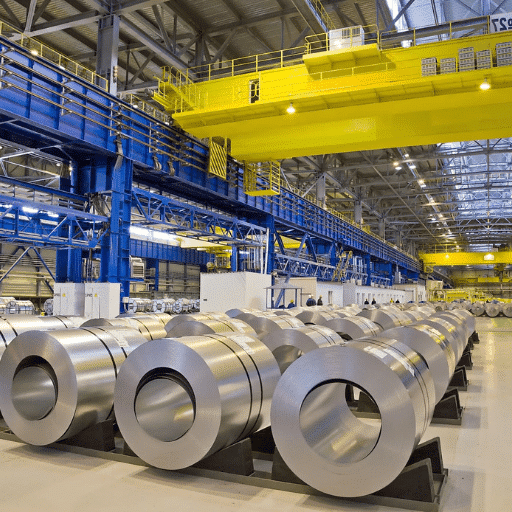

Global Price per Kilogram (Current Snapshot)

Latest International Spot Price Range: USD 3.20–3.85/kg FOB (Grade 304, 2B finish, as of November 2025)

Reputable Sources:

- MEPS International Steel Review – November 15, 2025: EUR 3,200–2,950/tonne (USD 3.53–3.25/kg) FOB Northern Europe

- Shanghai Metals Market (SMM) – November 20, 2025: CNY 15,400–14,800/tonne (USD 2.17–2.08/kg) ex-works China(note: domestic pricing lower due to overcapacity)

- Argus Stainless Steel – November 18, 2025: USD 3.80–3.65/kg FOB South Korea (premium Asian export quality)

CIF Premiums to Major Hubs:

- Rotterdam (Europe): CIF: +USD 0.15–0.25/kg (freight + insurance from Asia)

- Los Angeles (USA): +USD 0.20–0.30/kg (shifting by sea across the Atlantic)

- Shanghai (China): Standard for Chinese origin; +USD 0.10–0.18/kg for imports from Europe/Japan

- Dubai (Middle East): +USD 0.12–0.22/kg from Asian suppliers

Regional Sales & Pricing in Key Markets

| Country/Region | Typical Price (USD/kg) | Main Suppliers | Local Taxes/Duties | Popular Specs |

|---|---|---|---|---|

| USA | 4.10–4.65 | Outokumpu, North American Stainless, imports (South Korea, Taiwan) | Section 232: 25% tariff on many imports; domestic surcharges | ASTM 304/316L, 2B/No.4 finish |

| European Union | 3.75–4.20 | Aperam, Outokumpu, Acerinox | VAT 19–25%; AD duties on Chinese imports (~25%) | EN 1.4301/1.4404, BA/2B |

| China | 2.05–2.40 | Tsingshan, TISCO, Baosteel, Hongwang | VAT 13%; export rebate 0% (net neutral) | GB 304/316L, mostly 2B |

| India | 3.20–3.60 | Jindal Stainless, SAIL, imports (Indonesia, China) | GST 18%; BIS certification required | IS 304L/316L, 2B/No.1 |

| Japan | 4.00–4.50 | Nippon Steel, JFE Steel | Consumption tax 10%; minimal import duties within CPTPP | JIS SUS304/316, BA/HL |

| South Korea | 3.50–3.95 | POSCO, Hyundai Steel | VAT 10%; FTA benefits with EU/US reduce barriers | KS 304/316L, 2B/BA |

Regional Insights:

- USA: The pricing of domestic products remains high because of the Section 232 tariffs; mills are taking 8 to 12 weeks at least to get the orders done.

- EU: The supply chain is very tight as a result of curtailment of mills energy-driven to be implemented in 2023-2024; however, the process of normalization is gradually moving forward.

- China: Structural oversupply is keeping the domestic prices at 30-40% discount below the global benchmarks, and the country is practicing aggressive export pricing.

- India: A country that is becoming more and more self-sufficient; the supply of Indonesian nickel ore is very important to be able to compete on cost.

Historical Price Volatility (Past 24 Months)

Monthly Average Price Trend (USD/kg, FOB Asia):

2023-12: 2.95 |███████████████

2024-01: 3.10 |████████████████

2024-02: 3.25 |█████████████████

2024-03: 3.45 |██████████████████▌

2024-04: 3.60 |███████████████████▌ ← Peak

2024-05: 3.50 |██████████████████▌

2024-06: 3.35 |█████████████████▌

2024-07: 3.20 |████████████████▌

2024-08: 3.05 |███████████████

2024-09: 2.90 |██████████████ ← Trough

2024-10: 3.00 |███████████████

2024-11: 3.15 |████████████████

2024-12: 3.30 |█████████████████

2025-01: 3.40 |██████████████████

2025-02: 3.50 |██████████████████▌

2025-03: 3.55 |███████████████████

2025-04: 3.60 |███████████████████▌

2025-05: 3.65 |████████████████████

2025-06: 3.70 |████████████████████▌

2025-07: 3.75 |█████████████████████

2025-08: 3.80 |█████████████████████▌

2025-09: 3.75 |█████████████████████

2025-10: 3.70 |████████████████████▌

2025-11: 3.72 |████████████████████▌Key Statistics:

- Peak: USD 3.80/kg (August 2025)

- Trough: USD 2.90/kg (September 2024)

- Total Volatility: +31.0% peak-to-trough

Major Price-Moving Events:

- April 2024: Indonesia nickel export quota rumors sparked 15% rally in Ni-bearing grades.

- September 2024: Chinese real estate sector collapse triggered demand collapse; prices fell 19% in 8 weeks.

- January 2025: EU Carbon Border Adjustment Mechanism (CBAM) implementation raised compliance costs.

- May 2025: India infrastructure budget boosted Asian demand; stainless scrap prices surged.

- August 2025: Typhoon disruptions in Taiwan/Philippines constrained supply; temporary spike to USD 3.80/kg.

Short-Term & Long-Term Price Trends

Next 3–6 Months Forecast (December 2025 – May 2026): NEUTRAL TO SLIGHTLY BEARISH

Main Drivers:

- The forecast set by LME is that the nickel prices will be lower at USD 16,500–17,800/tonne compared to the current price of USD 18,200. This is mainly due to the increase in supply from Indonesia.

- The Lunar New Year, which falls in February 2026, marks the end of seasonal demand and subsequently, its decline.

- The Chinese market is predicted to witness an upswing in exports while the domestic market is expected to remain slow; World Steel Association foresees a 2.1% YoY increase in China flat-rolled stainless output but only a 0.8% rise in domestic demand.

Expected Price Range: USD 3.40–3.65/kg FOB Asia (Grade 304, 1.2 mm)

2026–2028 Outlook: MODERATELY BULLISH

Structural Factors:

- Green Steel Transition: It is expected that the incentives for low-carbon stainless (through hydrogen-based DRI and scrap recycling) in the EU and USA will create a premium of USD 150–250/tonne by the year 2027 (as per the CRU Group – Q3 2025 Report).

- EV Battery Demand: The use of stainless steel for battery enclosures is expected to more than double the current volume of 18% CAGR during the years 2025–2030 (as per the Roskill Consulting report of September 2025).

- Infrastructure Spending: The US Infrastructure Investment and Jobs Act and India’s National Infrastructure Pipeline will drive the annual demand growth of 4-5% in the medium term.

- Supply Constraints: The European mill consolidation will result in the closure of three furnaces in the period of 2023–2024, thus limiting the surplus capacity.

Analyst Consensus:

- World Steel Association (October 2025 Short-Range Outlook): Global stainless crude steel demand will increase by 3.2% in 2026 and then by 2.8% in 2027.

- MEPS International (November 2025 Forecast): Foresees the price of 1.2 mm 304 sheet to reach USD 4.00–4.20/kg FOB Europe by Q4 2026.

Buying Tips & Risk Hedging

Procurement Best Practices

Minimum Order Quantities (MOQ):

- Mills: 20–25 tonnes (full coil or multi-coil order)

- Service Centers/Distributors: 500kg – 5 tonnes

- Spot/E-commerce: 100 kg minimum (higher unit cost)

Lead Times:

- Domestic (USA/EU): 8–14 weeks for mill orders

- Asian Imports: 10–16 weeks (6–8 weeks production + 4–8 weeks shipping)

- Stocked Items: 1–3 weeks from service centers

Payment Terms:

- Standard: 30% deposit + 70% before shipment (T/T)

- Established Buyers: 30–60 day L/C or O/A terms

- Small Orders: Full prepayment common

Price Hedging Strategies

- Forward Contracts: Guarantee fixed prices for period of 3–12 months delivery; normally requires a deposit of 10–25%. Appropriate for consumption that is predictable.

- LME Nickel Futures: Protect against raw material exposure (nickel is about 35–40% of 304 sheet cost). Select 3-month or 6-month contracts.

- Supplier Price Protection Agreements (PPAs): Agree quarterly price reviews with ceiling/floor clauses (for example, ±8% band) to facilitate negotiation.

- Diversified Sourcing: Divide orders among 2–3 suppliers located in different regions to reduce geopolitical/logistics risk.

Quality Assurance Red Flags

- No Mill Test Certificate (MTC): Insist on EN 10204 3.1 or ASTM A480 certification.

- Suspiciously Low Pricing: Be cautious with 200-series stainless (Ni 1-3%) deceptively sold as 304 (Ni 8-10%); an XRF analyzer is the way to go for confirmation.

- Poor Surface Finish: Defects like scratches, staining, or a 2B finish that is not even indicate poor quality cold-rolling has taken place.

- Inconsistent Thickness: Ask for a guarantee of +/-0.05 mm tolerance; rejection of coils that are over +/-0.10 mm.

- Supplier Vetting: Check for ISO 9001, PED (Europe), or ASME (USA) certification verification for critical applications.

Conclusion

At present, the price of the 1.2 mm stainless steel sheet ranges globally from USD 3.20 to 3.85 per kg, with certain regions hiked by tariffs, logistics, and local supply-demand balances. Short term impacts from dropping nickel prices and Chinese overproduction might limit the price increases throughout the first quarter of 2026, however, the demand from the green infrastructure and electric vehicles is supporting the cautiously positive 2-3 years forecast. It is recommended that buyers use forward contracts and varied sourcing as a way to handle the volatility, while also applying strict quality inspections to detect and avoid counterfeit material.

Sources Cited:

- MEPS International Steel Review (November 2025)

- Shanghai Metals Market (SMM) – November 2025

- Argus Stainless Steel – November 2025

- World Steel Association – Short-Range Outlook (October 2025)

- CRU Group – Low-Carbon Stainless Steel Report (Q3 2025)

- Roskill Consulting – Battery Materials Outlook (September 2025)

Disclaimer: Prices and forecasts in this article reflect data available as of November 5, 2025, and are subject to change without notice. This analysis is for informational purposes and does not constitute financial, legal, or commercial advice. Always verify current spot prices and contractual terms directly with suppliers and industry pricing services.