The steel industry worldwide is important for the modern world as it is the main area where cars, machines and cutting-edge technologies are being made besides just making them on different continents. In this huge and ever-changing industry, some countries have emerged as major exporters and thus influenced the global trading of this indispensable product. The present article offers a detailed breakdown of the top steel-exporting nations and their respective manufacturing abilities, market tactics and the economic drivers behind their stronghold.

Global Steel Market Overview

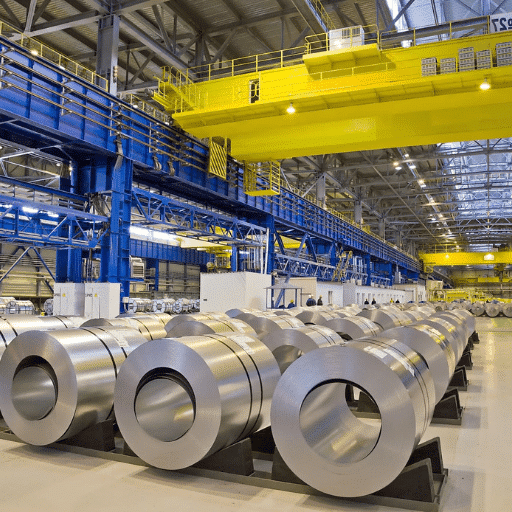

Current Trends in Steel Production

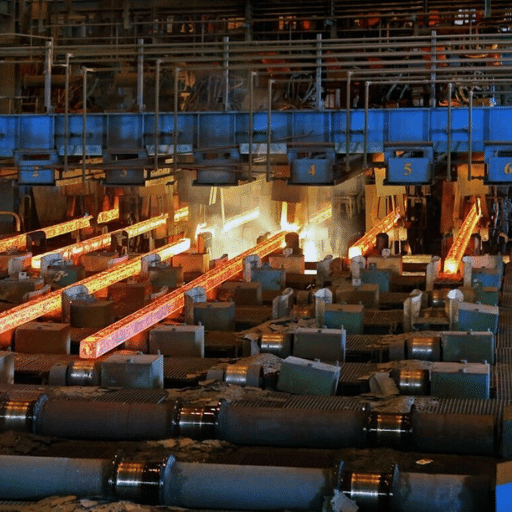

The global steel industry is undergoing considerable changes that can be attributed to technological innovations, sustainability policies, and demand shifting. Recent statistics reveal that steel production is more and more being impacted by efforts to reduce carbon dioxide emissions. All countries are committing to investing in and adopting low-carbon technologies such as electric arc furnaces (EAFs) and hydrogen-based direct reduction processes which will cut down on CO2 emissions and bring them to par with the global climate goals.

Key Industry Insights

- South East Asia, primarily China and India, is responsible for over 70% of the world’s steel output in recent years

- China’s dual-control energy consumption policy has led to lower production and caused a ripple effect in global supply and prices

- India has been enjoying a booming market owing to domestic infrastructure projects and exports

- Recyclability and circular economy practices are greatly impacting the industry

Recyclability and circular economy practices are others that greatly impact the industry as most companies have come to the point of giving priority to using scrap steel not only for efficiency improvement but also for lowering the dependency on virgin materials. This move is not only eco-friendly but also in line with the current cost-cutting measures taken in anticipation of the changing market. All these factors combined point to the fact that the industry is still going through a transformation towards eco-friendly, resilient production methods.

Market Share of Top Steel Producers

A small number of leading companies dominate and control the global steel market that relies on large-scale operations and continuous technological advancements for growth. Current reports place China’s Baowu Group, the largest steel producer globally, as sourcing roughly 10% of the world’s crude steel production in 2022.

| Company | Country | Market Share |

|---|---|---|

| Baowu Group | China | ~10% |

| ArcelorMittal | Luxembourg | 6-7% |

| Nippon Steel | Japan | 3-4% |

| POSCO | South Korea | 3-4% |

This concentration of market share allows the major steel producers not only to influence the pricing trends but also to adopt advanced manufacturing processes and control the supply chain effectively. They also benefit from their standings by pouring in large sums into research and development especially in the area of decarbonization and sustainability since these factors are becoming pivotal in preserving the top position in the changing steel industry scenario.

Impact of Global Demand on Steel Exports

Global demand is the main factor affecting the steel export volume, prices, and directions. The latest market research and recent trends suggest that the changes in demand are primarily due to the construction and infrastructure development activities in the emerging markets and the growth in the manufacturing sector in the developed economies. For instance, increased urbanization in Asia and Africa has led to a massive surge in demand for steel in the construction sector, thereby turning the export flows toward these growing regions at a fast pace. On the contrary, the decline in industrial production within Europe caused by economic uncertainties has led to a fall in demand which, in turn, has exerted downward pressure on export prices.

💡 Important Note

The shift towards sustainable environmental practices has drastically affected demand patterns. Nations and industries committed to being environmentally friendly are going to manufacturers whose steel products meet their strict requirements on allowable carbon emissions.

Leading Steel-Exporting Countries

Top 10 Steel Exporters Overview

The world steel export market is ruled by a few countries, while others too contribute to the marketing and the overall trade value of the steel industry. As per the latest statistics, China still holds the position of the global largest steel exporter by taking advantage of its great production capacity and modern manufacturing infrastructure.

🥇 China

Largest global exporter with advanced production capacity and manufacturing infrastructure

🥈 India

Gradually growing through investment in modern infrastructure and processing capacity

🥉 Japan & South Korea

Best in terms of technology and efficiency in the steelmaking process

Other Major Steel Exporters

- Russia: Strong in specific steel grades with significant export volumes

- Germany & Italy: EU leaders displaying highest quality and innovation in specialty steel products

- USA: Plays an important role targeting high-demand markets in the Americas

- Turkey: Strategic location and access to regional markets

- Brazil: Benefits from availability of raw materials and cost-effective production

Steel Export Volumes by Country

The latest statistics confirm that China is still the number one exporter of steel in the world by making use of its advanced production capacity and economies of scale. Reports suggest that in recent years, China’s steel export volumes have been more than 60 million metric tons each year which is mainly due to its strong manufacturing capacity and trade agreements.

China’s closest rivals in this field like Japan, Russia, and South Korea contribute significantly to world steel exports and are mainly targeting areas such as Southeast Asia and Europe where the demand is high. Together, these countries were responsible for a large portion of the global steel trade, and the changes in this portion were often due to international trade regulations, tariffs, and economic policies.

Market Statistics: 2021 to 2024

The period of 2021-2024 is marked with the global steel industry going through a series of changes with varying production outputs and new trade patterns taking place.

| Year | Crude Steel Production (Billion Metric Tons) | Key Factors |

|---|---|---|

| 2021 | 1.95 | Baseline year |

| 2022 | 1.88 | Supply chain disruptions and control measures |

| 2023 | 1.90 (est.) | Infrastructure expansion in developing countries |

| 2024 | 1.93 (est.) | Increased demand in developing countries |

In terms of exports, China was still the world’s biggest exporter, making up about 15 percent of the global steel exports in 2021 and keeping its power until 2024 even after the strict export policy changes. At the same time, new upcoming exporters like Vietnam and India are consistently boosting their shares in the market with the help of cost-effective pricing and more production. The growth of demand for regionally available products in Southeast Asia and Africa countries is driving the shifts as the economies are industrializing.

Regional Insights into Steel Exports

Steel Exports from Asia

Researching steel exports data from Asia creates a vivid picture of the patterns that the global steel market is going to be influenced by. The Asian continent, comprising mainly of exporters like China, Japan, and South Korea, has been the market leader by a huge margin in the global steel export sector, providing more than half (that is, over 50%) of the total steel used worldwide.

Asian Steel Export Factors

- Governmental policy changes affecting production levels

- Energy costs and their impact on competitiveness

- Raw material access and supply chain efficiency

- Trade policies and market entry strategies

European Steel Export Dynamics

European steel export dynamics present puzzling patterns that reflect the region’s unique economic and regulatory environment. The global interest increases during times of economic instability or when there are important announcements coming from the European Union concerning policy. This relationship illustrates the increasingly common practice of using online platforms as a reference to market movements and subsequently making informed strategic business decisions.

For the movers and shakers in the industry, tracking market trends provides a futuristic ability, which allows them to expect demand variations and consequently adjust their supply chain strategies according to the world’s new preferences and to the global interest that is just emerging.

North American Steel Export Trends

Market data indicates considerable interest in steel exports between North America and the major global markets, with Europe and Asia being the main trade focus. The changes have been made recently regarding trade tariffs and the environmental regulations that are impacting the manufacturing sector in the U.S. and Canada that are becoming stricter and stricter.

⚠️ Critical Trend

North American companies are increasing their investment in low-emission steel production to retain their competitive edge in the global marketplace. Export dynamics are strongly led by policy changes and the demand for environmentally friendly solutions.

Challenges Facing Steel Exporters

Trade Tariffs and Their Impact

Global market tariffs on trade have the biggest impact on the competitiveness of steel exporters worldwide. Industry experts note that recent data shows a significant uplift in the concern of industry players about the rising tariff policies. Major importers’ tariffs, like the Section 232 tariffs in the U.S. and retaliatory tariffs imposed by China and the EU, have increased the costs of exporting steel.

Consequences of Trade Tariffs

- Narrowing profit margins for exporters

- Restricted access to key markets

- Increased prices for end-users

- Need for strategic supply chain relocations

A lot of corporations are moving their supply chains to regions that are free of tariffs or they are even setting up their businesses in markets that are protected. The adaptations made by companies are a must when looking to reduce the impact of changing protectionist policies on their businesses.

Supply Chain Disruptions in the Steel Industry

Supply chain disruptions in the steel industry can stem from several key factors, including shifting trade policies, production delays, and logistical bottlenecks. When tariffs or quotas are imposed, companies dependent on steel imports must either secure alternative suppliers, often at a higher cost, or attempt to source materials domestically—a process that may not meet their operational timelines or quantity requirements.

✓ Strategy 1

Relocating operations closer to raw material resources

✓ Strategy 2

Leveraging tariff-exempt trade agreements

✓ Strategy 3

Investing in advanced logistics technologies

Ultimately, addressing these disruptions requires a proactive approach that combines robust risk forecasting, compliance with trade regulations, and continuous monitoring of global market trends. By aligning with data analytics and predictive tools, businesses can significantly strengthen their supply chain frameworks and sustain their competitive position amidst evolving challenges.

Environmental Regulations Affecting Steel Producers

Overall, environmental regulations are one of the major factors that determine the fates of steel producers as the worldwide governments and international organizations launched a war on carbon emissions by going green. A case in point, the EU’s carbon market (EU ETS), the U.S. Environmental Protection Agency (EPA) manufacturing clean air standards both impose strict regulations on the emissions of greenhouse gases, and the use of cleaner production systems.

🌱 Environmental Compliance Requirements

- Installation and operation of carbon capture and storage (CCS) plants

- Implementation of energy-efficient production methods

- Switching to hydrogen-based steel-making processes

- Use of non-fossil energy and closed-loop production systems

Thus, the adoption of eco-friendly practices by the steel industry is inevitable and so is its position as a supplier of the metal for the sustainable future.

Future Opportunities in the Steel Export Market

Growing Demand for Green Steel

The green steel decarbonization is a global issue that is raising the demand for the green steel which means steel with greatly reduced carbon emissions produced by replacing coal with hydrogen for instance or by using electric arc furnaces run by renewable energy. Green steel demand is mainly driven by government net-zero emissions policies, corporates setting environmental, social and governance (ESG) goals and making them public, and consumers giving preference to products that are ecologically responsible.

📈 Green Steel Market Growth

Interest in green steel has increased by over 70% in the last year, indicating greater awareness of sustainable industrial practices.

Major industries like automotive, construction, and energy are taking steps to replace conventional steel with green steel to comply with regulations and satisfy changing customer demands.

Technological Advancements in Steel Production

The latest technology innovations are changing the steel production industry in terms of operational efficiency, sustainability, and product quality. The use of electric arc furnaces (EAF) instead of the conventional blast furnace is one of the key processes that are leading to this shift.

| Technology | Benefits | Impact |

|---|---|---|

| Electric Arc Furnaces (EAF) | Uses recycled steel scrap instead of iron ore | Huge reduction in carbon and energy emissions |

| Hydrogen-based Steelmaking | Green hydrogen replaces coal as reducing agent | Nearly eliminates emissions from steel sector |

| AI & Machine Learning | Process control and optimization | Predictive maintenance, reduced downtime |

| Advanced Automation | Robotics in production | Safer and more efficient operations |

In addition, AI (artificial intelligence), ML (machine learning), and sensory data analytics are some of the digital technologies that are being used in process control and optimization. This means, for instance, that predictive maintenance powered by AI greatly reduces the time when the machines are not working while, at the same time, the ML algorithms provide up-to-the-minute information to help in making the best decisions regarding the operations. The robots and advanced automation also contribute to production as they not only make it safer but also more efficient by performing in the place of humans who have less exposure to dangerous situations.

📊 Market Interest Statistics

Search activity related to sustainable steel production has increased by over 40% during the last five years, indicating growing public interest and regulatory pressure for green solutions.

Forecasts for Steel Exports through 2024

The steel export market is likely to witness a slow but steady growth worldwide up to 2024 due to the strong demand coming from both infrastructure investments and manufacturing, especially not only in the case of developed but also in the case of the emerging economies. Data trends indicate an apparent increase in interest in sustainable and value-added steel products which suggests that the market is shifting towards greener and better solutions. On top of that, the geopolitical matters and trade agreements are believed to be the key factors in determining the volumes of exports and balances of regional trade.

🔮 Future Outlook

If the greening of the steel industry keeps on gathering momentum and if the standards imposed by regulations continue to tighten, the exporters who are using eco-friendly methods will be the ones to take the lead in the market. This shift helps the environmentally friendly exporters to take up a larger share in the market and they can also contribute to the rise of global export figures in 2024 and after.

Frequently Asked Questions (FAQ)

The main countries exporting steel for the year 2024 are those always listed as the top 10 regarding export volume. The world steel organization together with national customs have demonstrated that, China, Japan, South Korea, and Germany remain the strongest in exporting, while Russia and India are dominating in particular grades.

The figures for world crude steel production and millions of metric tons of steel give an idea of how production levels are turned into exports and imports. The majority of the exporting countries also deliver finished steel and stainless steel on the global market, which influences the apparent steel consumption of the importing countries.

World steel production has a direct impact on metal exports since the larger the world crude steel output—the more the metal available for export—measured in million tons and tonne units. Annual output fluctuations are considered as factors that lessen the exportable surpluses and at the same time move the trade balance among exporters and importers.

Production changes including the switch to direct reduced iron and R&D investment in steel makers are among the factors which alter cost structures and competitiveness in the export market. To sum up, production changes affect exports and imports and even can lead to countries swapping their positions in the top 10 steel exporters list.

Russia is still a big player in the global steel market providing huge quantities of iron and steel to foreign markets and influencing the regional trade movements. Sanctions, transportation problems, and changing suppliers have all played a role in the situation that Russia finds itself in; some countries have reduced their imports while others have increased them based on price and availability.

Finished steel and raw metal inputs usually comprise Russian exports, and fluctuating global demand may change the specific quantity of its exports in any given year. Trade analysts are monitoring Russia’s exports and imports activities very closely as these can have an impact on world trade flow and the prices of the most important steel products.

The demand fluctuations, added capacities, and policy changes are the underlying causes of rank changes between exporters and importers, which in turn can alter the trading of tons of steel measured in million metric tons so quickly. For example, new countries like Indonesia may be a major source of more steel while existing producers will experience slower growth thereby moving their position in the top 10 steel exporting ranks.

The market factors like the demand for stainless steel, hot-rolled products, and finished steel will cause the countries to either lose or gain more in the export share. Trade data, HS classifications, and apparent steel use statistics are used to quantify changes and compare year-on-year performance.

World steel association statistics and world crude steel production data serve as the building blocks for the projection of exports and imports through 2025 since they display the trends in yearly output, capacity utilization, and apparent steel use. Forecasters come up with the future volume of exports in million tons by combining the production trends with the indicators like construction demand, automotive activity, and R&D-driven efficiency gains.

The shift to less carbon-intensive means like direct reduced iron and investment by the steel producing companies can change the unit costs and competitive positions, thus determining the top steel exporting countries. Trustworthy, up-to-date statistics facilitate the planning of policymakers and firms for supply chain changes and market opportunities throughout 2025.

The product mix is of great importance because the prices and customer bases of the stainless steel and other finished steel items are usually higher and different compared to those of the commodity hot-rolled or crude products, and thus the country’s export profile and world trade share are affected. Countries that focus on stainless steel or high-value finished steel are in an advantageous position in terms of the demand for quality and technical specifications.

Trade stats and HS codes distinguish the exports according to the product type, which influences the apparent steel use patterns in the importing countries. The steel corporations’ emphasis on R&D and value-added processing can lead to a shift in exports from raw commodity shipments to finished steel. Even if the total million metric tons exported remain stable, diversification into higher-value products can still enhance export revenues.

Conclusion

The global steel export market is constantly changing its character due to new technologies, environmental regulations, and varying consumer preferences. China has not yet lost its position as the leader in steel exports, thanks to its gigantic production capacity and excellent infrastructure. Not only this, but also other exporters such as India and Vietnam have slowly started gaining more presence in the industry through the combination of lower prices and well-planned investments.

The day when the steel export industry will be mainly dependent on the sustainability transition has come. The production of green steel by means of hydrogen-based technologies and electric arc furnaces is slowly becoming the norm in the industry as various political and corporate spheres actively engage in reaching their respective carbon neutrality goals. Thus, it is the innovators that will be the monopolists in the multicultural marketplace which is turning greener.

The export dynamics will still be impacted by the factors of trade policies, tariffs, and supply chain resilience. It is the companies, which are data-minded, have advanced technology and flexible supply chains, that will be the ones to overcome the difficulties and take the chances in the global steel market during 2024 and beyond.

📚 Reference Sources

- Steel: Price and Policy Issues – Cornell University eCommons: This paper discusses global steel export trends, including China’s role as a major exporter and its impact on the U.S. market.

- Evaluation of Proposed Policies Concerning Japanese Steel Exports and the United States Steel Industry – Colorado School of Mines Repository: This study evaluates policies affecting steel exports from Japan to the U.S., providing insights into international trade dynamics.

- Analytical Input-Output and Supply Chain Study of China’s Coke and Steel Sectors – MIT DSpace Repository: This research analyzes China’s steel and coke sectors, highlighting its role as a major exporter and its supply chain dynamics.